How to Sleep While Meme Stocks Are Pumping 100% in a Day

Five battle-tested habits for resisting FOMO

I came across this meme from someone clearly exhausted by the endless Twitter and Reddit feeds, all trying to pump meme stocks around the clock.

If you feel a similar sense of fatigue when opening social media, here are a few simple strategies I’ve developed over the years to combat the Fear of Missing Out, based on studying markets and investor psychology.

1. Be a student of financial history

Today’s bubbles and manias aren’t anything new. This has all happened before — many times over. When you dive into history, you’ll be amazed at how closely today’s events rhyme with what happened 100, 200, or even 300 years ago. The more stories like these you absorb, the stronger your immunity to the “reality” of the present moment.

Want to sleep better? Read books on financial history before bed.

One great example is Boom and Bust: A Global History of Financial Bubbles by William Quinn and John D. Turner.

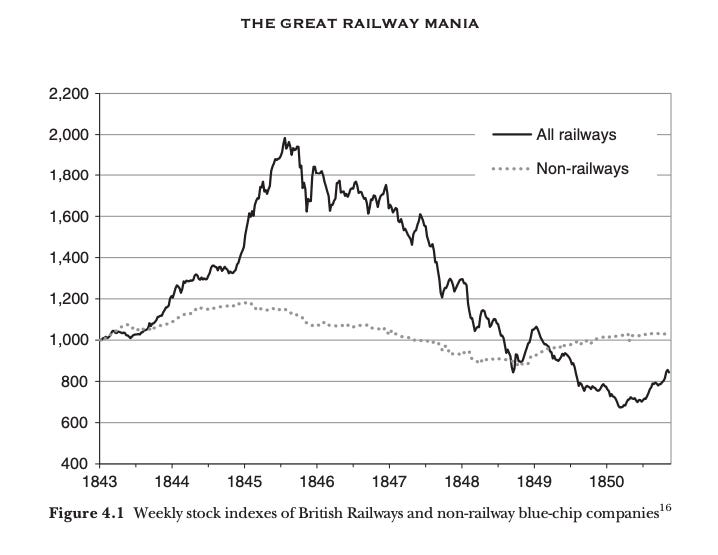

One of the most striking chapters is about the Railway Mania in the UK.

Unlike the more famous Tulip Mania, this one started with a real technological innovation: the invention of steam locomotives, which quickly became commercially successful. Against the backdrop of low interest rates, a wave of speculation followed, and even Charles Darwin got swept up in the frenzy.

The result? The Bank of England raised interest rates, and the bubble burst; as a result, most investors suffered catastrophic losses, despite the fact that the underlying technology was revolutionary and brought lasting benefits to society.

The more stories like this you know, the better your internal bullshit detector becomes.

Here are a few other excellent books that are both enjoyable reads and powerful emotional training for any investor:

Lords of Finance by Liaquat Ahamed

This Time Is Different: Eight Centuries of Financial Folly by Reinhart & Rogoff

Financial Shenanigans by Howard M. Schilit

2. Don’t trade stocks on your phone

Modern fintechs hire marketing teams whose job is to turn investing into a game with flashy animations, fireworks, confetti, and random “gift” stocks. It’s all designed to trigger FOMO and get you to tap Buy before you’ve had a chance to think.

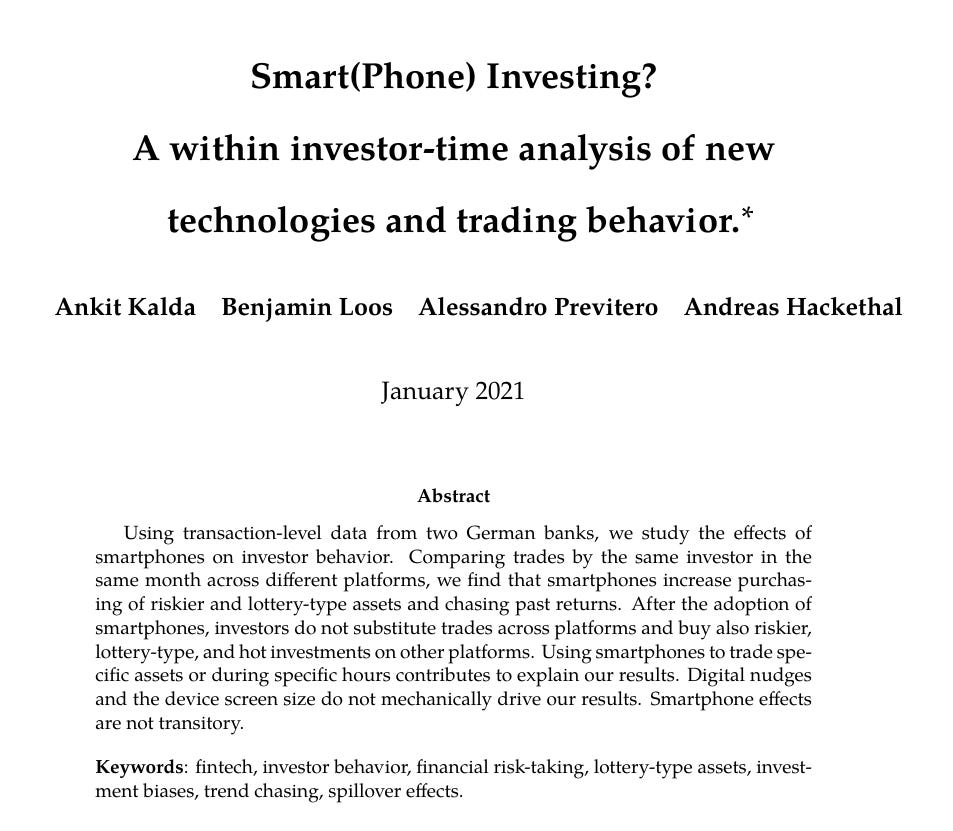

A study by the National Bureau of Economic Research, based on data from 15,000 investors in Germany, found that the same individuals, when trading on their phones:

Took more risk

Bought more lottery-like assets

Were more likely to chase recent price spikes

Here’s the paradox:

A technologically outdated broker — the one without a slick mobile app — might actually be better for your account and emotional wellbeing than a trendy fintech giant trying to turn you into a gambler.

Want to avoid getting dragged into the pump? Put the phone down.

3. Unfollow and mute the pumpers

I actively track market movements myself. It’s essential to understand investor sentiment, which is why I publish a weekly Trend Tracker, reviewing key short-term trends across financial markets. Analyzing is fine. Manipulating is not.

There’s a big difference between thoughtful market commentary and shameless hype.

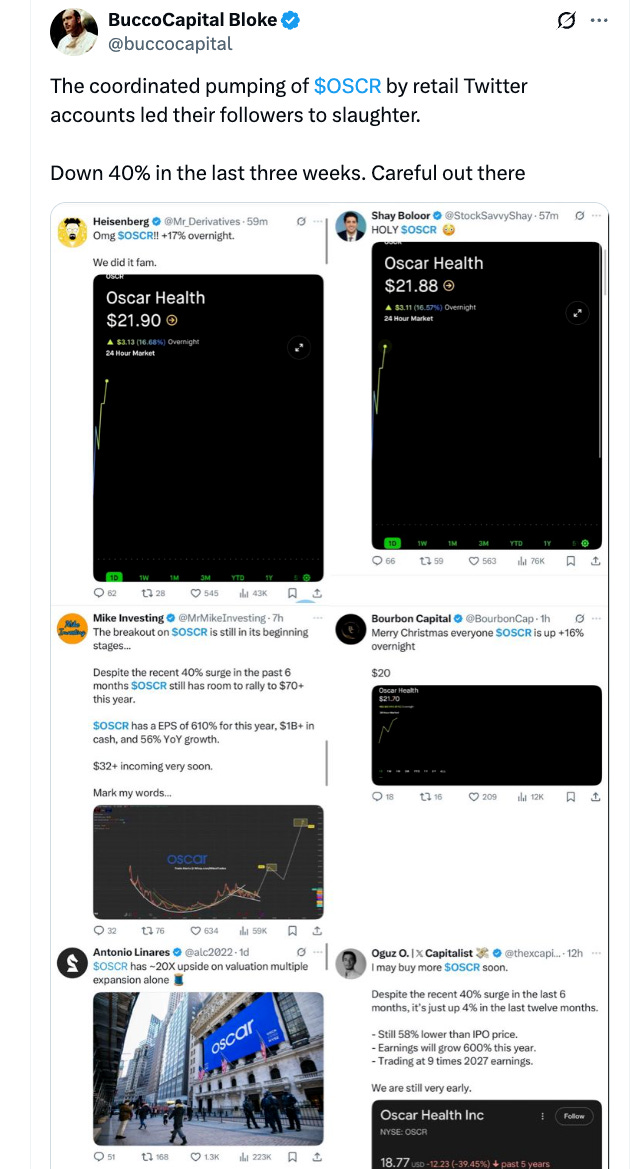

Take the recent pump of Oscar Health (OSCR), for example. The stock dropped 40% within a couple of weeks after a wave of "we're going to the moon" posts.

My advice: build yourself a mental dictionary of pumper catchphrases like:

“You are not late”

“OMG we did it”

“It still has room to rally. Mark my words”

“Don’t miss this opportunity”

Providing a well-reasoned growth thesis on a stock is totally fine. If the stock goes down afterward, that’s part of investing. But hyping stocks like you’re selling Turkish delight in a bazaar? That’s not fine.

Let those phrases be red flags. See posts like that? Immediate mute. The cleaner your information diet, the fewer temptations you'll face.

Also, keep in mind:

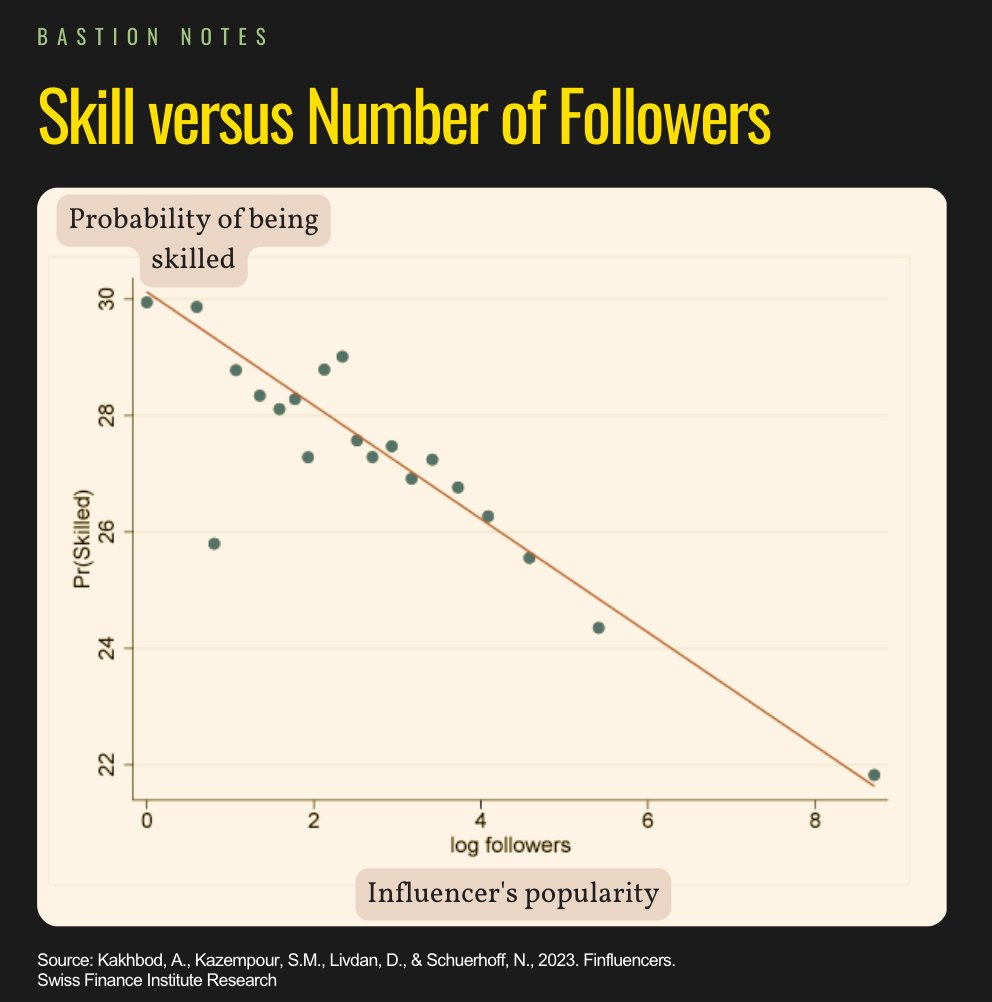

The more followers they have, the worse their investment advice tends to be.

A fascinating study, “Finfluencers” by Kakhbod et al. (2023), analyzed the stock picks of 29,000 FinTwit influencers and found some striking results:

56% of finfluencers displayed “anti-skill”. Their stock picks produced abnormal monthly returns of –2.3%

The worse the recommendations, the more followers they tend to have and vice versa.

There was a strong negative correlation between how often they tweet and their actual skill. Put simply: the more they tweet, the less they know

Value the small, authentic voices, the ones who write about markets with clarity and calm, not clickbait and chaos. Those are the real gems in a sea of screaming pumpers.

4. Set up a separate account for speculation

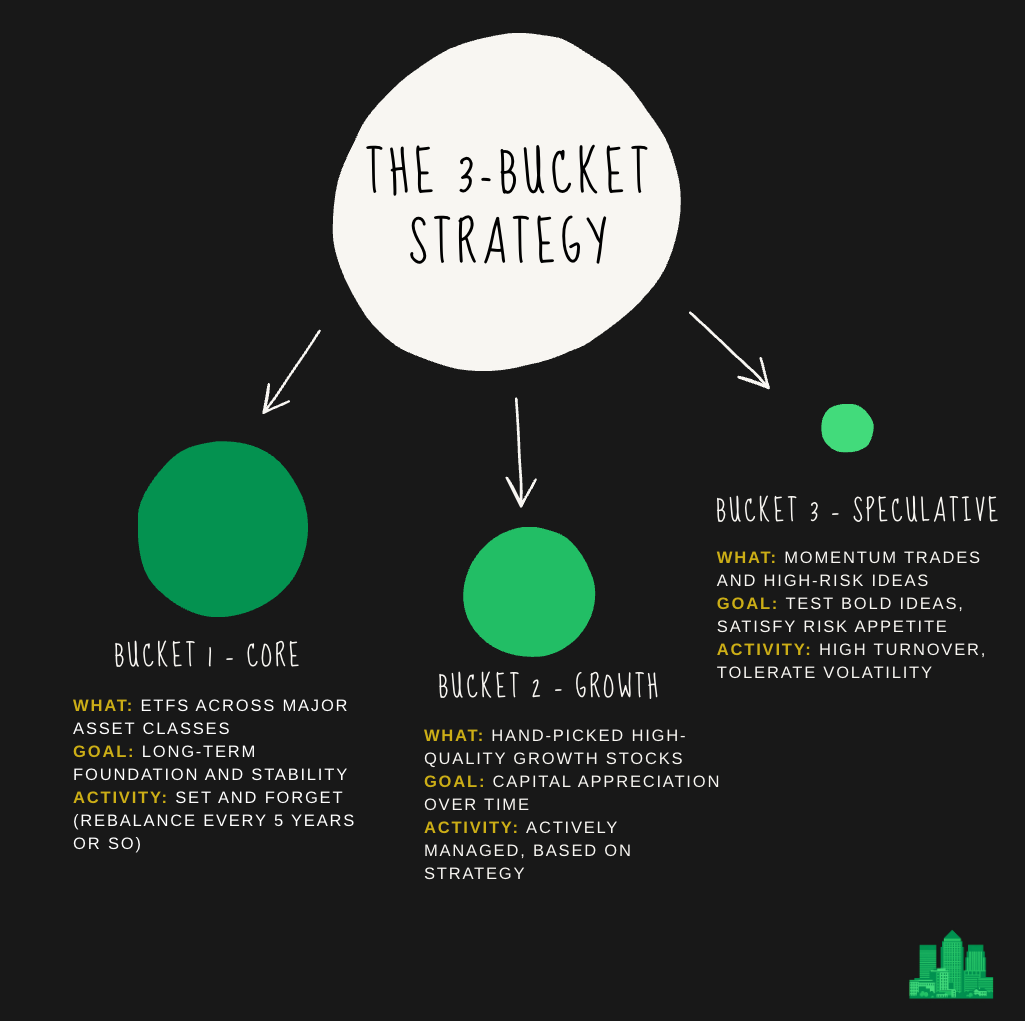

I’m a big believer in the three-bucket approach, though I’ve adapted it to fit my investing style:

Bucket 1 (60%): A core ETF portfolio across major asset classes. I almost never touch it.

Bucket 2 (30%): A long-term portfolio of handpicked, high-quality growth companies.

Bucket 3 (5–10%): A small portion of the portfolio dedicated to momentum trades and higher-risk ideas.

If you're naturally drawn to risk, or just want to test bold ideas, that’s completely fine.

I do it too. I maintain a small trading account that makes up no more than 5–10% of my liquid assets and follows a strategy that explicitly allows for what I’d call rational speculation.

Here’s why it works:

If it outperforms the rest of my portfolio, great, and FOMO stays under control.

If it underperforms, it doesn’t harm my overall financial stability or long-term plan.

That account serves as a psychological buffer between disciplined investing and the emotional triggers that even experienced investors can fall prey to.

5. Automate your decisions

Rules are powerful. As Andrew Huberman often says, it's helpful to create protocols —predefined patterns of behavior — that support your physical health, mental clarity, and effective communication with others. You can (and should) do the same in investing.

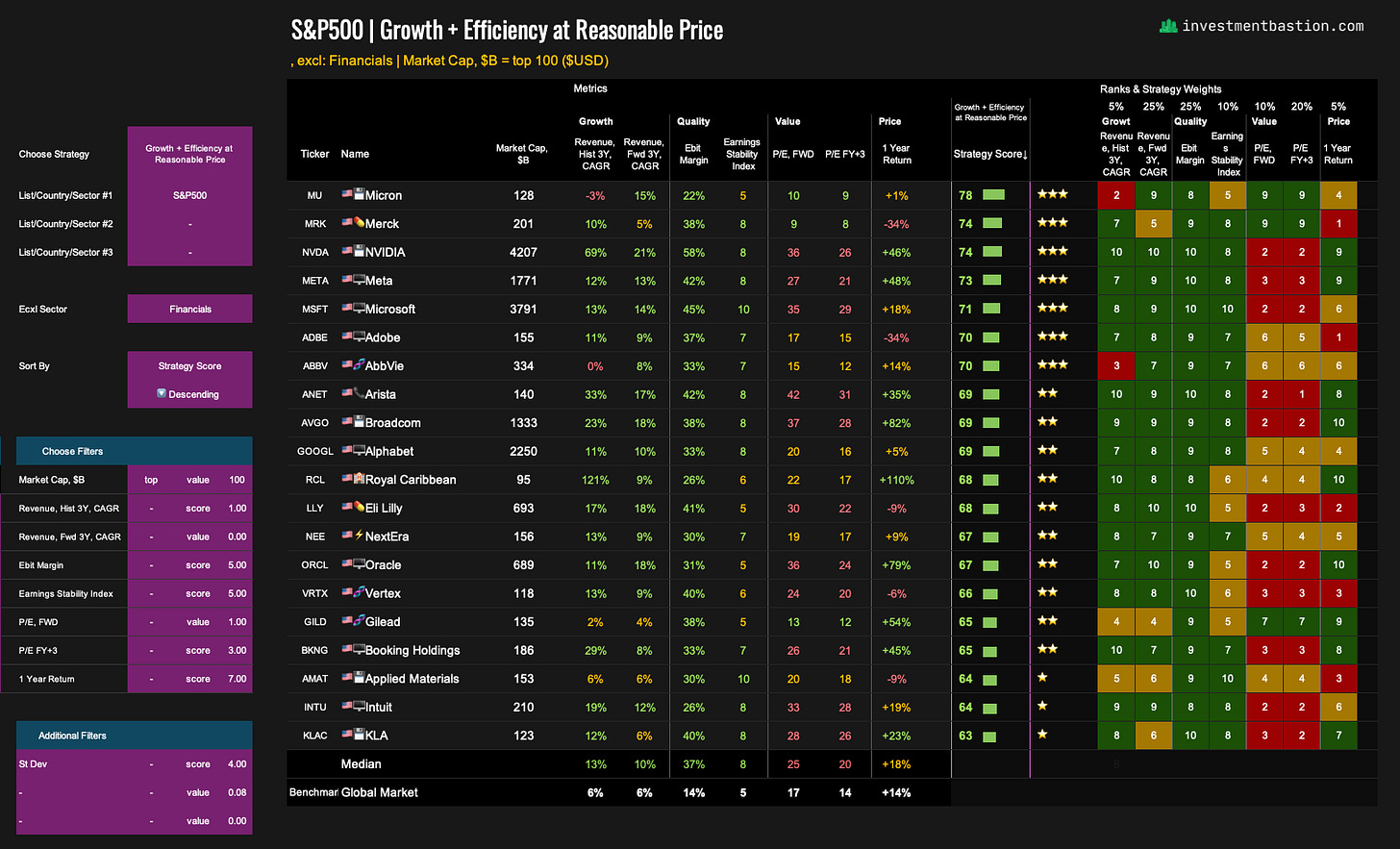

For example, I created a tool in Excel for myself. I define the parameters of my strategy, based on key fundamental metrics, and the system calculates a scoring rank for each stock.

The higher the score, the better the stock fits my investing philosophy.

In other words, I design the strategy first, and the algorithm tells me what to buy and when. If my principles evolve, I adjust the parameters; however, the overall framework remains consistent.

I’m not trying to beat the market over 1 month or even 1 year. My goal is to build a portfolio of stocks that reflect my core beliefs, and I am confident that investing in those companies will pay off over time.

But what if you do want a portfolio of high-growth, high-hype FOMO stocks?

If that aligns with your philosophy, then go for it. Just do it with structure:

Allocate 5% of your liquid capital

Build a screener of 10–15 names that match your thesis

Rebalance it once a month

That’s it. Now you have rational, rules-based speculation aligned with your philosophy, with minimal emotional stress and no second-guessing.

Thanks for reading. I hope these ideas help Garcia Capital (and anyone else feeling overwhelmed) find a little peace of mind before bed.