Bastion Portfolio Manager – September 2025 Rebalancing

Systematic strategy updates across global equity universes

We’re excited to present the updated Portfolio Manager report for Bastion subscribers. The stock selection process is now fully automated, enabling us to build and rebalance multiple portfolios across countries and strategies on a regular monthly basis.

The result is a 40-page report with portfolios of stocks that best fit Bastion’s strategies.

We will rebalance these portfolios monthly, during the first week of each month, based on ratings across three strategies:

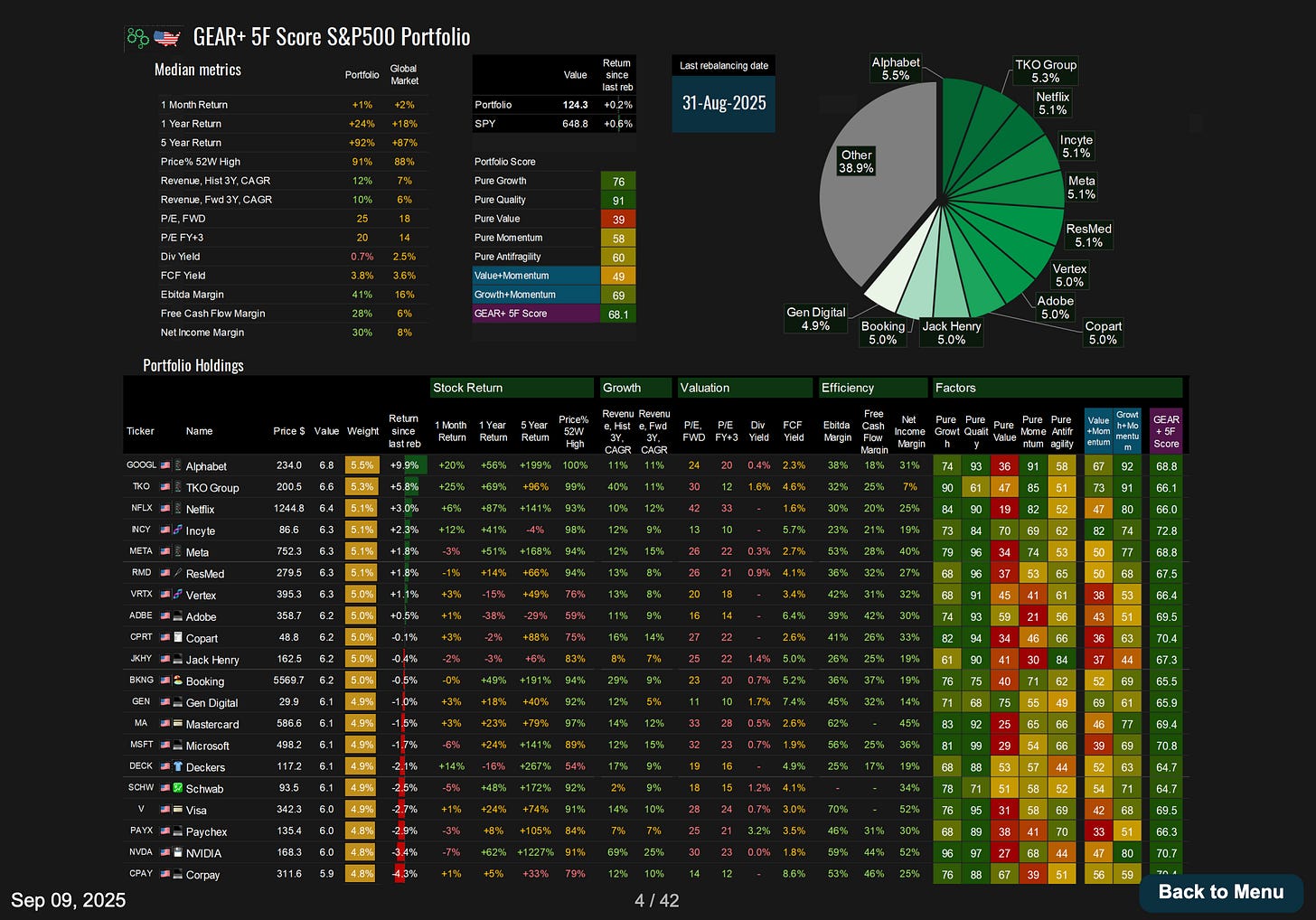

Growth + Efficiency at Reasonable Price (GEAR) - stocks with an optimal balance of growth, efficiency, and valuation. Designed for long-term investors with a medium risk profile.

Value + Momentum - more speculative portfolios, focused on undervalued companies currently gaining market interest. Risk level: above average.

Growth + Momentum - the riskiest portfolios, built around trending growth stocks with higher long-term expected returns.

Portfolios are constructed across the following Asset Universes:

🇺🇸 S&P 500

🇺🇸 US Mid Caps

🇪🇺 Europe 500

🌍 Global 500

🌐 Ex-USA 500

We’ve also included a dedicated GEAR+ portfolio of US Dividend Aristocrats.

At the moment, the report includes 13 portfolios. New regions, sectors, or thematic strategies may be added in the future.

Each strategy comes with its own filtering system, detailed in the strategy description cards.

Here’s an example of what a strategy card looks like:

Each portfolio card includes a slide with performance metrics…

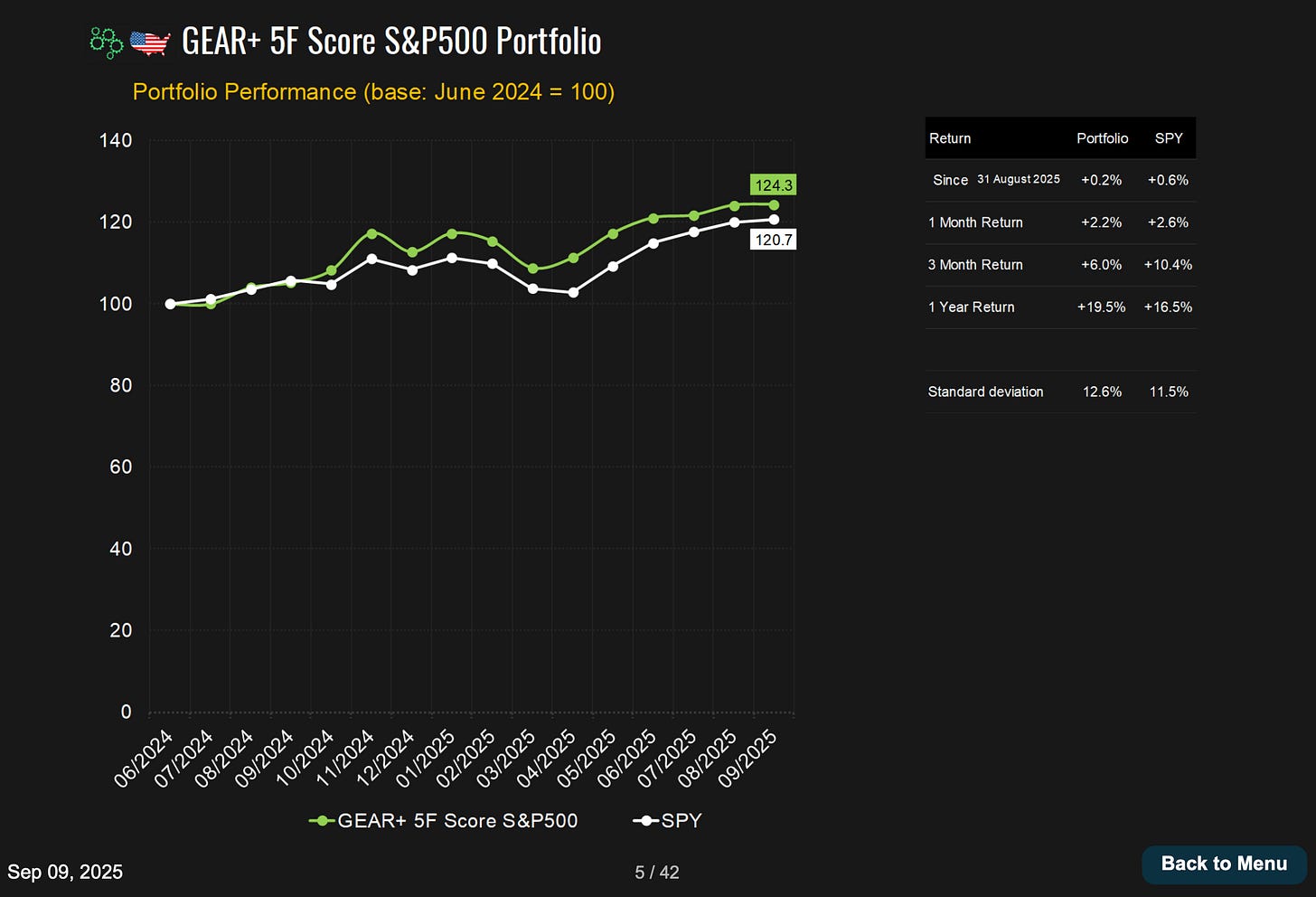

…and return tracking.

Enjoy 👇 Next rebalance – during the first week of October

Keep reading with a 7-day free trial

Subscribe to Investment Bastion to keep reading this post and get 7 days of free access to the full post archives.