Bastion Trend Tracker: NVIDIA breaks out

Strategy-driven insights from this week’s top market movers

Your fast, focused hit of the biggest market trends. Designed for active investors, momentum traders, and strategy-driven PMs who want signal, not noise.

All signals come from the Bastion Terminal, where you can sort and score 3,500+ global stocks by Growth, Quality, Efficiency, Momentum, and more.

Terminal – Updated on June 28, 2025.

The Bastion Terminal is a set of Excel-based tools that I use for stock analysis and generating investment ideas.

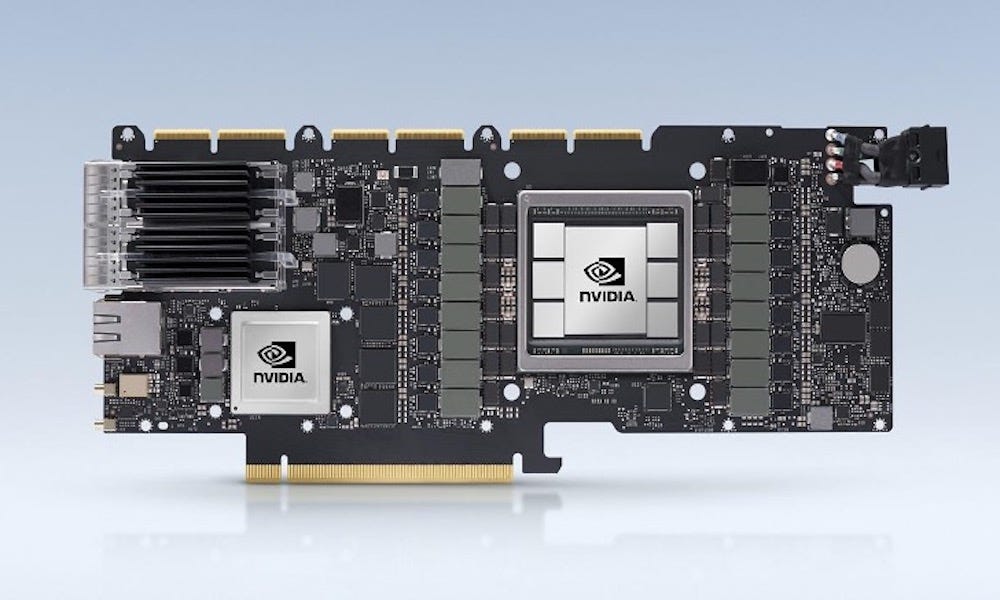

1. 💾 NVIDIA Hits New Highs on Sovereign AI Boom

CEO Jensen Huang doubled down this week, calling it a “multitrillion-dollar decade” driven by demand for sovereign AI. While headlines about trade wars and China’s DeepSeek made noise, the stock surged +10% and hit fresh all-time highs.

→ In Bastion: NVIDIA holds one of the highest Growth + Quality scores in the market. Short-term pullbacks remain an opportunity to build exposure in long-term portfolios.

2. Uber Eyes Autonomy. Outperforming Tesla This Week

Uber (+9%) outpaced Tesla (+2%) this week, despite headlines around Tesla’s Robotaxi launch. While many saw it as a long-term threat to Uber’s model, the market seems to be rewarding Uber’s counter-move.

According to The New York Times, former CEO Travis Kalanick is in talks with Uber to back his acquisition of Pony.ai’s U.S. operations, a Chinese autonomous vehicle firm navigating regulatory constraints in the US.

→ In Bastion: Uber shows rising momentum and improving efficiency.

Ranked in the top 10% of global stocks by Growth + Quality composite score.

3. 👟 Nike Jumps +20% on Turnaround Hopes

Nike was one of the top performers this week, surging +20% after CEO Elliott Hill outlined a renewed focus on core sports categories and product-line restructuring. But context matters: The stock is still -32% over three years, ranking among the worst in the US broad market.

→ In Bastion: Nike doesn’t yet qualify for GEAR+ or Momentum portfolios. Its re-rating is early, and score trends remain weak. Still, it’s a turnaround name worth watching as fundamentals reset.

4. 💊 Hims & Hers Crashes -23% After Wegovy Fallout

Novo Nordisk ended its supply deal with Hims & Hers, accusing the telehealth company of illegally selling copycat versions of its blockbuster weight-loss drug, Wegovy. The news wiped more than 20% off HIMS’ stock in a single day.

This is critical: without GLP-1 sales, Hims & Hers would be barely profitable, if at all.

→ In Bastion: HIMS remains a high-volatility retail favorite. It doesn’t meet any GEAR+ or Quality-based criteria and is best viewed as a speculative name, not a strategic allocation.

5. 🛢️ Oil Prices Slide -12% After Ceasefire Headlines

U.S. oil ETFs dropped over 12% this week after reports of a ceasefire agreement between Israel and Iran. Just days earlier, financial influencers were calling for “$100+ oil” on the back of geopolitical tensions. This week? Silence.

→ In Bastion: This is exactly why you need a repeatable, strategy-based system — not reactive bets on headline-driven narratives. Speculation is fine, but only if you have a clear momentum signal framework before the fact.

I’m currently finalizing systematic Momentum portfolios for Bastion subscribers.

While I finish building, here’s a preview of this week’s top-rated Momentum names:

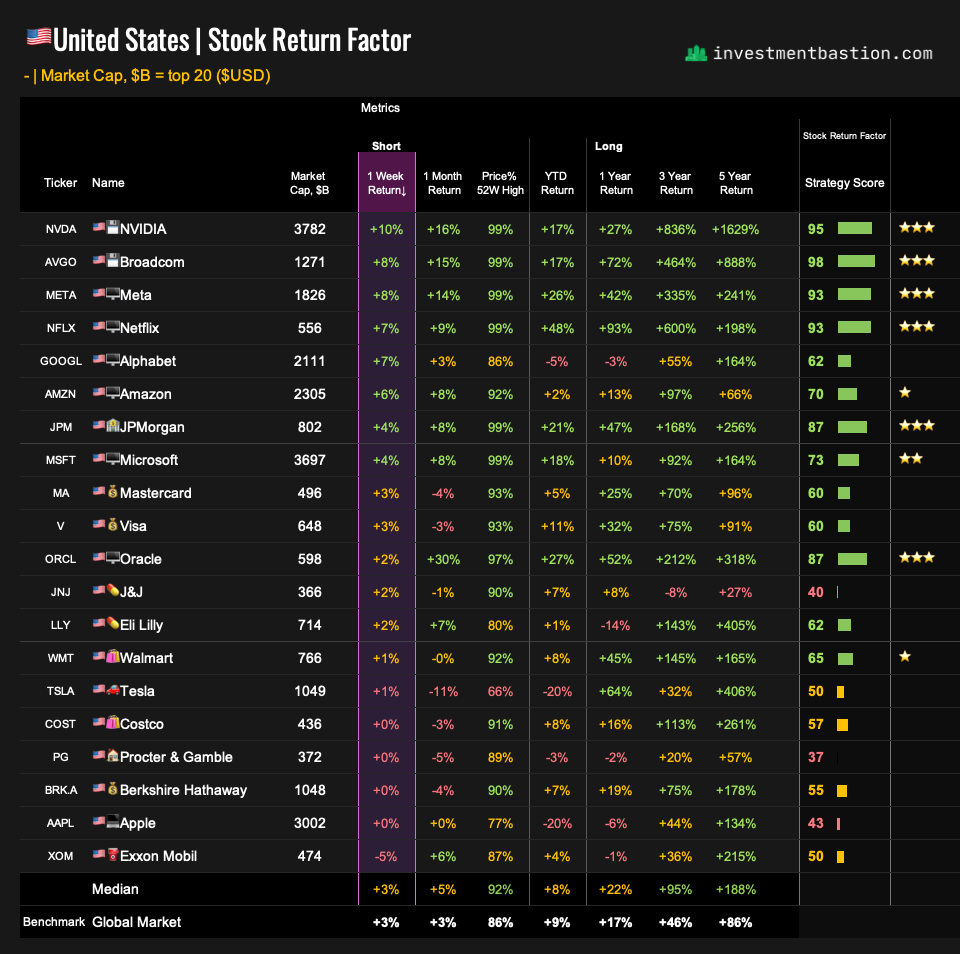

🇺🇸 US Top 100 Stocks – FOMO Momentum Leaders

Featuring the latest 52-week highs among the biggest names.

🇺🇸 US Top 500 Stocks – FOMO Momentum Leaders

Scanning for 52-week breakouts across the broader market

All of this is live in the Bastion Terminal — sort, filter, and explore momentum leaders, 52-week highs, and strategy scores across 3,500+ global stocks.

Terminal – Updated on June 28, 2025.

The Bastion Terminal is a set of Excel-based tools that I use for stock analysis and generating investment ideas.