The Bastion Strategy Playbook – a weekly report that ranks global stocks across 9 investment strategies. It helps investors discover ideas that align with any investment style – from Value to Growth and Momentum trading.

Rankings can be explored by region or sector in an interactive Excel file, or examined in more detail through a dedicated 150-page PDF report covering the S&P 500, US Mid Caps, Europe 500, Global 500, and Ex-US 500 universes.

Below are my notes and observations based on the 3rd edition of the Playbook.

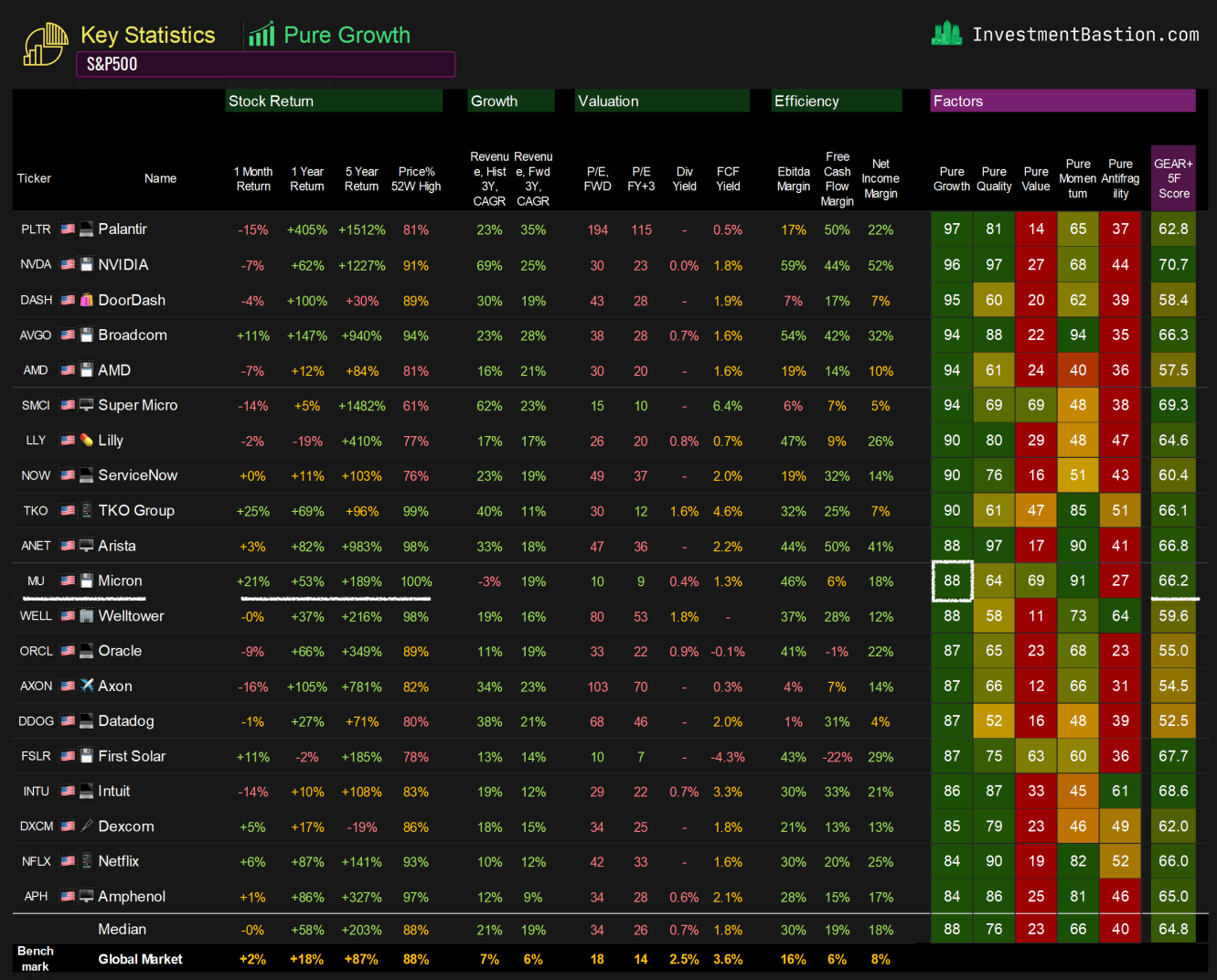

1. Micron – Top 20 S&P 500 Growth stock with low multiples and strong momentum

Micron’s revenue and profit growth depend heavily on the long-term adoption of its High Bandwidth Memory (HBM) chips, a critical component in Nvidia’s H200 GPUs. Demand for artificial intelligence chips is secured for years ahead, supporting a strong business growth outlook. The company’s 5-year revenue CAGR forecast stands at 15%.

The stock has been one of the market’s top performers over the past month, hitting new yearly highs. Yet valuation remains remarkably cheap, with a forward 2027 P/E of just 9x.

Micron also ranks in the top 5% of the S&P 500 under the Growth + Efficiency at Reasonable Price (GEAR+) strategy.

Risks: Micron faces intense competition in the traditional memory business from Korean giants Samsung and SK hynix. Its supply chains also rely on subcontractors in Taiwan, adding geopolitical and operational risks. This makes the stock attractive for growth investors, but it is certainly not a defensive play.

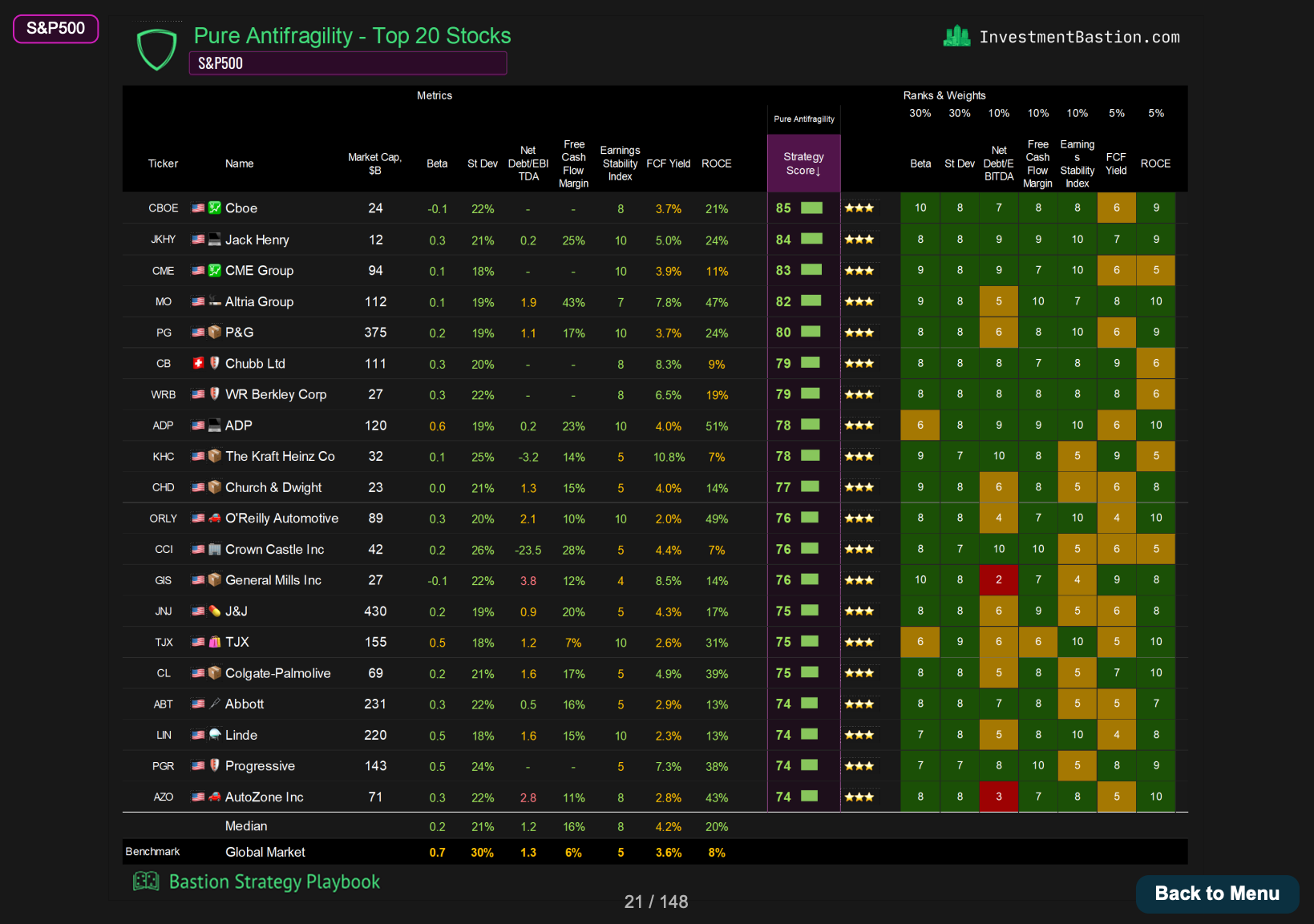

2. Defensive moves: best antifragility stocks in the S&P 500

These companies combine low beta, low volatility, and solid quality fundamentals.

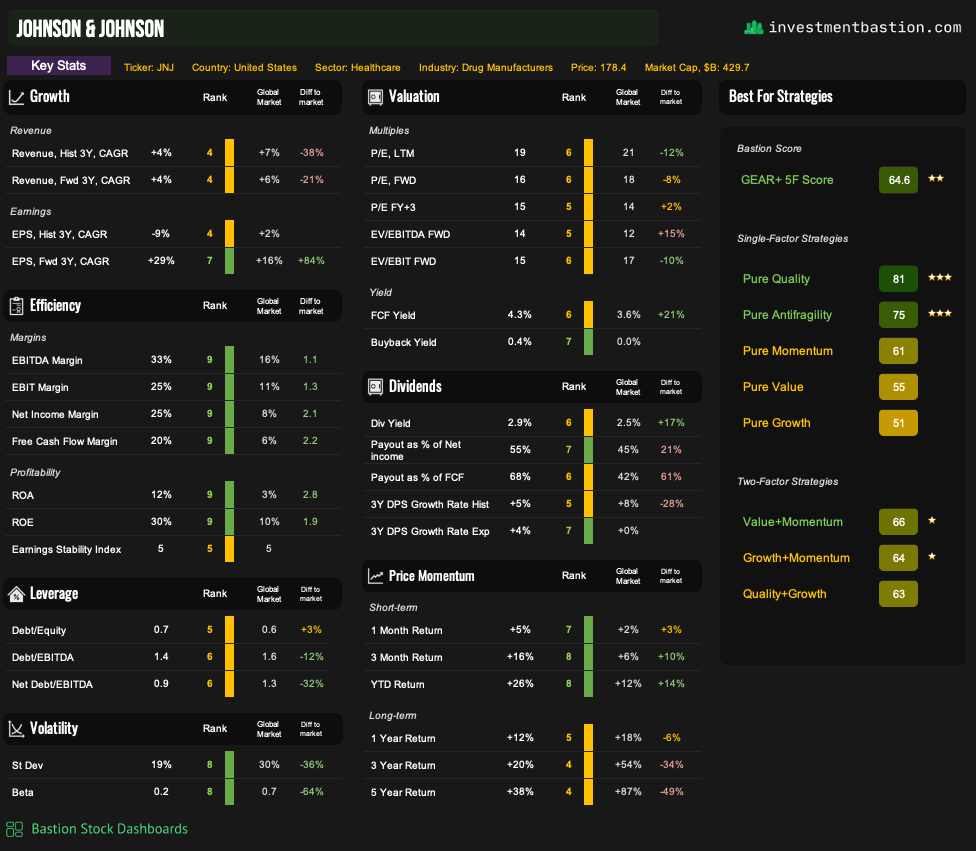

In this list, I would like to note Johnson & Johnson.

After years of stagnation, the stock is breaking out of underperformance and has recently set a new 12-month high. Valuation remains reasonable at a forward P/E of 16x, and the latest earnings came in ahead of expectations.

J&J’s pharmaceutical segment is growing about 5% annually, supported by strong demand for cancer therapies (Darzalex, Carvykti, Erleada) and its depression treatment Spravato. The company has raised its 2025 sales guidance, expecting a strong second half of the year and only a limited hit from tariffs. Management now projects around $200 million in tariff costs, down from the $400 million forecast in April.

Overall, J&J looks like a strong candidate for Quality and Low Volatility strategies.

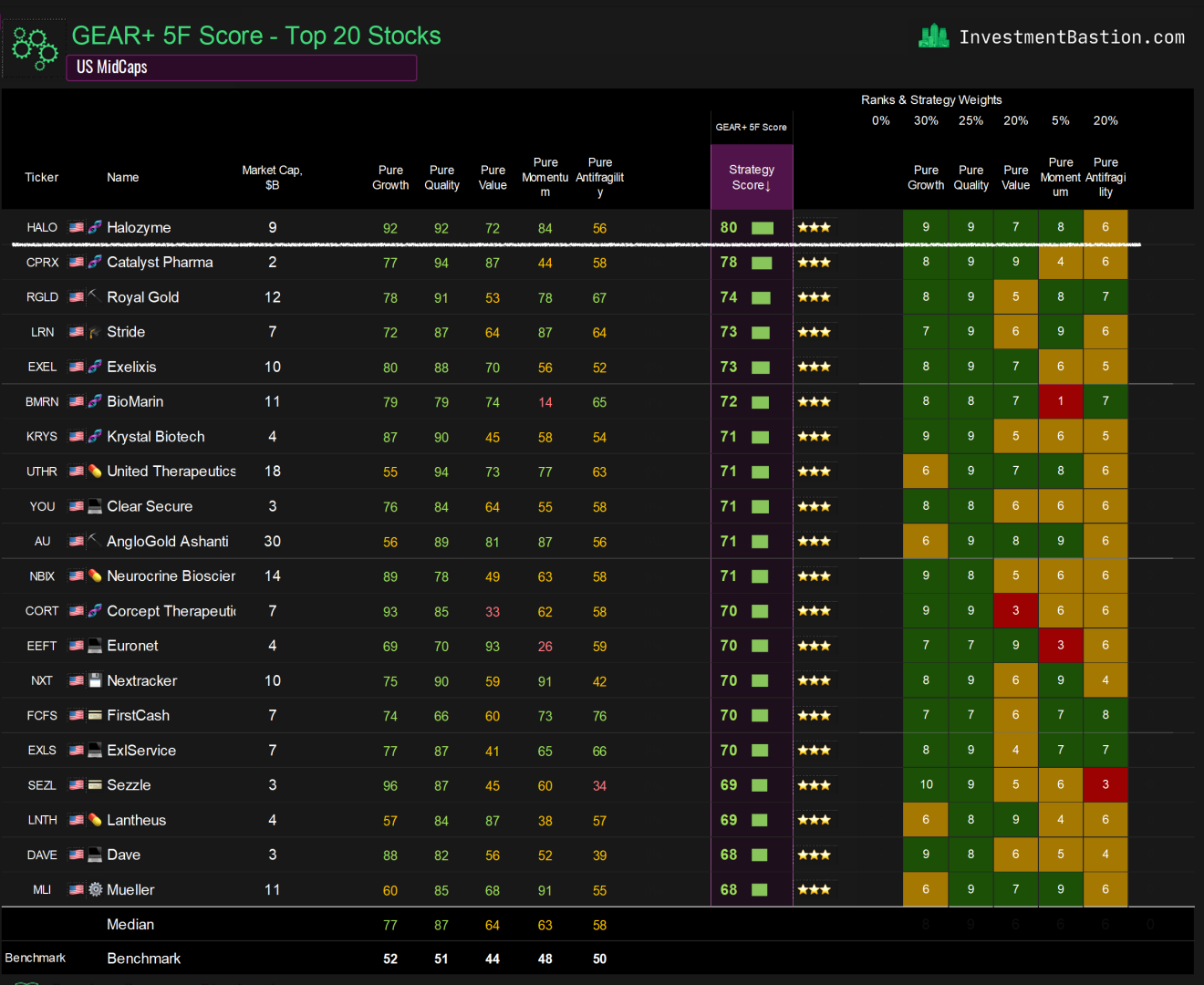

3. Let’s take a look at something interesting from US Midcaps.

I recently highlighted biotech Halozyme.

Halozyme has the highest score in the Growth + Efficiency at Reasonable Price (GEAR+) strategy among US mid-cap stocks.

The stock is breaking out to all-time highs – the market is starting to take notice.

A few notes from the Wells Fargo 20th Annual Healthcare Conference 2025:

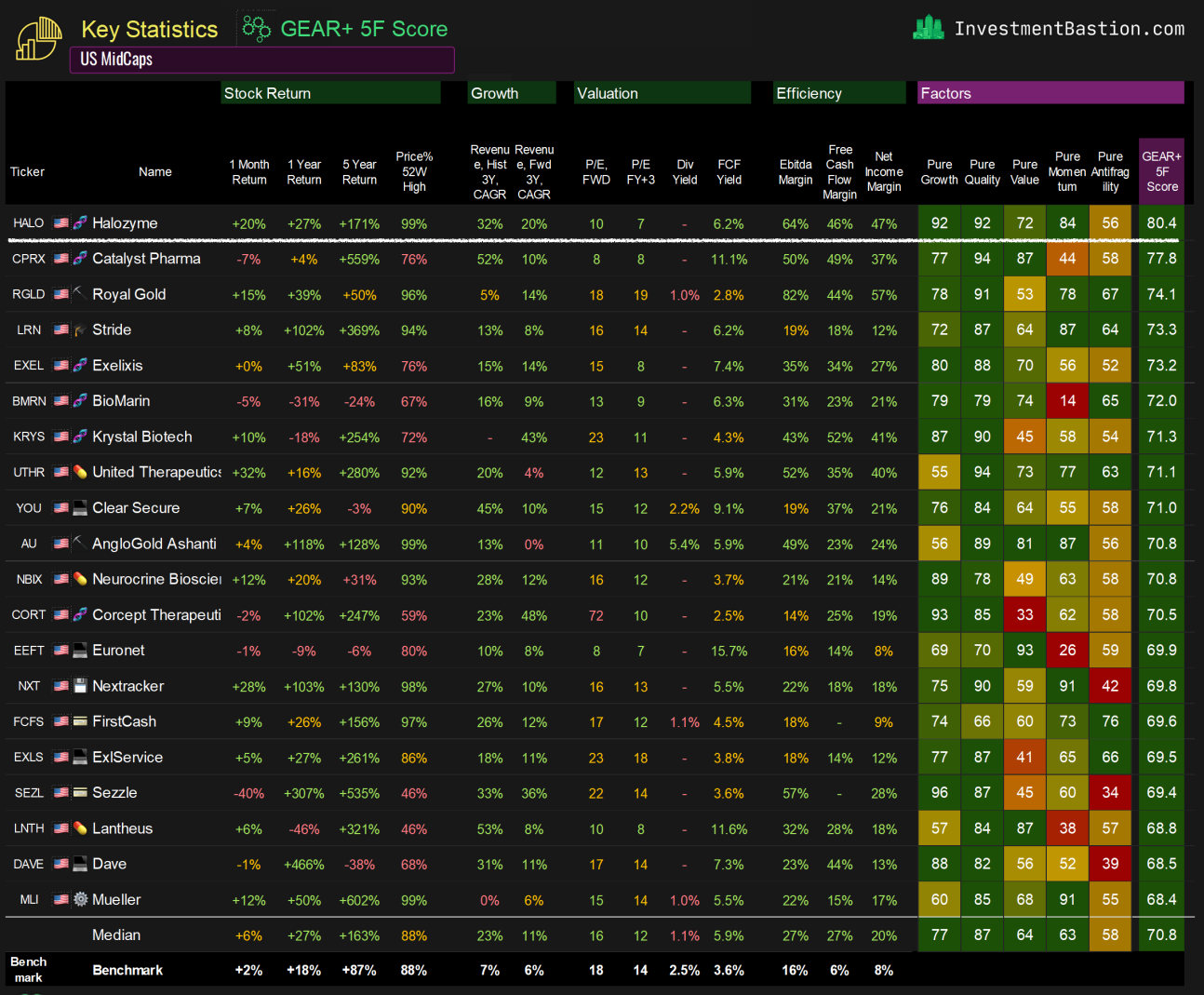

Halozyme (HALO) generates royalty revenues from its ENHANZE technology, which converts intravenous biologics into subcutaneous forms. At the same time, the company is building an auto-injector platform, enabling patients to administer treatments at home – a very attractive growth opportunity.

For 2025, management expects about $1.3 billion in revenue, with $825–860 million from royalties, growing 46–51% year over year.

With the company’s technology, more and more drugs are moving to subcutaneous delivery. For example, Roche’s multiple sclerosis drug Ocrevus used to require a 6-hour IV infusion and observation, but now it can be given subcutaneously in just 10 minutes.

With ~20% annual revenue growth and a forward P/E of ~10x, Halozyme looks like a compelling idea.

The Playbook — Updated on September 8, 2025.

Next is the section for Pro subscribers. The Playbook includes a 150-page PDF report with full navigation, helping you track up-to-date global stock rankings across 9 strategies. Plus, you get an Excel file to explore more markets and extended statistics.

Keep reading with a 7-day free trial

Subscribe to Investment Bastion to keep reading this post and get 7 days of free access to the full post archives.