Idea Radar #5: Buyback Aristocrats, China Growth Portfolio, Germany’s Fiscal Engine

Investment bank insights, reframed with Bastion’s strategy lenses.

Idea Radar is a report that extracts interesting stock ideas from investment bank research and filters them through Bastion's analytical systems.

How to use it?

You can look for actionable ideas to support your own strategies, or expand your knowledge about what’s trending among professional analysts.

1. US Buyback Aristocrats

Everyone knows about Dividend Aristocrats — companies that have increased dividends for more than 25 consecutive years. But while dividends remain a key part of shareholder capital return, buybacks are gaining even more traction.

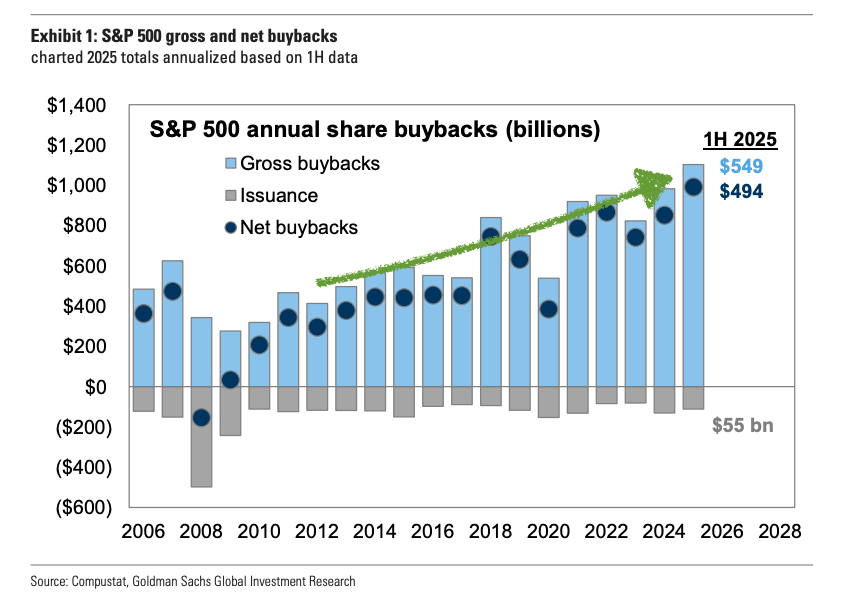

In 2024, S&P 500 companies repurchased shares worth a record $982 billion, 2.5x more than ten years ago.

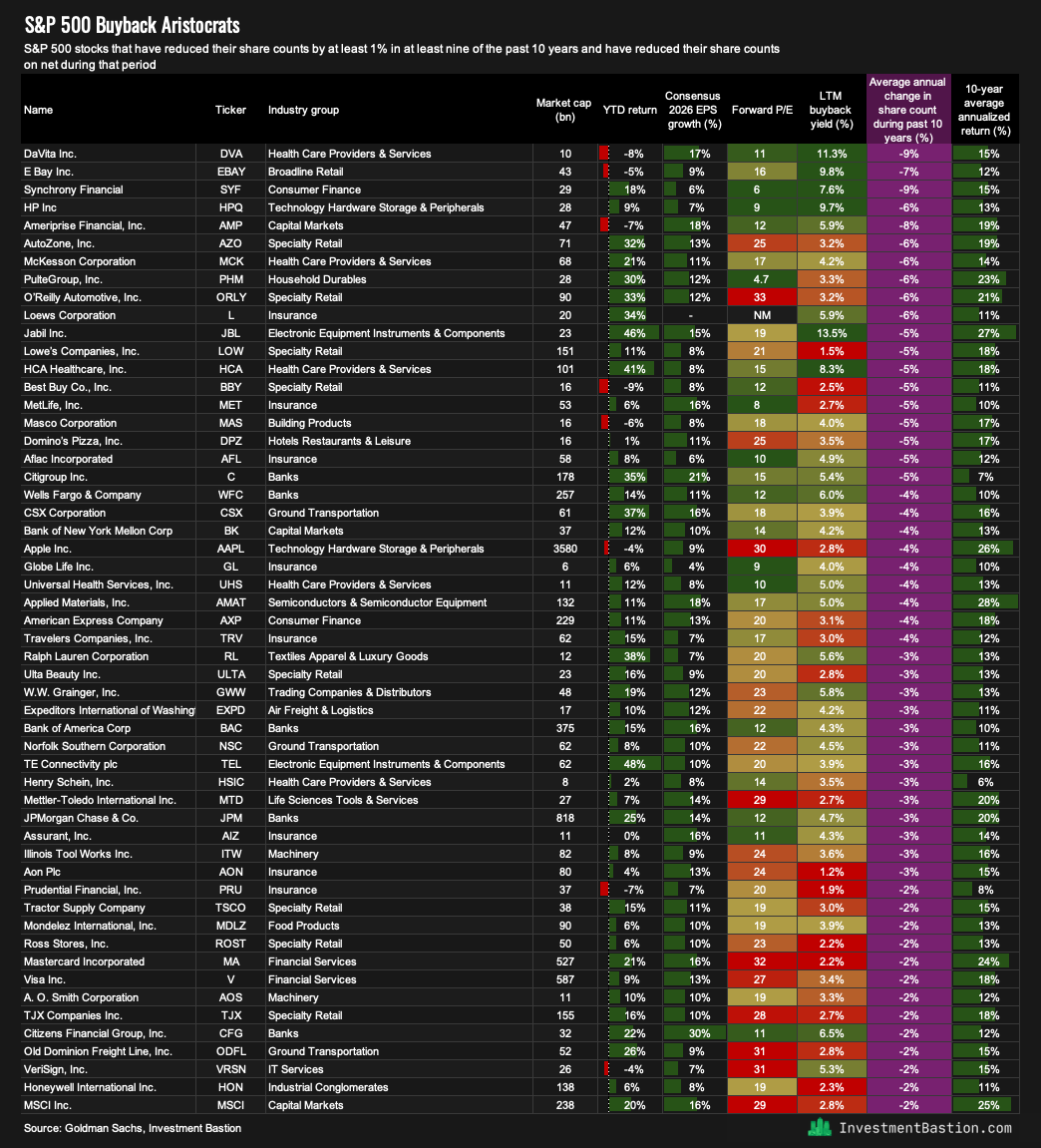

Goldman Sachs highlights a special group of S&P 500 stocks that have reduced their share count by at least 1% in nine out of the past ten years.

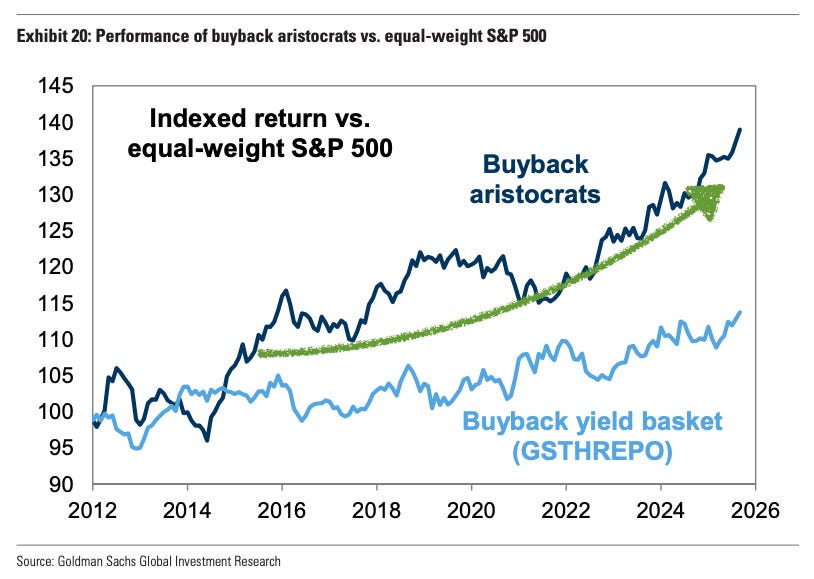

“An equal-weight portfolio of Buyback Aristocrats, reconstituted and rebalanced annually, has outperformed the equal-weight S&P 500 by an annualized 3 pp since 2012 and 6 pp in the past 3 years. The strategy has also outperformed our Buyback basket, which is constructed purely based on buyback yields.”

Goldman also notes a valuation edge:

“The median Buyback Aristocrat trades at 18x forward P/E, slightly below the 20x multiple of the median S&P 500 stock, and slightly above the 17x P/E of the equal-weight S&P 500 index.”

I compiled Goldman’s full list in the table below.

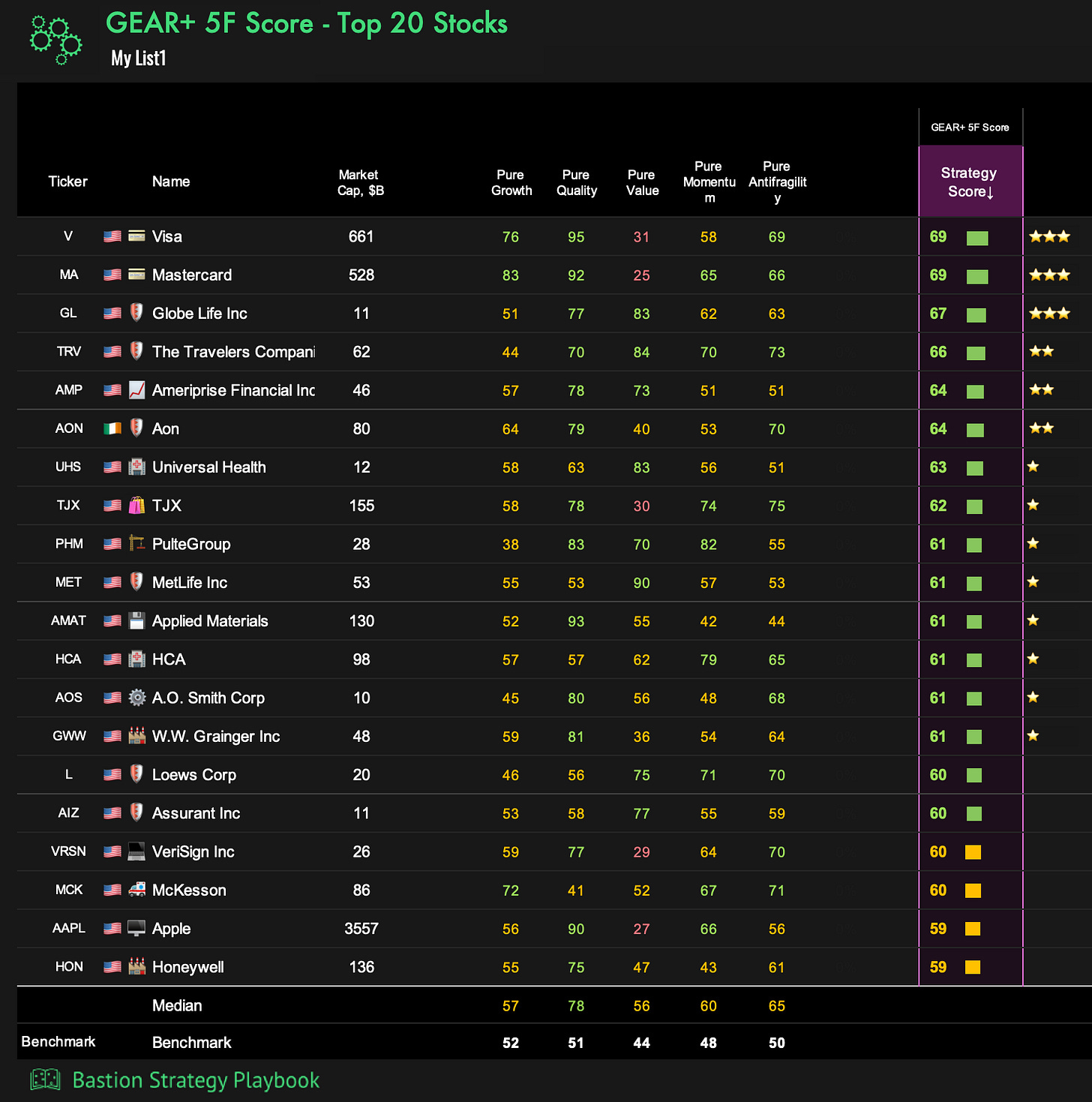

Top 20 US Buyback Aristocrats by GEAR Score (Growth + Efficiency at Reasonable Price)

Key stats on the Top 20 Buyback Aristocrats with high GEAR+ scores

Visa and Mastercard stand out. Both payment networks have barely outperformed global equities in the past 5 years, yet maintain double-digit expected revenue growth and trade near historical highs.

2. China Growth Portfolio

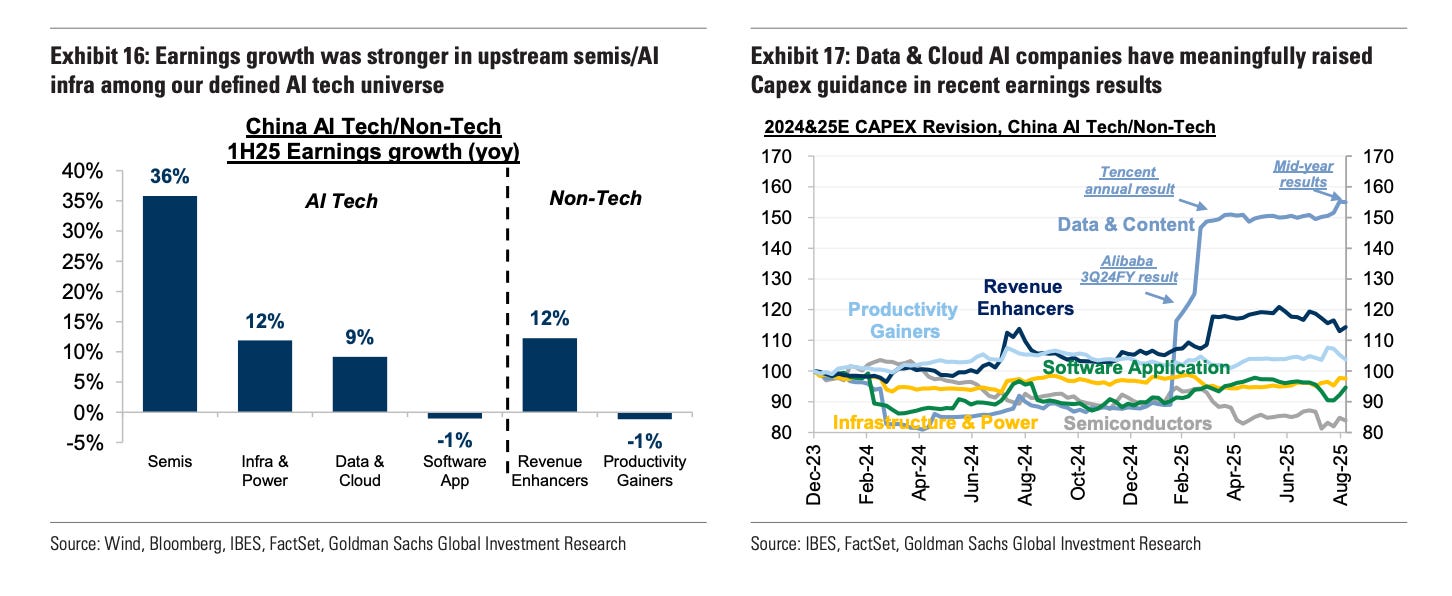

Goldman Sachs notes that the breakthrough of DeepSeek models continues to drive strong momentum in Chinese semiconductors and AI infrastructure, with earnings growth of +36% and +12% YoY.

The most interesting piece of their latest report for portfolio managers is the China Growth Portfolio, designed to help investors identify high-growth opportunities with strong risk/reward profiles.

GS selects companies that:

Fit into preferred earnings-linked themes (Chinese exporters to EMs, improving shareholder returns, Chinese AI story, services consumption, and POE policy support).

Show strong absolute earnings growth.

Are expected to deliver earnings beats vs. consensus, according to GS sector analysts.

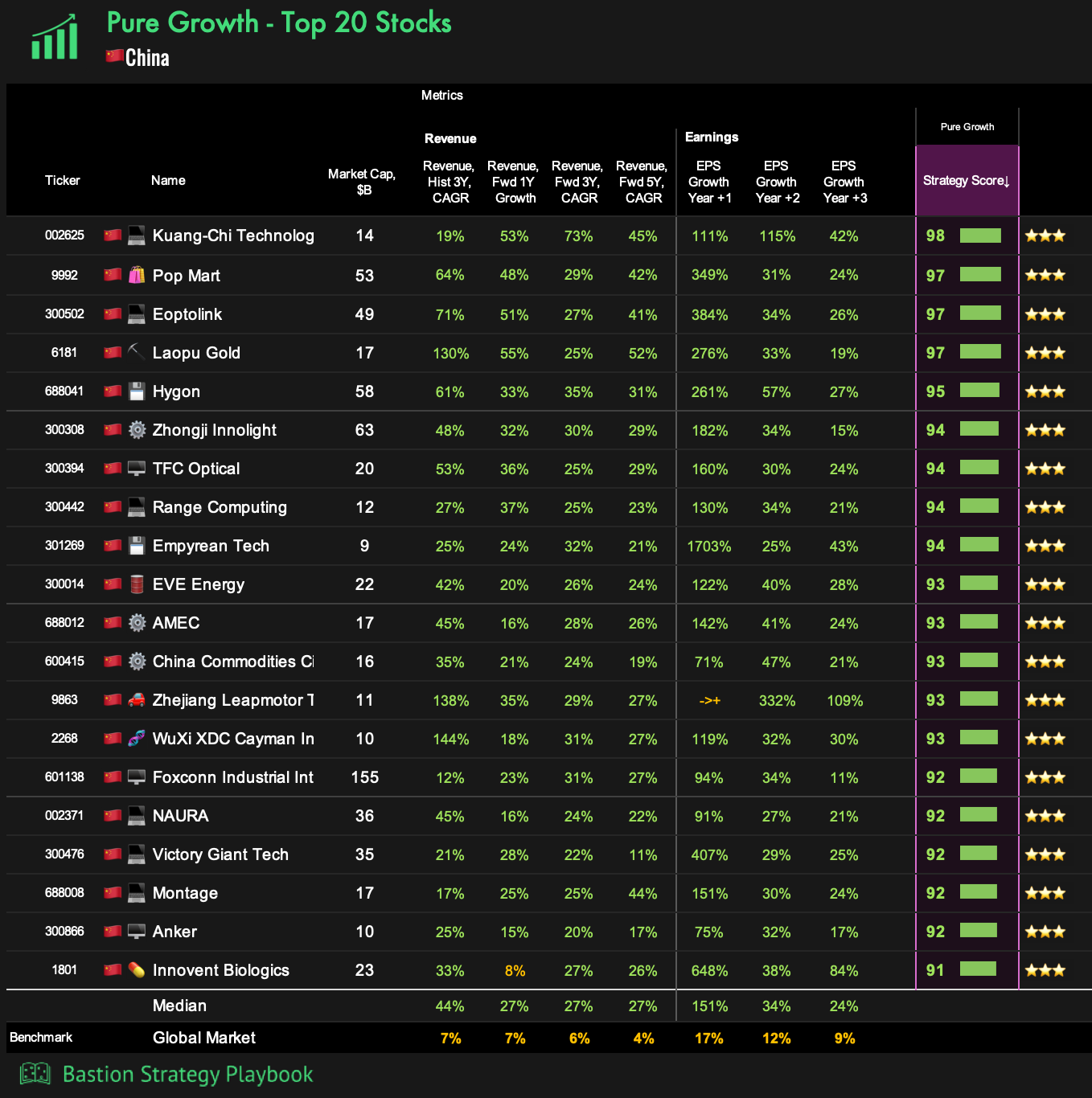

Bastion’s Playbook includes a view of the top stocks in China based on the Growth strategy. Here are the top 20 leaders ranked by Pure Growth.

Key Stats:

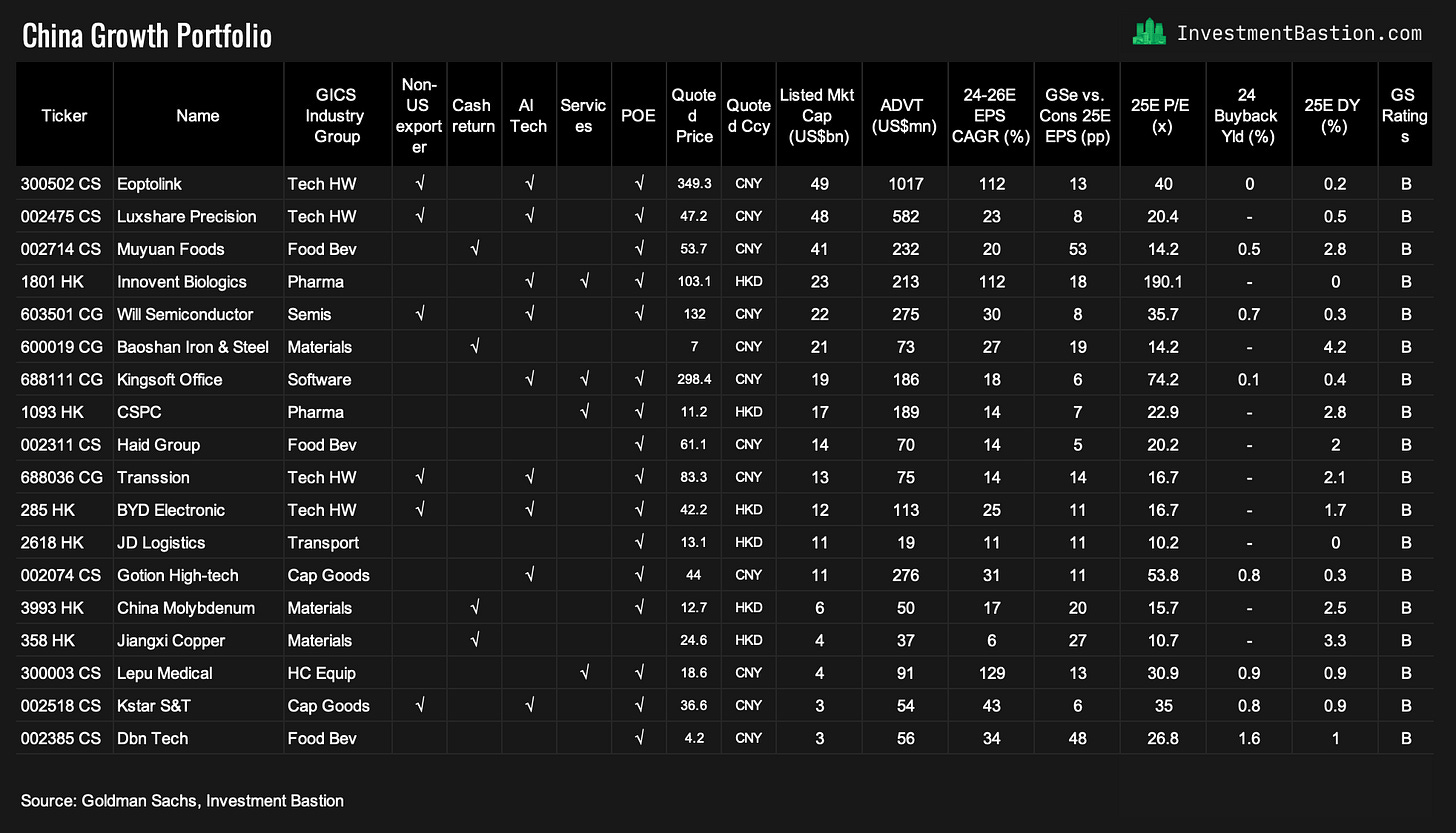

There are two overlaps with the Goldman Sachs portfolio.

Eoptolink (300502, Non-US exporter, AI Tech) – offers the broadest 100G/200G/400G/800G transceiver portfolio used in data centers, cloud, telecom, and HPC. Export accounts for ~70% of revenue (India, Vietnam, Philippines, broader Asia). A top-quality, top-growth, top-momentum stock.

Innovent Biologics (1801 HK, AI Tech, Services, POE support) – Chinese biopharma developing monoclonal antibodies and protein therapeutics for oncology, autoimmune, cardiovascular, and metabolic diseases. Expected revenue CAGR: ~27% over the next 3 years.

3. Germany’s Fiscal Engine

Goldman Sachs also turns constructive on German equities. Why? I’ve highlighted a few key points:

Fiscal shift: Europe’s fiscal policy is undergoing a fundamental transformation, especially in Germany, which is preparing for a significant increase in its budget deficit to 3.8% of GDP by 2026 (vs. 2% in 2023). This fiscal impulse should accelerate economic growth.

Defence spending: now the centerpiece of this fiscal expansion, unconstrained by debt brake limits. Germany’s defence budget is projected to rise to 3.4% of GDP by 2029 (vs. 1.9% in 2024).

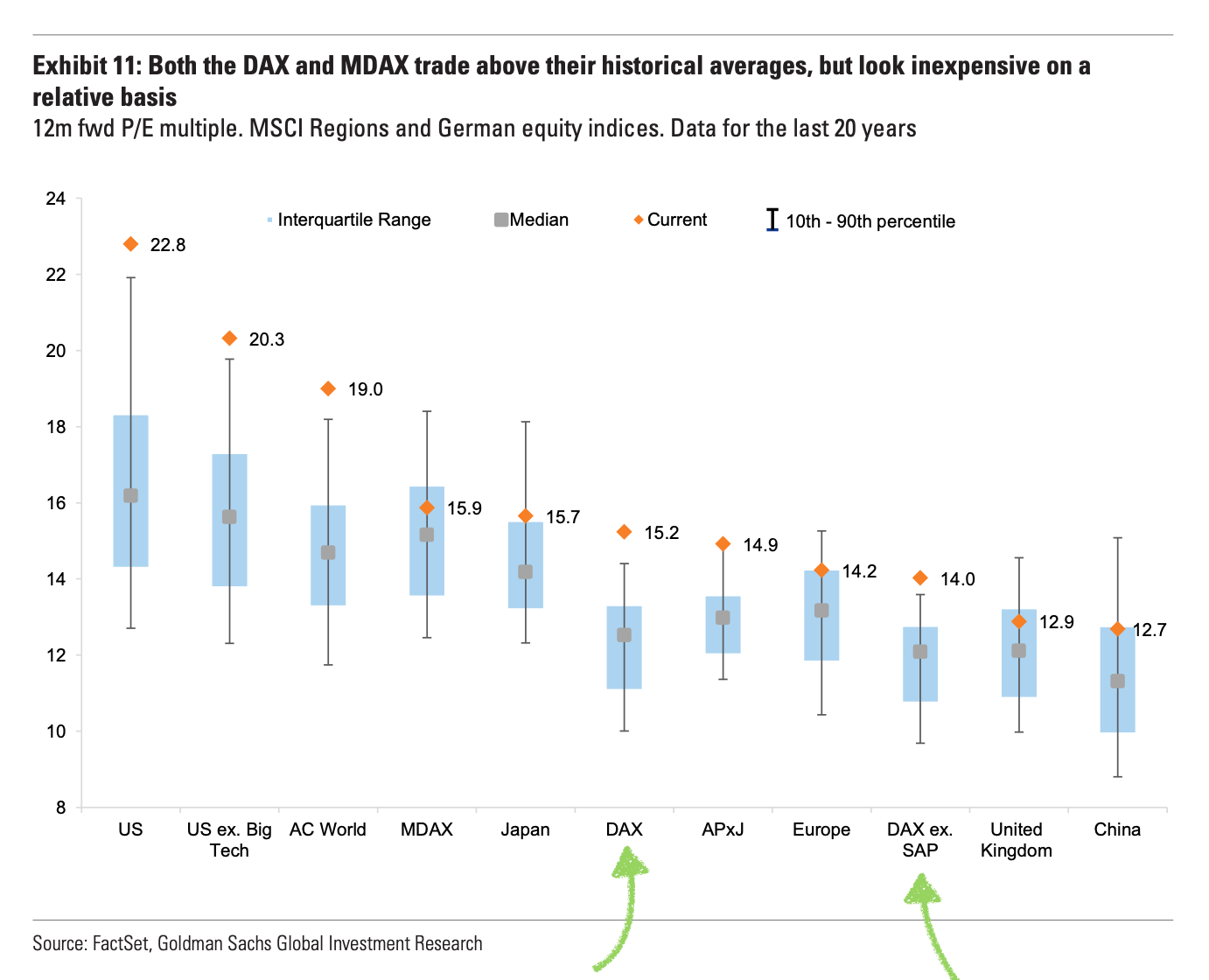

Attractive valuations: the DAX trades at 15x forward P/E, a 30–40% discount to the US. Growth-adjusted metrics support the case for continued re-rating.

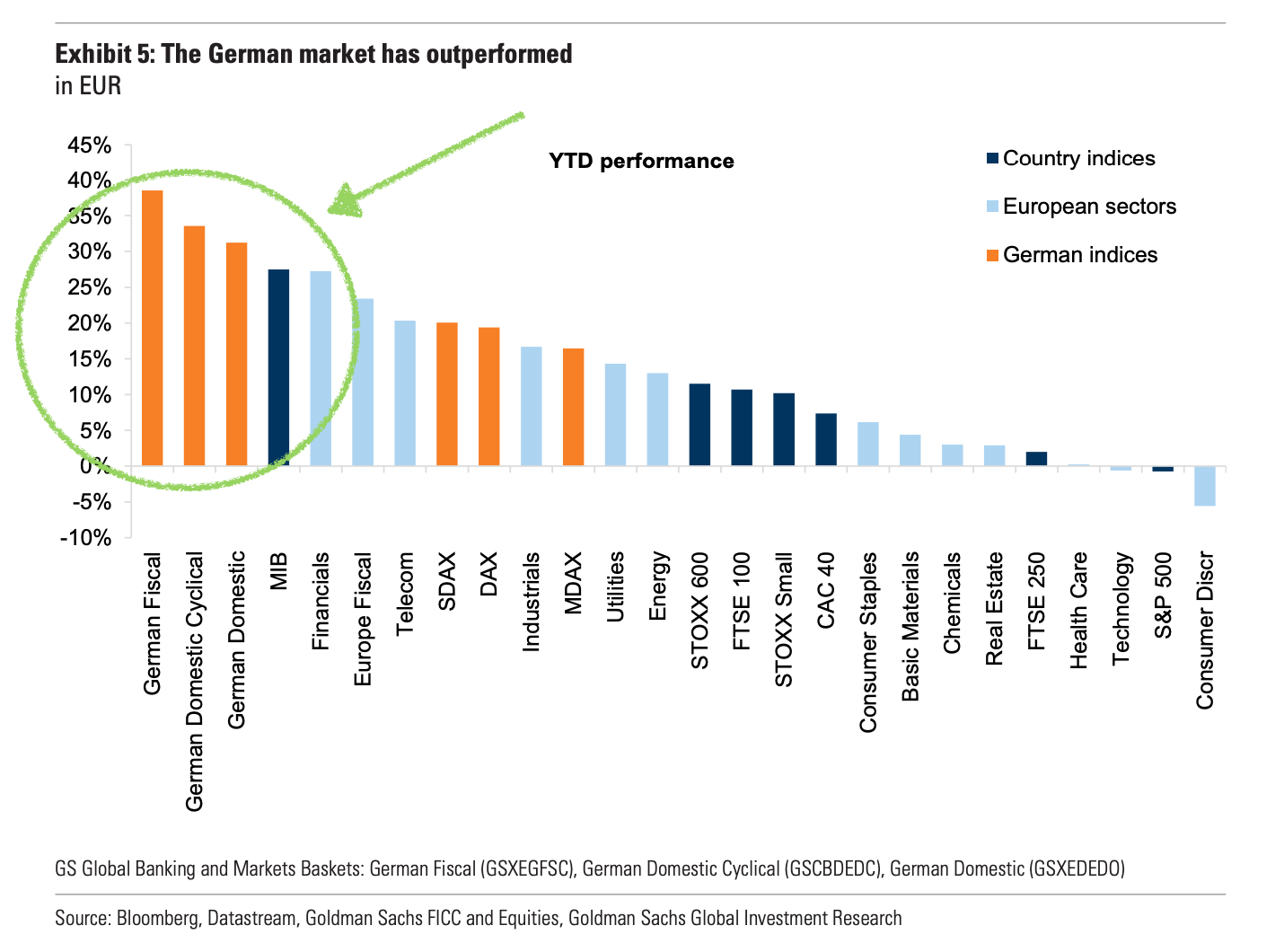

Momentum: German equities have delivered double-digit returns in 2025, reflecting strong investor conviction. Three main themes dominate: Aerospace & Defence, Power, and Financial Rebirth.

Narrow breadth: just seven companies, the “German Magnificent 7” (Rheinmetall, Airbus, Allianz, Commerzbank, Deutsche Bank, Siemens, Siemens Energy), account for almost half of HDAX gains. The HDAX is a broad German stock index that combines the DAX, MDAX and TecDAX.

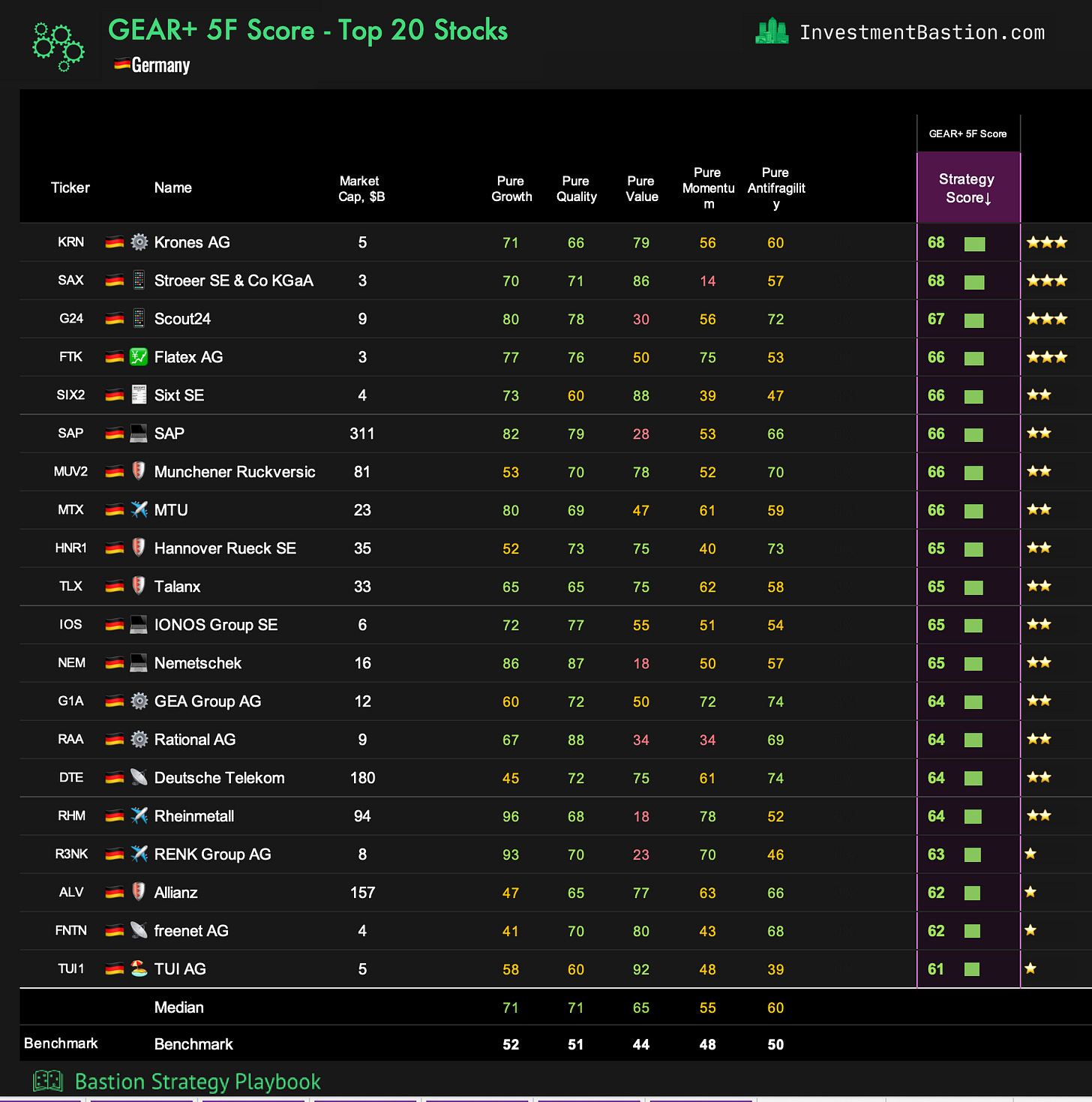

Best German Stocks by Bastion’s GEAR+ Ranking:

Key stats:

I would highlight Krones AG, a mid-cap company that tops the GEAR+ ranking. Krones is a global leader in engineering and constructing turnkey production lines and equipment for the beverage and liquid food industry, covering the entire process from brewing and processing to filling, packaging, and intralogistics. It has delivered solid historical growth (double-digit in USD terms), trades at a forward P/E of 12x, and generates a >6% FCF yield. A highly attractive and balanced profile.

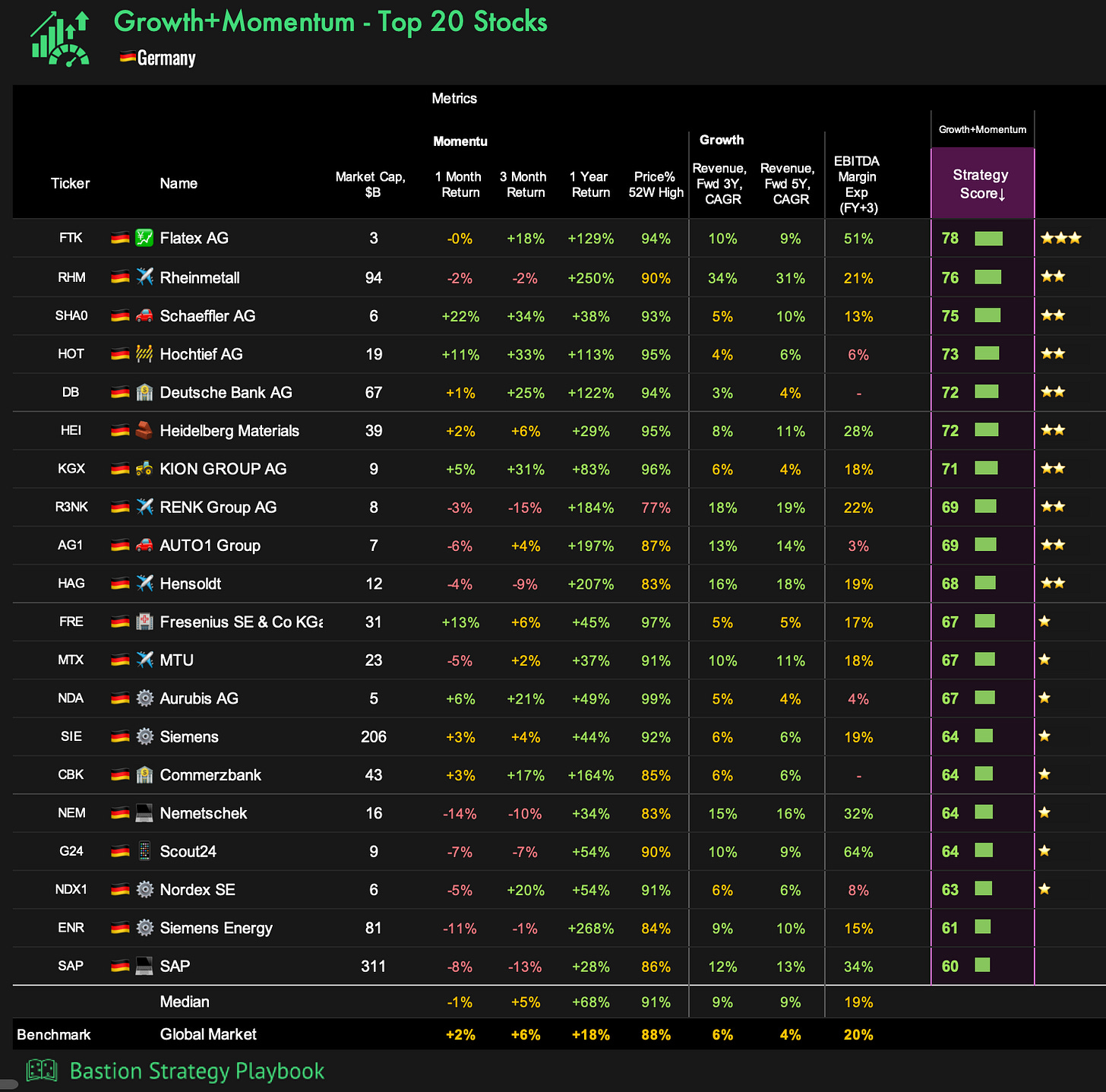

Looking for More Risk? Here are the top Growth + Momentum names in Germany.

Key stats:

The leader is flatexDEGIRO — a European online broker with a wide range of financial and fintech services, operating in ~16 countries with ~3 million clients. Strong growth prospects are paired with a reasonable valuation (forward P/E ~19x) and powerful stock momentum. It is the only German equity ranking in the global top 10% for Growth + Momentum score.

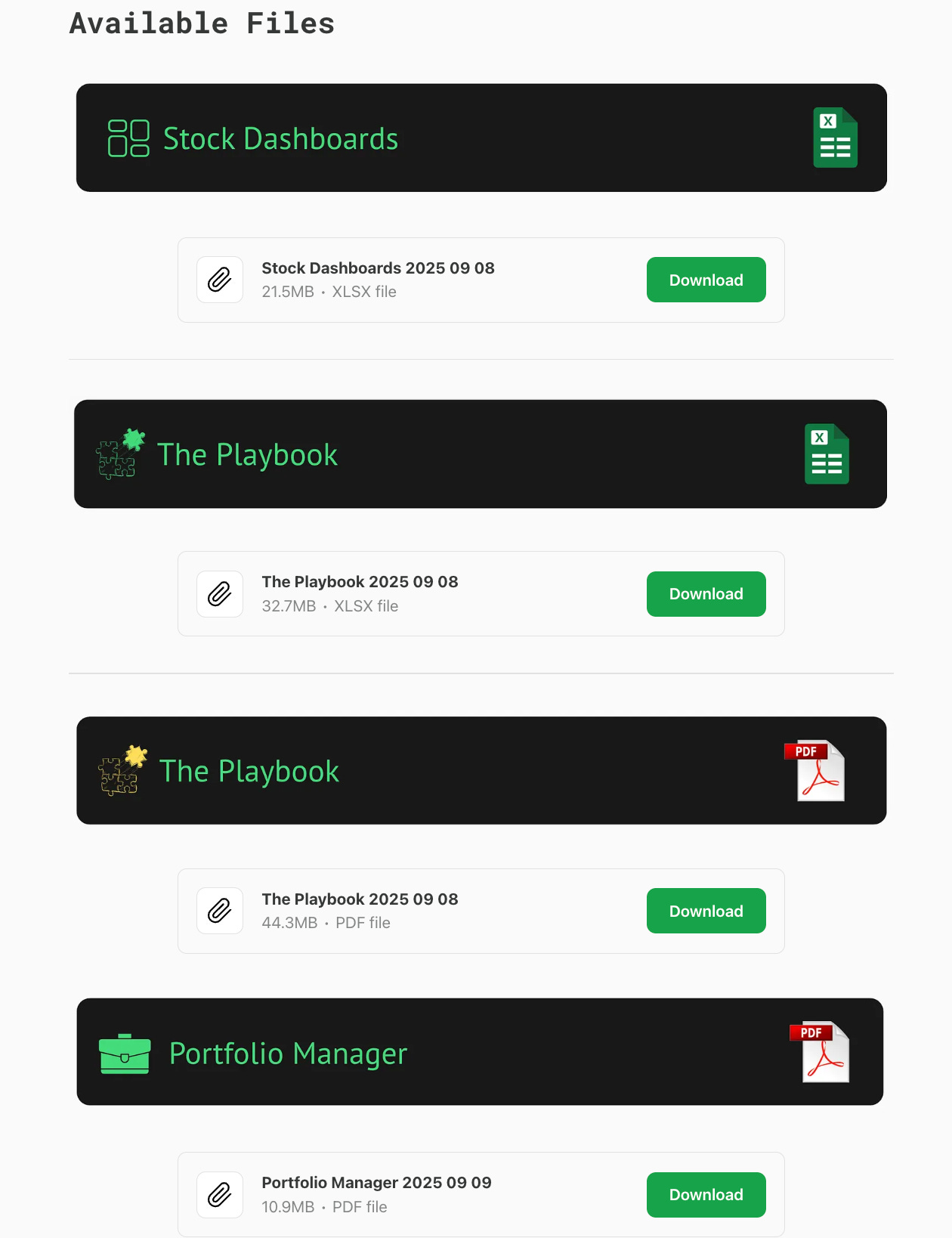

The Playbook

All visuals are powered by the Bastion Terminal and the Bastion Playbook — a weekly update of stock ratings by sector and region.

Available as both a PDF with key ratings and an Excel file. Try it with a 7-day trial. A tool built for super-intelligent equity decisions.