Idea Radar #3: The U.S. Mining Revival, Top Rare Earth Pick, Powering AI Winners.

Best Portfolio Ideas from Recent Investment Bank Research

Welcome to Idea Radar — an investor briefing built for investors, analysts, and portfolio managers.

I review over 100 research reports from top investment banks to surface the most original and actionable insights — and explain how they translate into real portfolio decisions.

I also include analytics and infographics from the Bastion Terminal to help you apply these ideas in your investment process.

My goal is simple: minimal filler, maximum actionable ideas.

📌 This edition’s highlights:

🔧 Why the U.S. resource sector is set for a revival

⛏️ A selection of high-potential small caps in mining

🌍 The top stock in rare earth metals

💰 A strong dividend candidate positioned to benefit from mining capex

🛢️ A silent dividend giant behind the AI boom

⚡ The best-positioned stocks for the Powering AI theme

🔋 One of the most underappreciated beneficiaries of the global data center energy surge

1. The U.S. Mining Revival: A Strategic Opportunity

Morgan Stanley highlights a striking trend: U.S. dependence on imported critical minerals is now at its highest level in over 30 years, while investment in the domestic resource sector remains near historical lows.

Back in 1990, the U.S. was fully reliant on imports for 9 minerals, and over 50% dependent on imports for 27 minerals (including both critical and non-critical ones). By 2022, those numbers had risen to 15 and 51, respectively.

Meanwhile, China has emerged as the global leader in mineral processing and refining. The U.S. is now over 50% reliant on China for 26 key minerals.

📝 Given the current US administration's focus on independence from China (and the rest of the world), this could mean a revival of the North American mining industry after years of stagnation and underinvestment.

Chart: US Resource Investment as % of GDP: Is a Boom Coming? Morgan Stanley Thinks Yes

One of the main reasons for underinvestment has been the complex and inefficient U.S. permitting system. It takes 7–10 years on average to secure permits in the U.S., compared to just 2–3 years in countries like Canada or Australia, despite having similarly strict environmental standards.

The new U.S. administration is expected to be highly supportive of the sector, which could lead to a significant reduction in bureaucratic hurdles over the coming years.

At the same time, innovation is rapidly transforming the sector. Companies are developing ways to extract minerals from reprocessed tailings and are using AI to accelerate exploration.

Morgan Stanley cites Freeport-McMoran as an example: the company is developing catalytic leaching technology to extract copper from waste rock. In the near term, it aims to produce 200 million pounds of copper annually using this method, and over the medium term, it plans to scale up output by an additional 600 million pounds.

2. Mining Revival Investment Implications (a): Focus on Junior Miners

In Morgan Stanley’s view, the clearest near-term winners from permitting reform and capital inflows will likely be Junior Mining and Exploration companies, which are most sensitive to improved policy and financing environments.

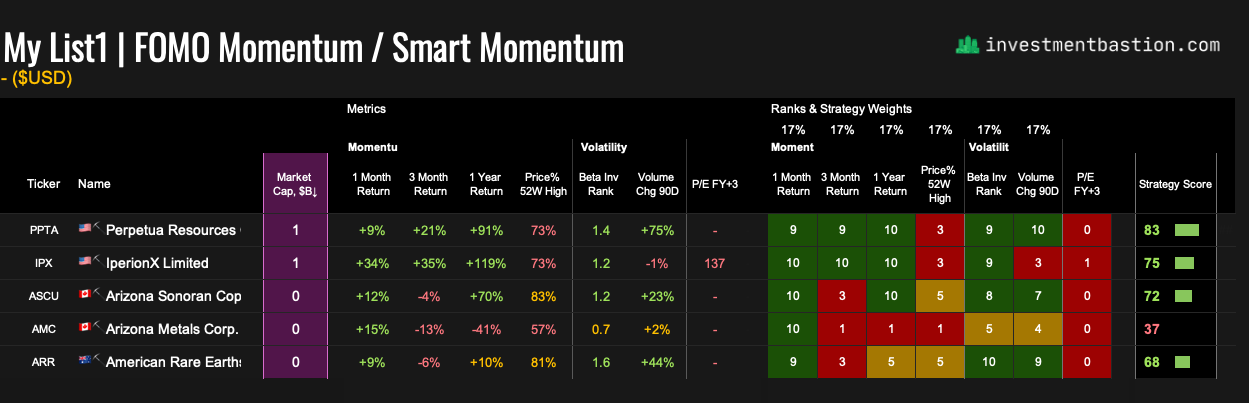

Here are a few junior miners with U.S.-based assets worth watching:

Arizona Metals Corp. (AMC.TO | Market Cap ~$235 million USD): Owns 100% of two exploration and development projects in Arizona. The company is actively drilling and progressing resource definition work.

Arizona Sonoran Copper Company Inc. (ASCU.TO | Market Cap ~$125 million USD) Based in Tempe, AZ, ASCU is developing the Cactus Project—an advanced brownfield copper project just south of Phoenix. The company plans to use a simple and low-cost heap leach and SXEW method to produce copper.

American Rare Earths (ARR.AX | Market Cap ~$43 million USD)

Focused on rare earth exploration and development. Its 100%-owned Halleck Creek project in Wyoming shows extensive mineralization and, according to the company, could become one of the largest rare earth deposits in the U.S.

Perpetua Resources (PPTA.TO | Market Cap ~$900 million USD)

Developing the Stibnite Gold Project in Idaho, which also contains significant antimony reserves—a critical mineral used in semiconductors, batteries, and defense. The company estimates it could supply around 35% of U.S. antimony demand in the first six years of production. It recently received up to $15.5 million in funding from the U.S. Department of Defense to support the creation of a domestic antimony supply chain.

Iperionx (IPX.AX, IPX.O | Market Cap ~$140 million USD)

Aiming to re-shore a fully integrated titanium metal supply chain to the U.S. via its Titan Project in Tennessee. In addition to titanium, the company plans to produce rare earths and zirconium as co-products. IperionX is also working on advanced processes to manufacture high-performance titanium alloys from both minerals and scrap metal.

📝 In my view, this is a very interesting list of stocks worth exploring further for investors focused on small caps. While I primarily focus on selecting medium and large-cap names, I’m adding these junior miners to my watchlist.

3. Mining Revival Investment Implications (b): Focus on Strategic Names

Bastion analysis and portfolio management mainly focus on large corporations with a market cap above $2 billion. Which mid- and large-cap companies could directly benefit from the launch of new growth projects in the sector? Morgan Stanley highlights Freeport-McMoRan (FCX) and MP Materials (MP) as potential long-term beneficiaries.

Freeport-McMoRan (FCX): Copper, gold, and innovation-driven growth

FCX is one of the world’s largest copper producers, with a pipeline of long-life U.S. growth assets:

Bagdad Expansion (Arizona, USA) – FCX plans to expand its existing Bagdad mine. The current reserves are sufficient for about 80 more years of operation. The company is evaluating an expansion of the processing plant to handle an additional 100,000 tons of ore per day. This could increase production to around 200 million pounds of copper annually. However, such an expansion would reduce the mine's life to approximately 40 years.

Lone Star sulphide expansion (Arizona, USA) — After FCX finishes its current project to increase oxide production (from 95,000 to 120,000 tons per day), they are looking at a much bigger project to mine sulphide copper. This area may have around 50 billion pounds of copper. The project would use both leaching and concentration methods. FCX hasn’t shared full details or costs yet, but they are doing more exploration and lab tests to prepare.

FCX's valuation remains reasonable at 16x 2027 expected earnings, and while FCX has underperformed over 1, 3, and 10 years, consensus expects strong long-term EPS growth. Any upside surprise in copper prices could significantly re-rate the stock.

Freeport-McMoRan is a candidate stock for portfolios based on Efficiency + Growth strategies. However, in this case, the growth is heavily tied not to project execution but to copper price dynamics. For my GEAR+ strategy, I primarily focus on companies with strong organic growth that outpace the market, which is why I rarely include resource companies in strategic long-term portfolios.

📝Currently, the stock has been trading sideways for several years. A breakout from this range and a move above its historical high could signal a shift in global sentiment toward copper projects, in which case the stock may be included in the speculative portfolio. For now, it remains on the watchlist.

MP Materials (MP): Rare Earths Leader With Long-Term Strategic Leverage

MP Materials is the leading U.S. rare earth miner and a key beneficiary of EV and wind power growth. By vertically integrating from mining to magnet production, and backed by strong policy support, MP is building a strategic domestic supply chain. Execution of its California mine and Texas magnet plant positions it for long-term upside as a critical supplier to U.S. industry.

MP Materials scores among the highest in the mining sector in terms of growth potential. The stock is also showing very strong momentum, recently breaking out to multi-year highs. While its forward P/E for 2027 stands at 66x, potential upside in rare earth material prices and strong government support could mean that the company’s long-term earnings are currently undervalued.

It's important to note that the company is still deep in a heavy investment phase. Net income margin is -48%, and free cash flow margin is -80%. Negative free cash flow and low profitability are likely to persist for several more years until its downstream operations fully scale.

📝The stock is a strong fit for Growth + Momentum strategies. I’m adding it to my speculative portfolio, which I plan to publish soon.

Keep reading for 6 additional insights and key takeaways for portfolio strategies.

4. Beyond Mining: Who Benefits from the U.S. Mining Capex Cycle?

Keep reading with a 7-day free trial

Subscribe to Investment Bastion to keep reading this post and get 7 days of free access to the full post archives.