Your fast, focused hit of the biggest market trends. Designed for active investors, momentum traders, and strategy-driven PMs who want signal, not noise.

All signals come from the Bastion Terminal, where you can sort and score 3,500+ global stocks by Growth, Quality, Efficiency, Momentum, and more.

Terminal – Updated on July 5, 2025.

The Bastion Terminal is a set of Excel-based tools that I use for stock analysis and generating investment ideas.

This Week’s Key Moves:

Oracle’s $30B AI boost: Shares +13% on historic OpenAI compute deal.

Solar shake-up: First Solar +22% as Trump tax shift favors U.S. producers.

Health spiral: Centene -38%, worst global large-cap, on ACA fallout and earnings pull.

Index catalyst: Datadog +17% after joining S&P 500, replacing Juniper.

Warehouse winner: Symbotic +29%, hits new high on automation momentum.

Taiwan tech pops: Delta Electronics +8% on Citi upgrade, AI power thesis.

China drag: Meituan logs worst sentiment globally as delivery wars intensify.

1. 🇺🇸US Top 20 Stocks

🧠 Oracle's AI Windfall

Oracle surged 13% this week, leading all mega-cap stocks, after news broke that OpenAI will lease 4.5 GW of compute from the company in a deal reportedly worth $30B annually. That’s nearly 3x Oracle’s 2025 infrastructure revenue and marks one of the largest AI cloud agreements to date. The move reinforces Oracle’s late-stage momentum in AI infrastructure, catching up to hyperscaler peers with massive, capital-intensive bets.

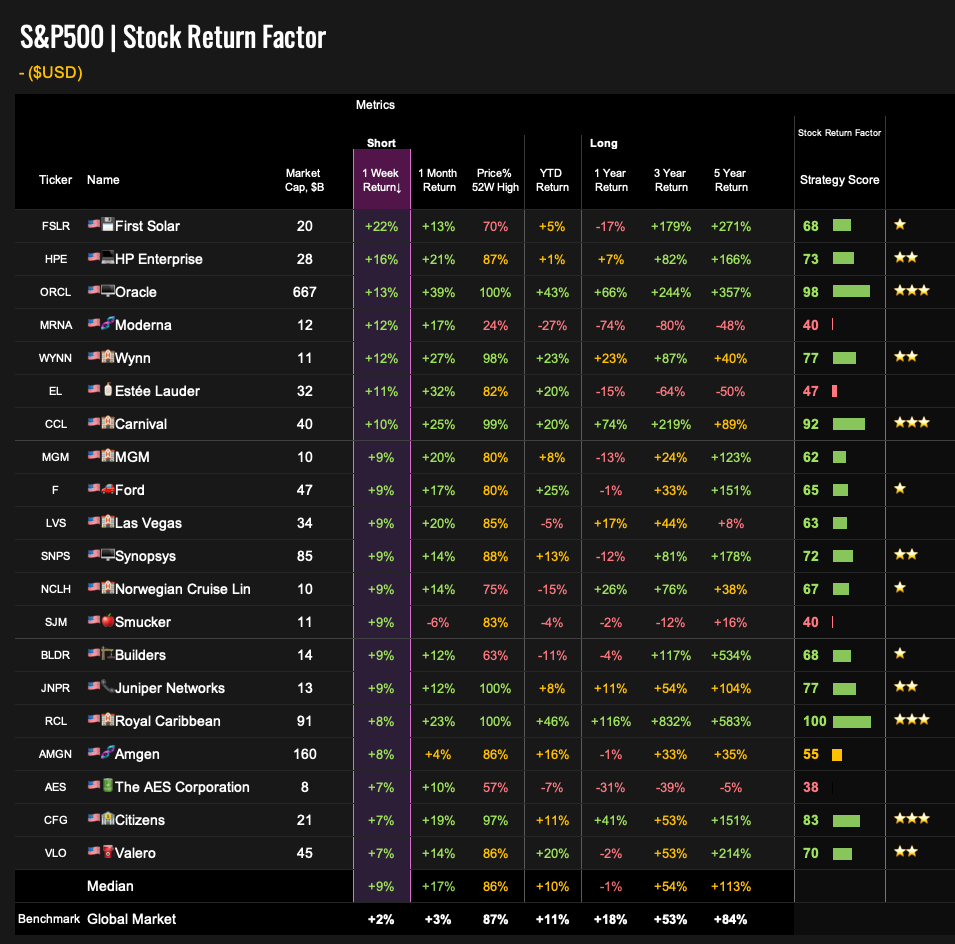

2. 🇺🇸S&P 500 Stocks

☀️ First Solar Shines

First Solar jumped 22% this week, outperforming clean energy peers as new legislation reshapes the U.S. renewables landscape. While Trump’s bill imposes a tax on projects using Chinese components and accelerates the phase-out of key solar and wind credits, it also appears to favor domestic manufacturers. According to BofA, First Solar stands to benefit from being able to claim credits on both components and final products. The tax may shrink the project pipeline overall, but it could be beneficial for First Solar, Nextracker, and GE Vernova.

⚕️ Centene Spiral

Centene shares plunged 38% this week after the ACA market leader pulled its 2025 earnings forecast, citing a sharp revenue hit from commercial Obamacare plans. The ACA (Affordable Care Act) marketplace is a government-run exchange where individuals can buy health insurance, often with federal subsidies. A crackdown on fraudulent enrollments is now pushing out healthier, low-cost members, leaving insurers with sicker, costlier pools. That’s pressuring margins and triggering premium hikes. Analysts warn of a potential “insurance spiral” as rising costs drive more people out. JPMorgan estimates Centene could lose over a third of its ACA enrollment next year.

3. 🇺🇸US Broad Market

📈 Datadog Joins the Club

Datadog surged 17% this week after being added to the S&P 500, replacing Juniper Networks. The move brings the cloud monitoring firm into the big leagues of U.S. equities, often triggering forced buying from index funds. Datadog went public in 2019 and competes with players like Cisco (which acquired Splunk) and Elastic. Inclusion in the index is a milestone for the company and a vote of confidence in its long-term relevance within the enterprise software stack.

🚨🤖 Breakout Alert: Symbotic Surge

Symbotic jumped 29% this week, hitting a new 52-week high as investor interest in warehouse automation intensifies. UBS highlighted strong structural demand in the space, citing low automation penetration and ongoing labor pressures. Its latest global survey of warehouse operators points to continued spending growth despite macro headwinds. Symbotic, which provides AI-powered robotic systems to modernize distribution centers, is riding powerful momentum and may be emerging as a core beneficiary of the logistics tech upgrade cycle.

⚕️ Centene Spiral

Centene shares plunged 38% this week after the ACA market leader pulled its 2025 earnings forecast, citing a sharp revenue hit from commercial Obamacare plans. A government crackdown on fraudulent enrollments is pushing out healthier members, skewing risk pools and forcing insurers to raise premiums. Analysts now warn of an “insurance spiral,” as rising costs drive further attrition. JPMorgan estimates Centene could lose over a third of its ACA enrollment next year — a stunning reversal for a company once seen as the poster child of the exchange market.

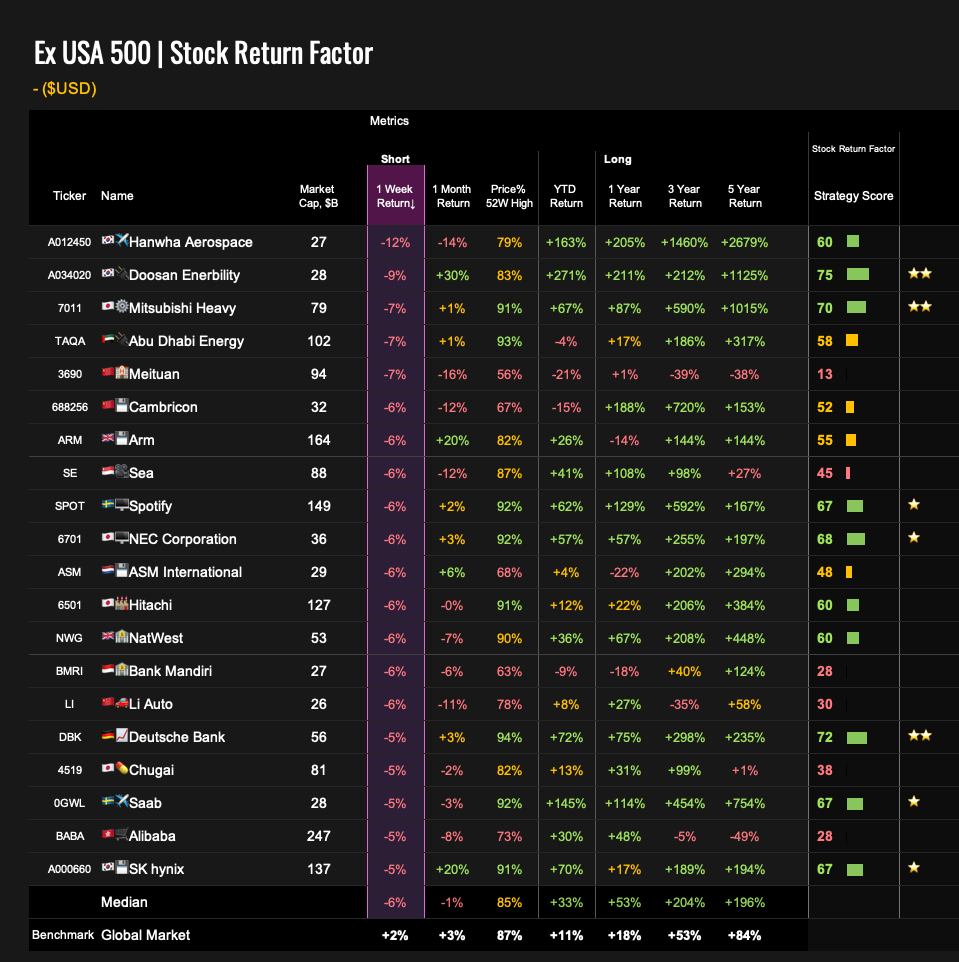

4. 🌍 Ex USA Top 500

🚨🇹🇼 Breakout Alert: Delta Electronics

Delta Electronics rose 8% this week, showing strong momentum ahead of its Q2 earnings. Citi raised its price target to NT$550 and placed the stock on a 30-day Catalyst Watch, citing potential upside surprise despite FX headwinds. The bank sees strength in AI server power and liquid cooling solutions driving dollar content growth, helping offset macro pressures. With positive mix shifts and a robust second-half outlook, Delta may be quietly emerging as a long-term beneficiary of the AI infrastructure buildout.

🥡 Meituan Meltdown

Meituan logged the worst sentiment among global large caps this week as China’s food delivery wars intensify. Fierce competition and margin fears continue to weigh on shares.

5. 📊Sector ETFs

6. 📊Country ETFs

7. 📊100 key ETFs

That’s your shot.

☕ See you next week for more charts, sharper signals, and no-nonsense market intel.