Bastion Trend Tracker: Alphabet's Big Bounce, Tesla’s Warning Signs, and a Surprise from Japan

Top momentum moves across global markets

Bastion Trend Tracker — your fast, focused dose of key market trends.

What it’s for:

Tracking the financial news that drives real price action

Spotting early breakouts across global markets

Filtering out the noise (so you don’t have to read every daily headline)

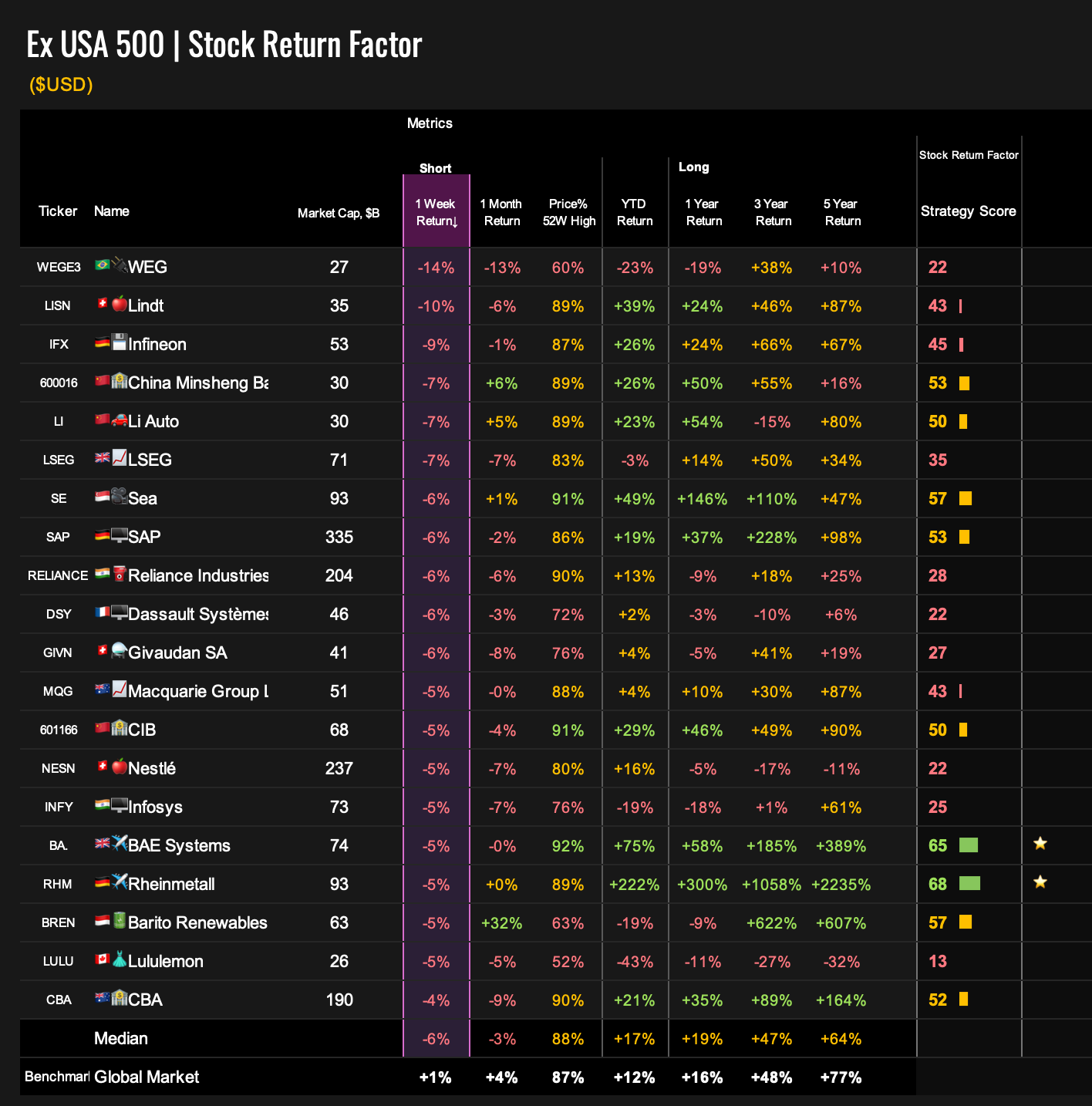

📁 Each chart is powered by the Bastion Terminal — my analytics platform that scans and ranks over 4,000 stocks worldwide based on momentum and price trends.

Here are the standout trends I tracked this week

1. 🖥️ Alphabet (GOOGL, +4%) - Fears Are Fading

Investor concerns that Google might lose the AI tools race are starting to fade. Alphabet emerged as one of the market’s top performers following the release of its latest quarterly results.

Revenue for the quarter reached $96.4 billion, exceeding expectations of $94.0 billion and rising 14% year-over-year. The standout segment was Google Cloud, with sales growing 32% from the prior year.

While competition from OpenAI and others remains a risk, Alphabet appears to be in stronger financial shape than it was several quarters ago. A return to all-time highs in the coming months looks increasingly likely.

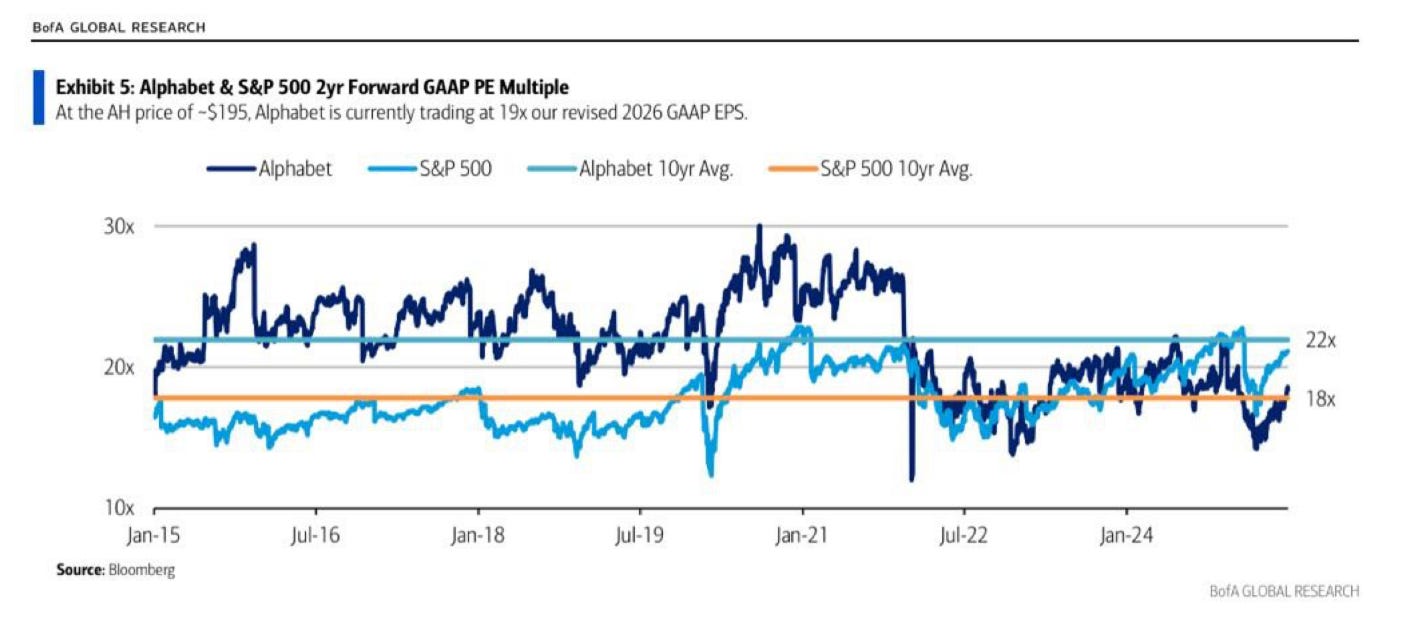

Bank of America suggests that there is still significant room for multiple expansions from here.

Alphabet is a stable constituent of the GEAR+ portfolio.

2. 🇺🇸🚗 Tesla (TSLA, -4%) — This Was Bad

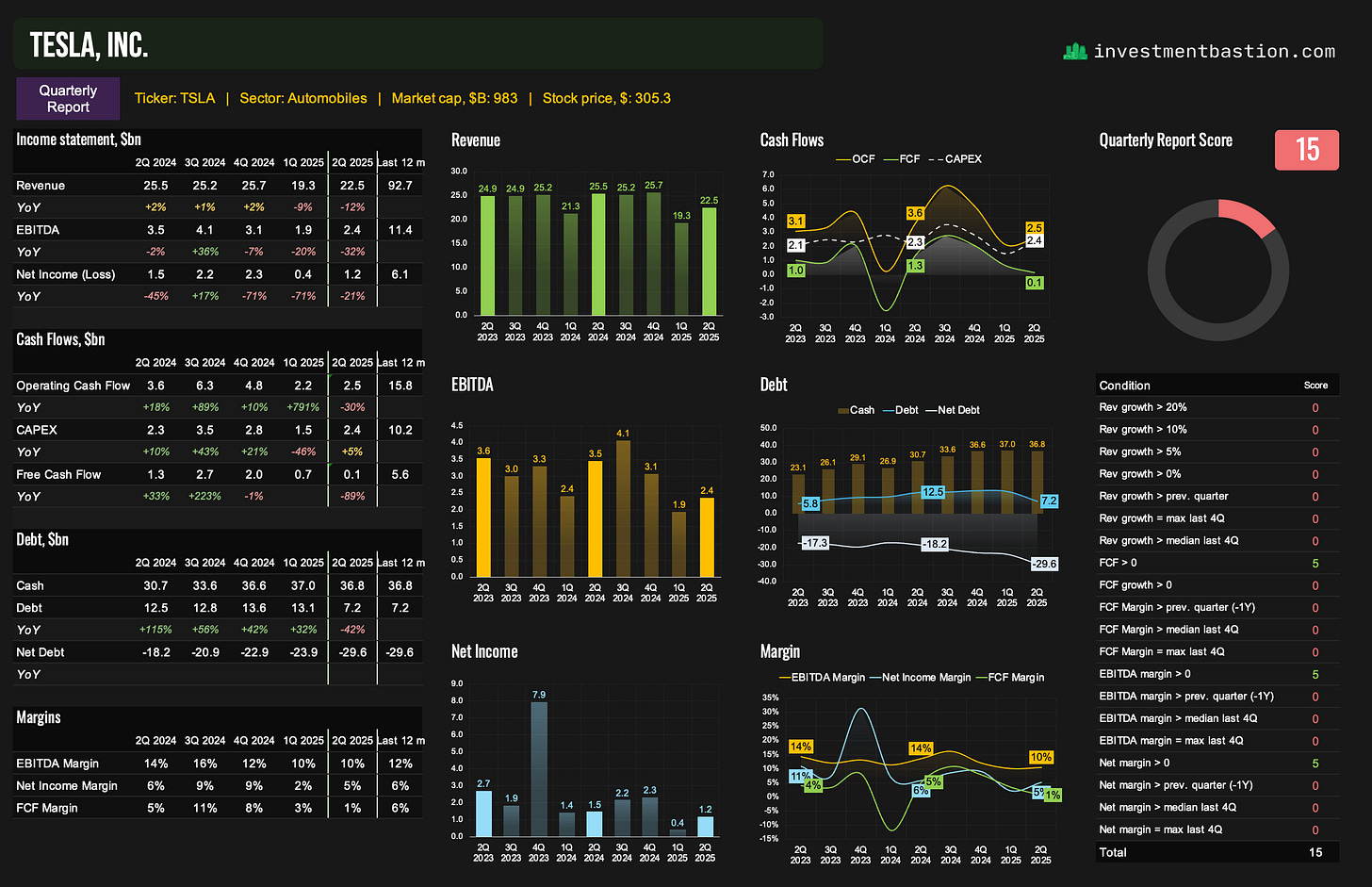

Tesla was one of the worst-performing large-cap stocks this week following a disappointing earnings report. Revenue decline is accelerating, and on the earnings call, CEO Elon Musk warned that “rough quarters” could lie ahead.

Investor sentiment took another hit as it became clear that the much-anticipated lower-cost model may not be a new vehicle, but simply a more affordable version of the existing Model Y. That raises concerns about cannibalization of existing sales rather than incremental growth.

The company is betting on its robo-taxi service, which launched in Austin in June. Musk believes it could expand to cover half the U.S. population by year-end. But questions remain around the profitability and scale of this initiative, especially as core auto sales weaken.

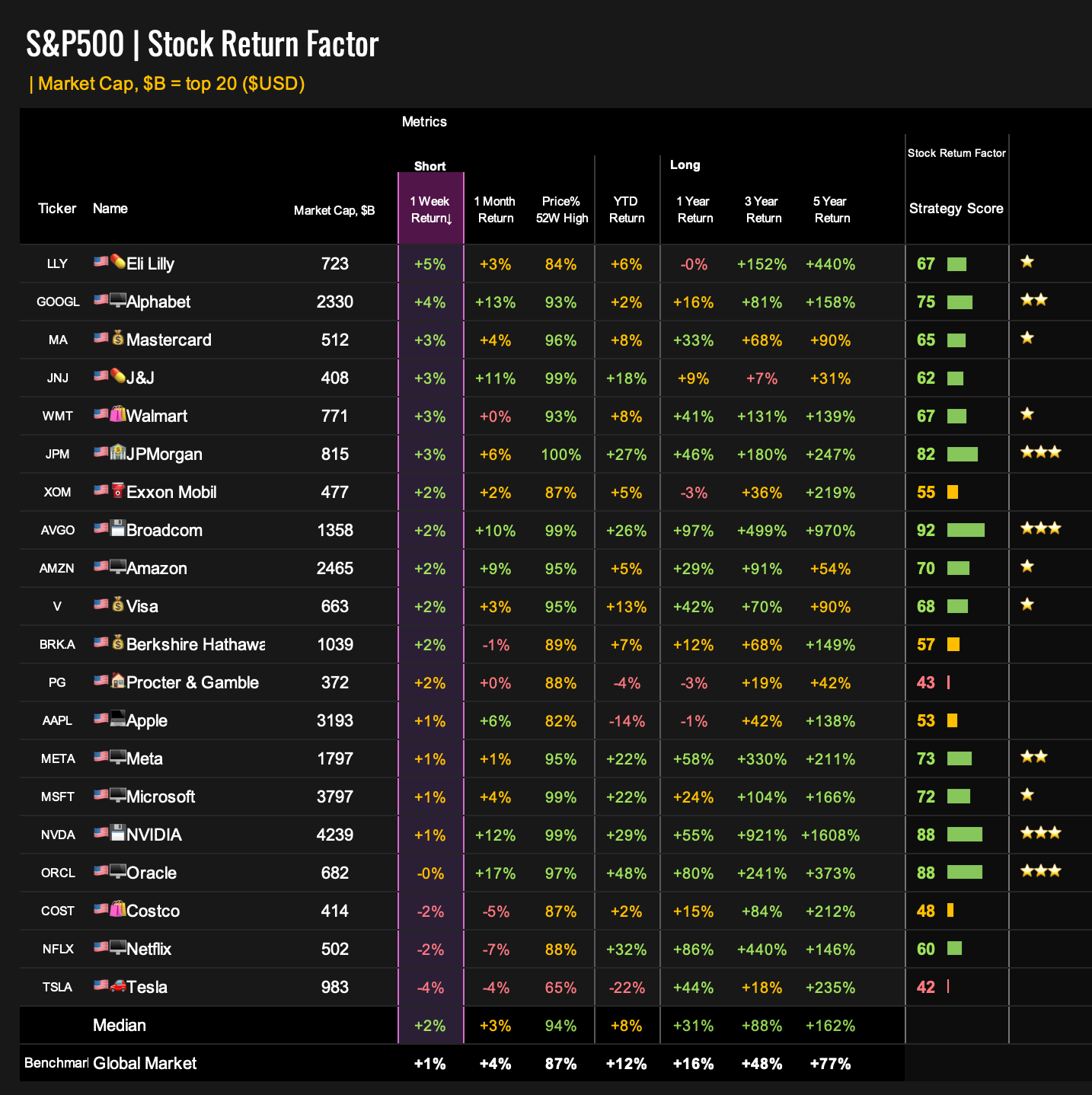

Momentum has deteriorated sharply. Tesla now holds the lowest momentum score among the top 20 U.S. stocks.

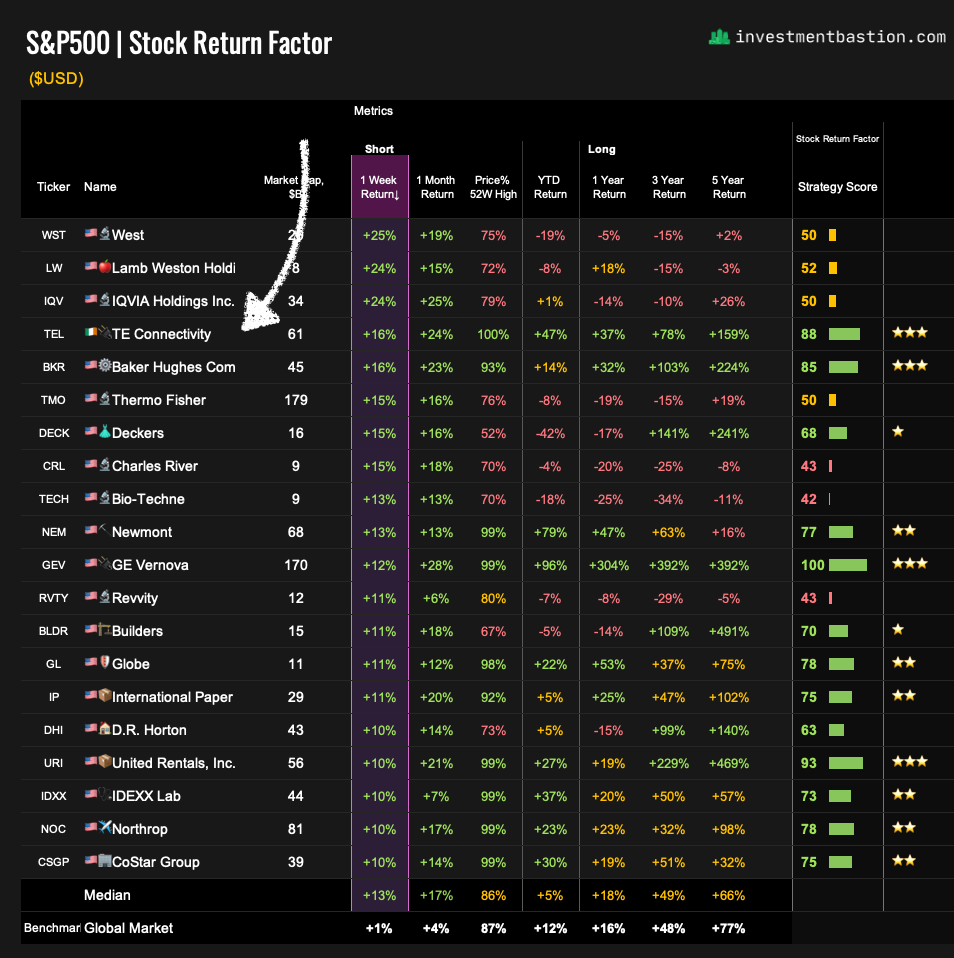

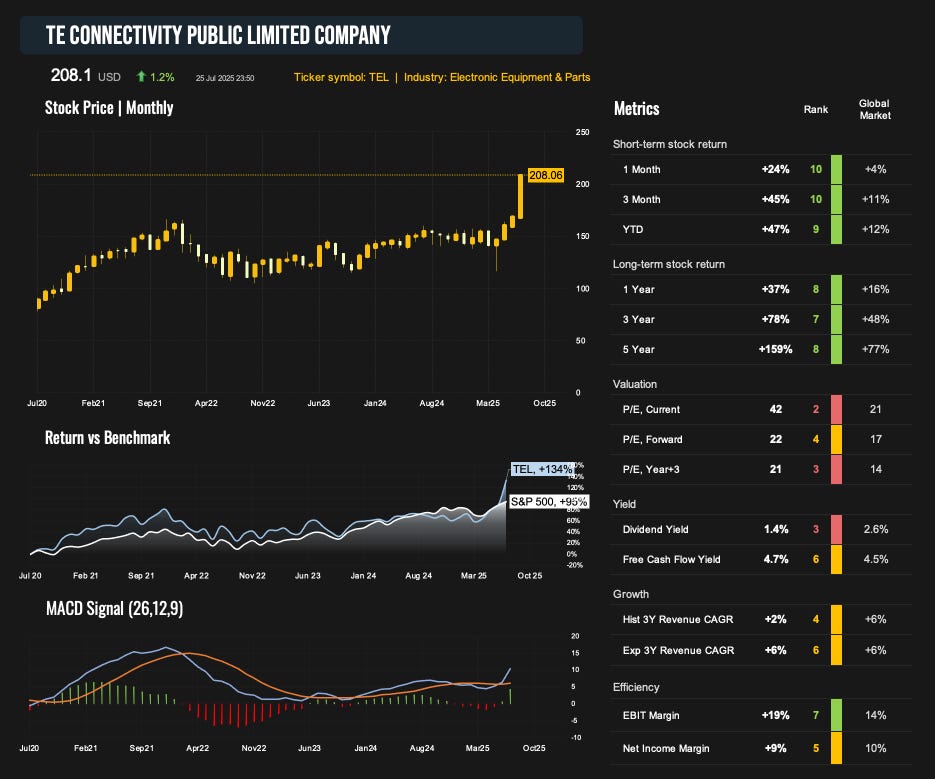

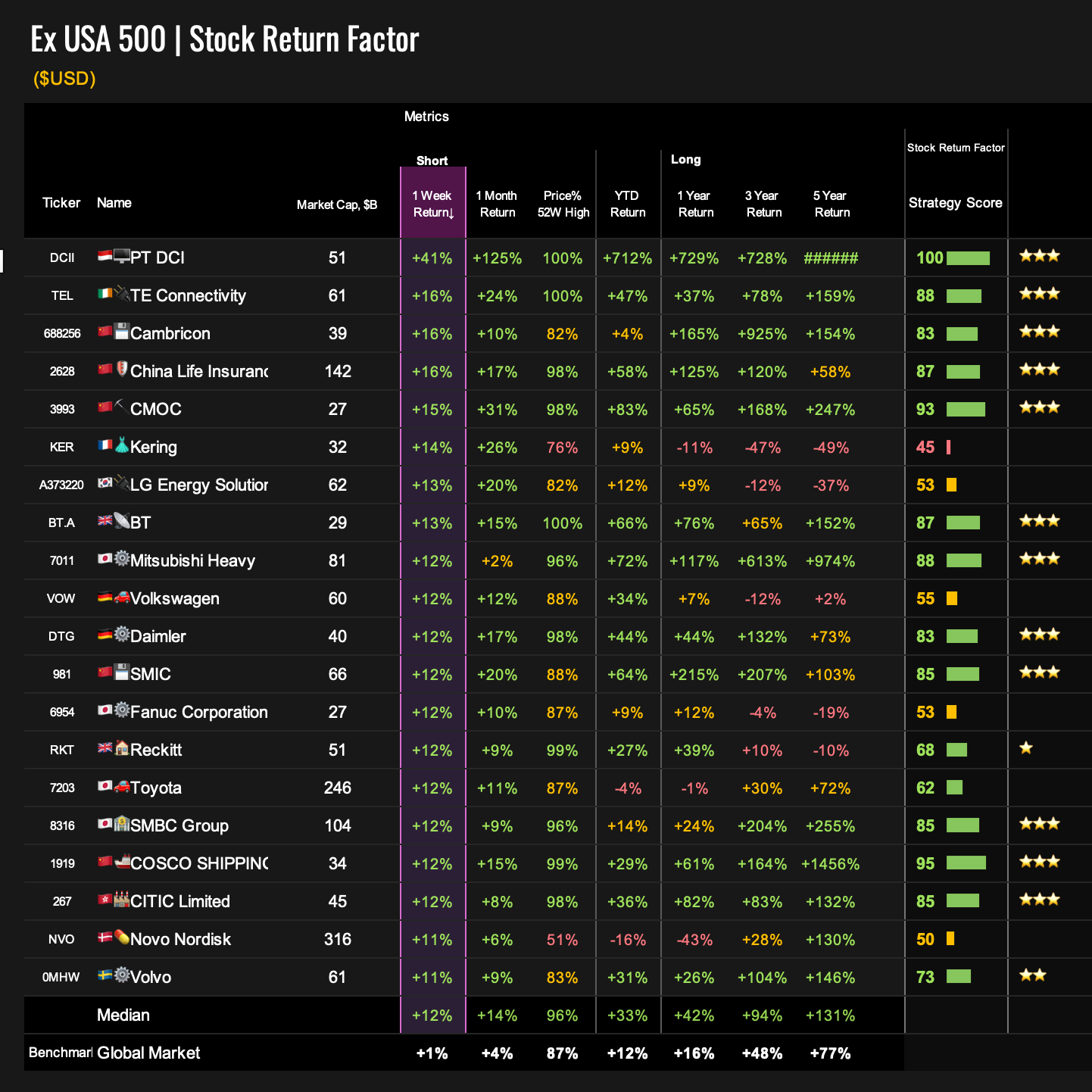

3. 🔌 TE Connectivity (TEL, +16%) - Plugging into the AI Grid

Another strong week for this underrated AI hardware enabler. TE’s data-center segment grew +84% YoY, powered by the February acquisition of Richards Manufacturing, which makes medium-voltage components essential for data centers and industrial electrification.

TE’s AI-related sales hit $300M in FY2024 and are expected to nearly triple to $800M in FY2025. CEO Terrence Curtin says we’re still in the “early to middle innings” of the AI infrastructure buildout. The weakness in the auto segment in the U.S. and Europe was more than offset by momentum in aerospace, electrification, and AI.

The stock is part of the Dividend Growth portfolio. Stay tuned for a full strategy update next week.

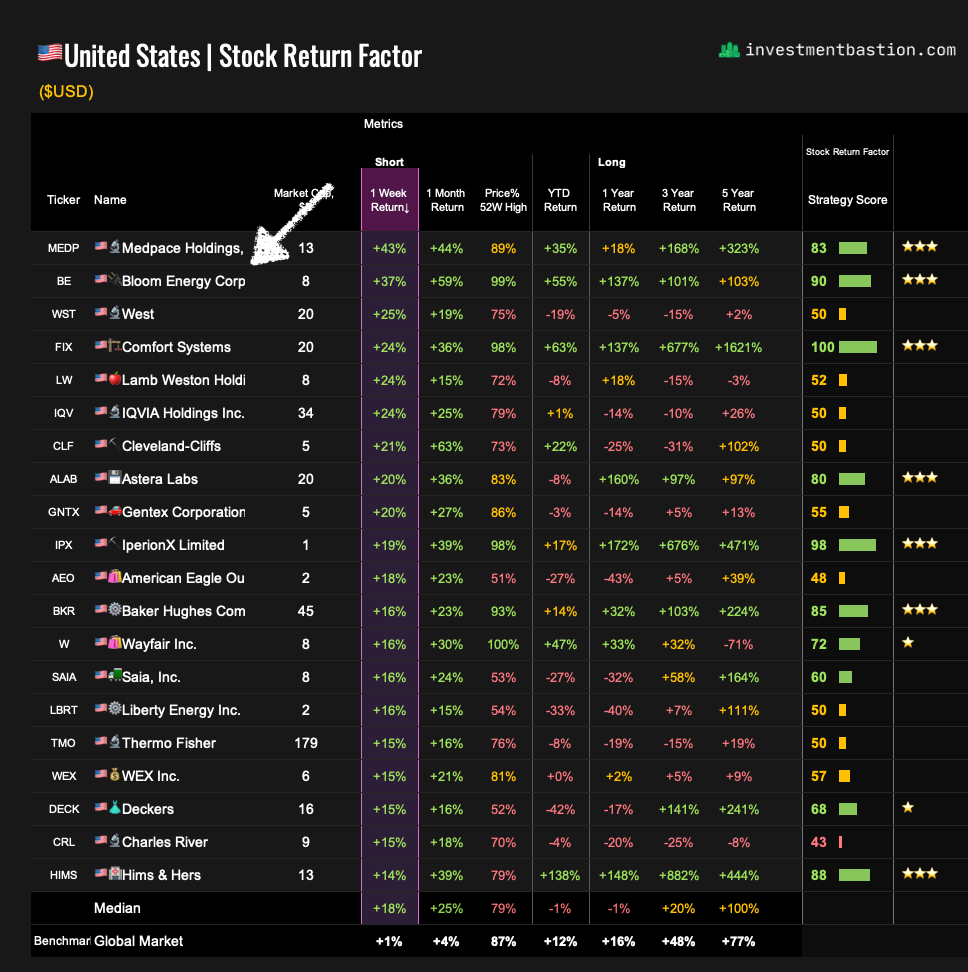

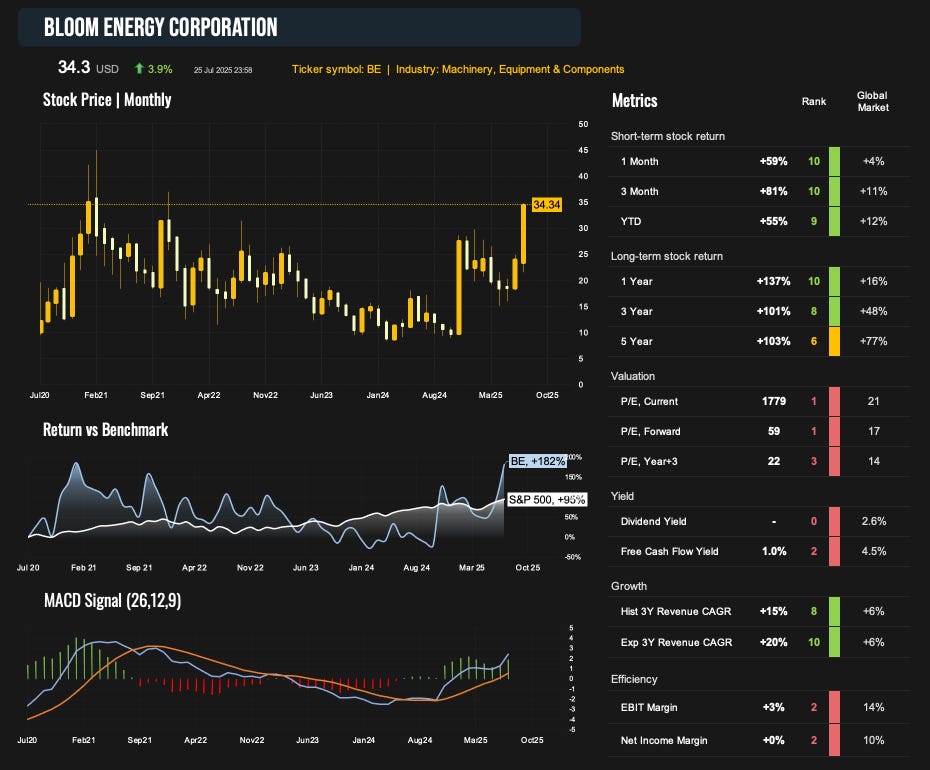

4. 🇺🇸🔌 Bloom Energy (BE, +37%) — AI Power Play

One of the top U.S. gainers this week, Bloom Energy rallied after announcing that it will deploy its fuel cell technology at select Oracle Cloud Infrastructure (OCI) data centers in the U.S.

I’ve been tracking Bloom closely since Idea Radar #3:

“Bloom is positioned as a main under-the-radar beneficiary of the AI energy boom.

This is a compelling long-term growth story. Given its low efficiency metrics, Bloom may not be a fit for GEAR+ strategies, but for Growth-focused portfolios, it’s definitely a name to watch.”

This week’s news reinforced the stock's potential.

5.🏅 Gold miners (GDX, +8%) – momentum remains strong

Despite the rally, the sector remains massively undervalued, partly reflecting market concerns about a potential pullback in gold prices. However, if precious metal prices hold steady, gold miners are well-positioned to continue outperforming over time.

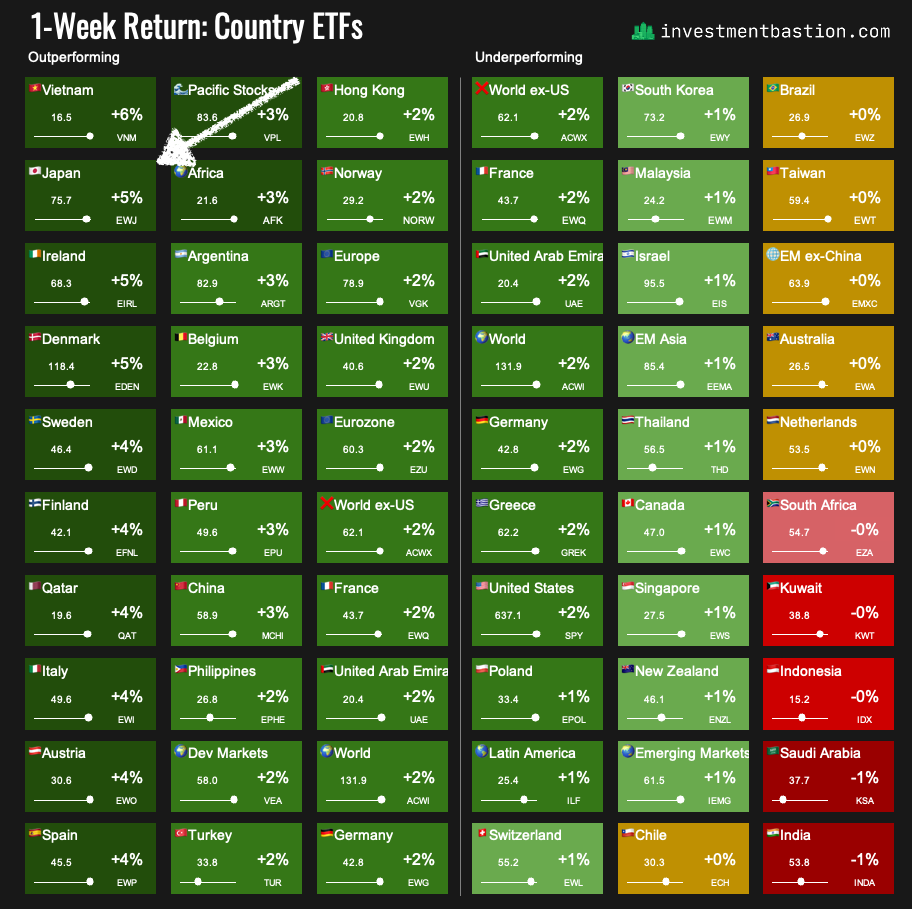

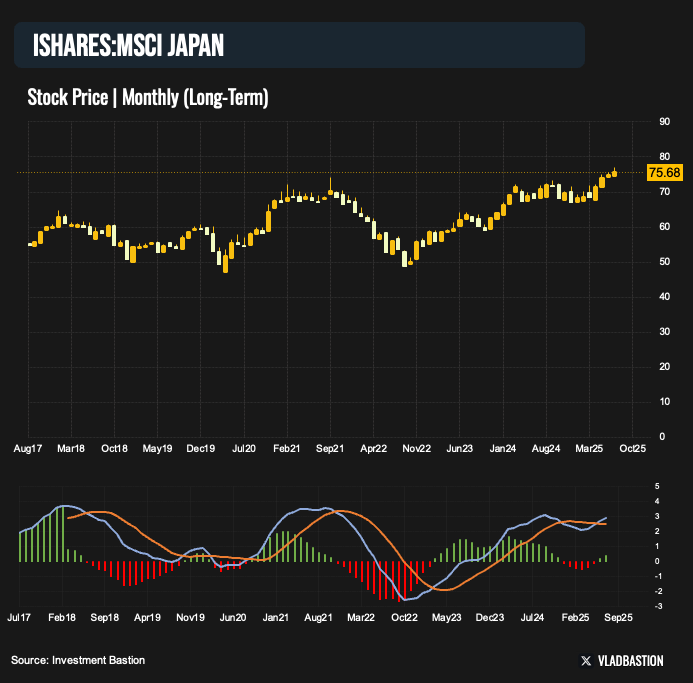

6. 🇯🇵 Japan (EWX, +5%) — Breakout on Trade Deal Momentum

Japanese equities were among the top performers this week following news of a trade agreement with former President Trump.

Reuters:

Trump reached a deal with Japan just days before the August 1 deadline. The agreement spares Japan from new tariffs on autos and other goods in exchange for a $500 billion package of investment and loans directed to the U.S. It’s seen as the most significant trade deal since his market-shaking tariff announcement in April.

The Japanese stock market is now hitting multi-year highs in USD terms, signaling renewed momentum and investor confidence.

7. 🌍 Europe’s Car Stocks Surge on Trade Optimism

Auto manufacturers were among the top-performing stocks outside the U.S. this week, driven by optimism around a potential EU–U.S. trade deal.

EU officials said a framework agreement could be reached as soon as this weekend. The deal would reportedly include a 15% baseline tariff on EU goods entering the U.S., but it remains unclear whether it would reverse the earlier 25% auto tariffs. The market appears to be pricing in a positive outcome.

Several major European automakers ranked among the top global performers this week (in $USD):

🇩🇪🚗 Volkswagen +12%

🇩🇪⚙️ Daimler +12%

🇸🇪⚙️ Volvo +11%

Momentum is back in gear.

📧 ❤️ Thanks for reading! If you found this report helpful, consider liking or commenting. Your feedback helps shape future editions. More trend insights coming next week.