Idea Radar #4: Nvidia’s R&D Supremacy, Wingstop’s Growth Machine, Boeing’s Rebound Play

Best ideas from recent investment bank reports

Idea Radar – a briefing built for investors, analysts, and portfolio managers, featuring insights I find while reading research reports from top investment banks. I evaluate these ideas using infographics from the Bastion Terminal and highlight how well they fit different strategy portfolios.

📌 This edition’s highlights:

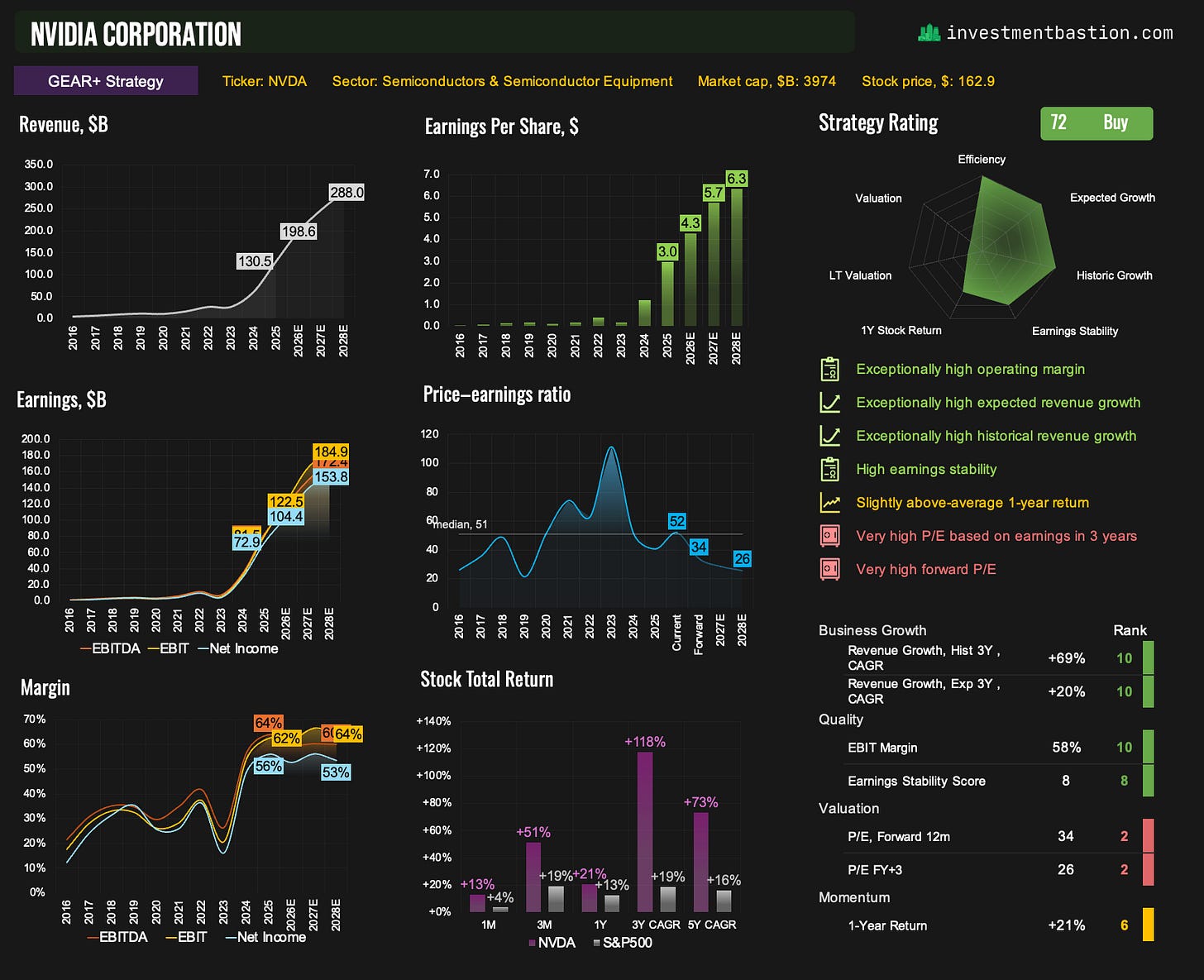

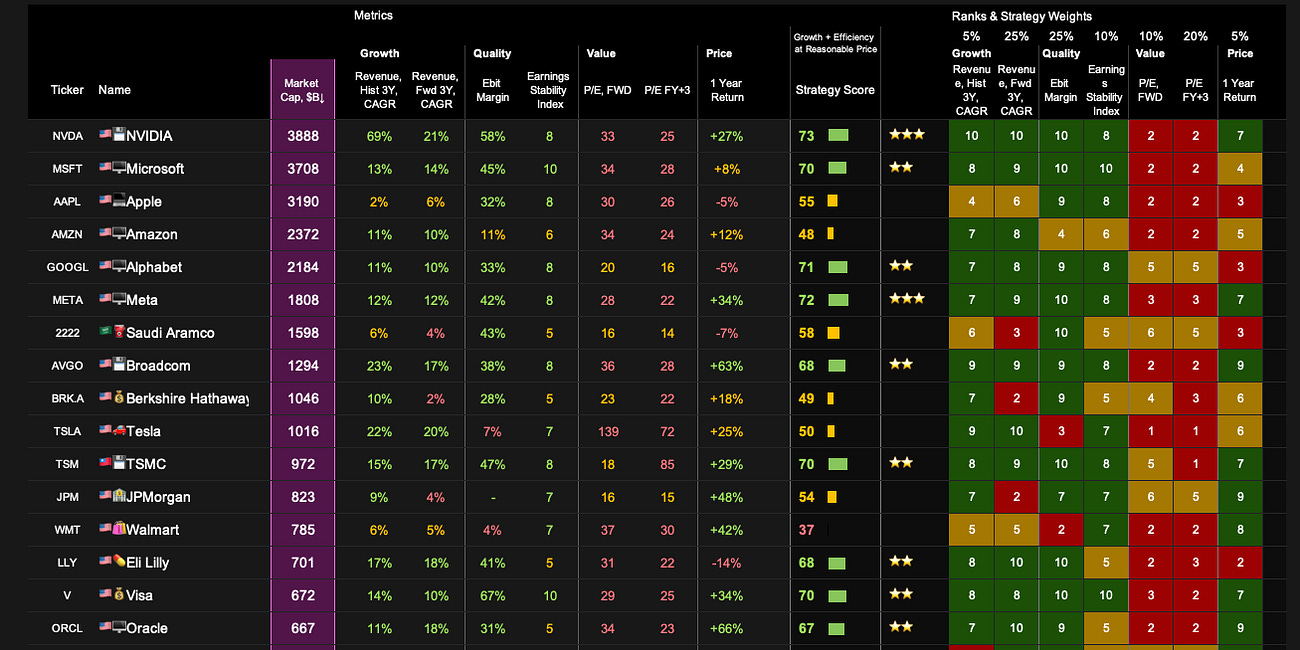

Nvidia - Still the undisputed leader in AI chips, with 80%+ market share and top GEAR+ scores.

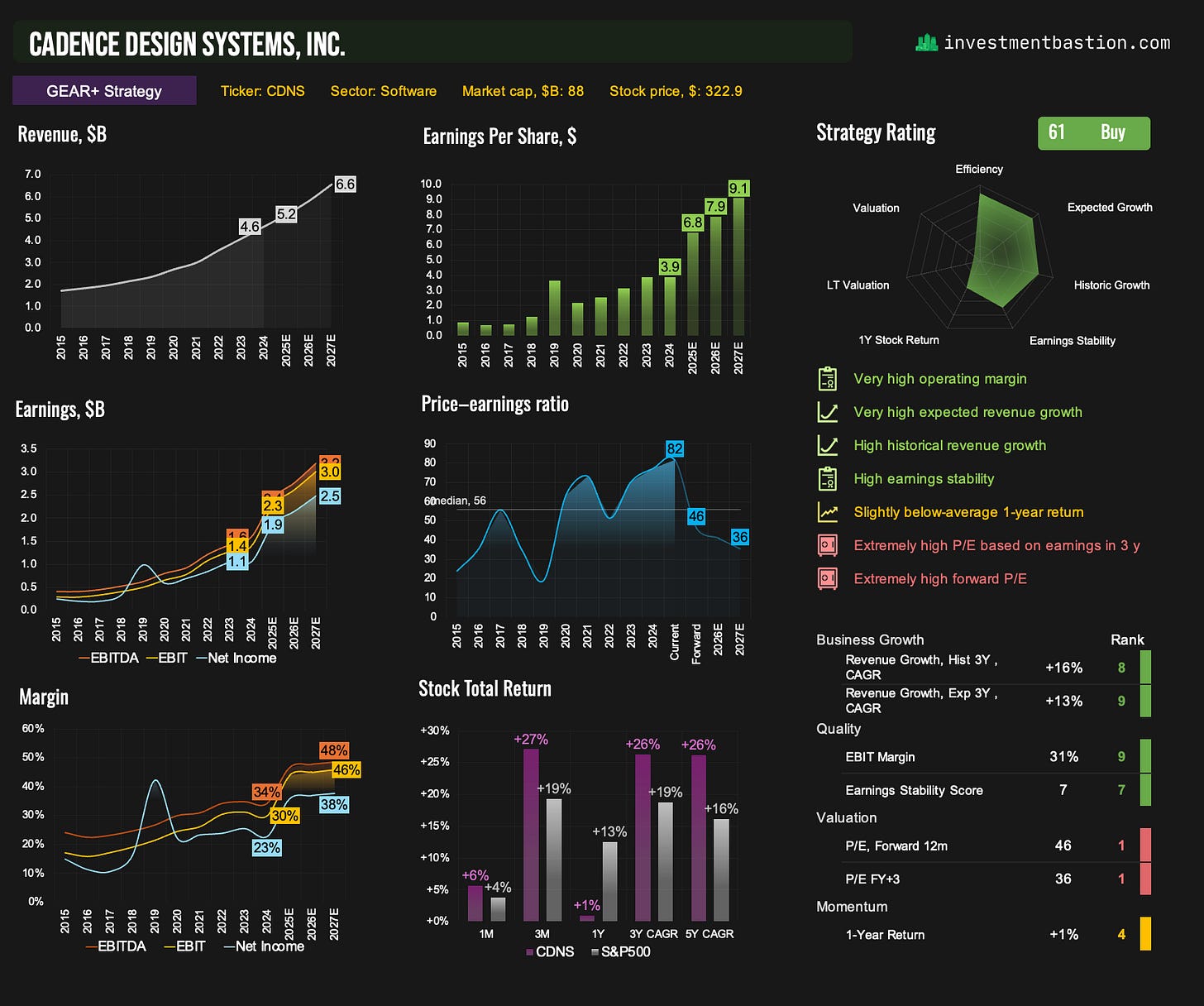

Cadence - Best risk-reward in EDA software, but valuation at 46x forward P/E keeps it out of GEAR+.

Synopsys - Similar profile to Cadence, but with a more moderate 27x P/E.

Microsoft and Vertex - Strong GEAR+ names from Goldman’s dependable growth screen.

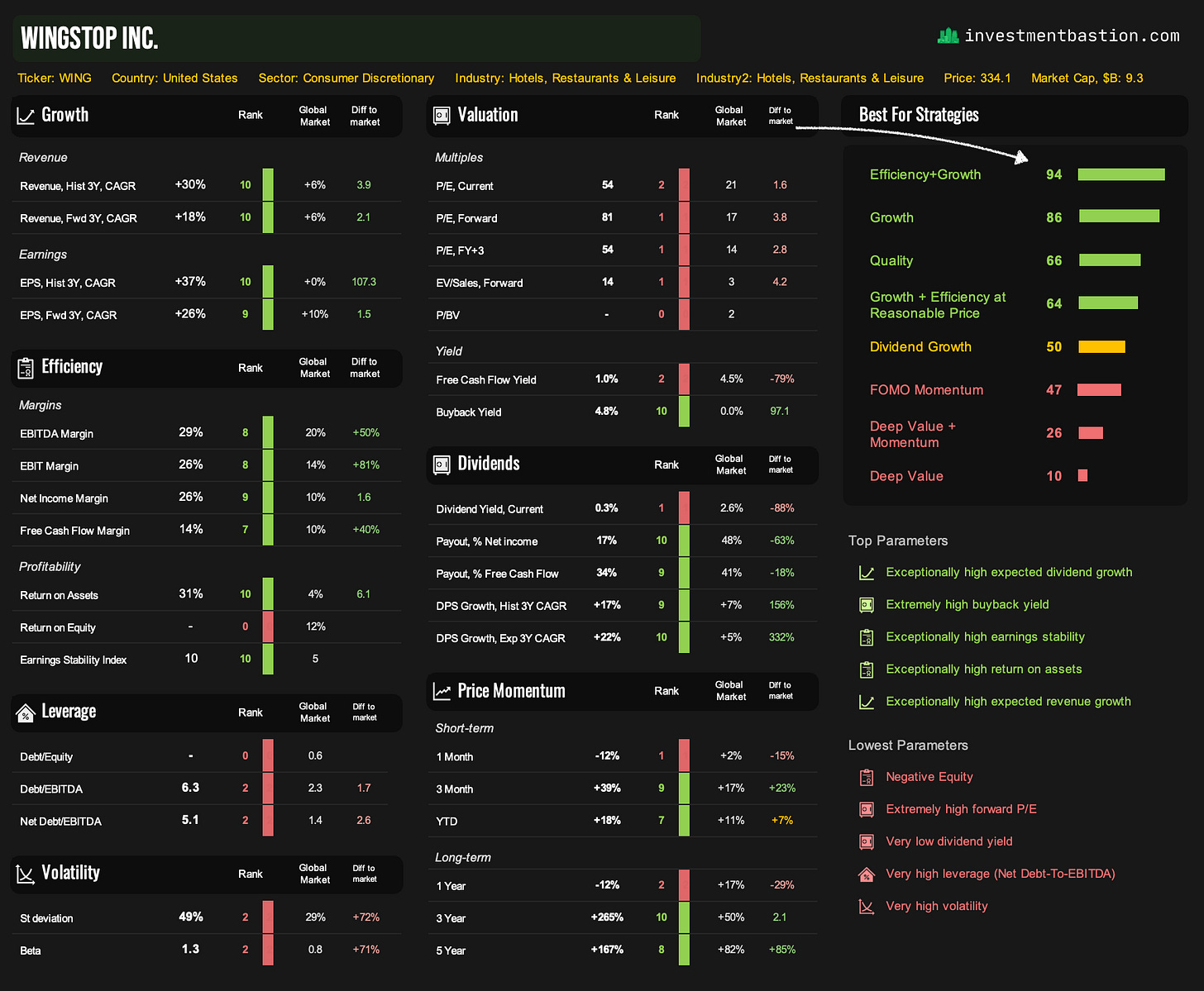

Wingstop - Elite Efficiency + Growth score.

ServiceNow - Great long-term setup, but current margins and high P/E (58x) hurt its GEAR+ score.

Uber - Reasonable growth and valuation, but structurally low margins and low profit stability.

Rebounding growth screen - Stocks with revenue declines in 2024 but expected recovery in 2025–2026.

Boeing - Most aggressive rebound potential in the group. Strong momentum puts it on the radar for a future Momentum + Growth strategy.

1. Nvidia remains the undisputed leader in the AI chip race – Goldman Sachs

The launch of ChatGPT triggered an AI arms race among consumer internet and software companies. In this first wave of AI infrastructure buildout to support large language models (LLMs), over $350 billion in capital expenditures has already been deployed, a significant portion of it spent on Nvidia’s accelerators.

AI-related capex is likely to keep growing from current levels, although the pace may moderate. Still, Nvidia remains the primary beneficiary of this infrastructure cycle, with no credible threat to its near-monopoly position in AI chips.

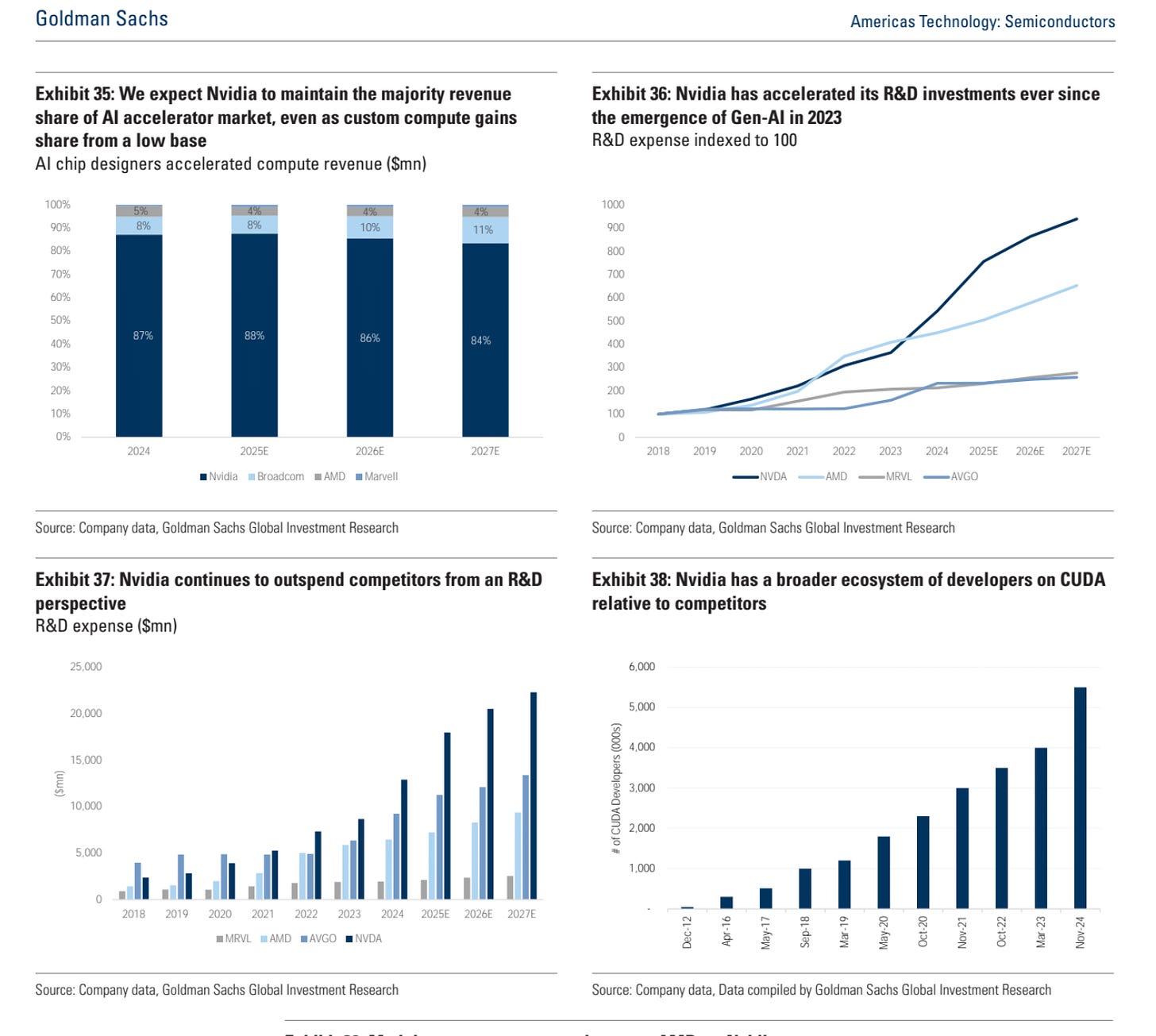

A key chart from Goldman Sachs highlights this dominance: Nvidia continues to dramatically outspend its peers in R&D, reinforcing its lead. The company is expected to maintain a market share of over 80% among AI chip designers.

"Despite 'peak concerns' and the growing presence of custom accelerators, we believe that a combination of (1) product leadership and rapid cadence of introductions, (2) broadening customer base, (3) early signs of AI monetization, and (4) attractive valuation can drive outperformance relative to our coverage in the medium term."

📝 🟢 Bastion’s scoring system continues to rank Nvidia highly under the GEAR+ framework (Growth + Efficiency at Reasonable Price). It remains one of the top-rated stocks in the strategy. In our view, the AI cycle still has several strong years ahead.

Growth + Efficiency + Reasonable Price Systematic Portfolios - July 2025 Update

Introducing Bastion Strategy Portfolios

2. Cadence: Best risk-reward in Digital Semiconductor & EDA Software – Goldman Sachs

Cadence provides advanced chip design tools to companies like Apple, Nvidia, and Tesla, enabling them to build and optimize next-generation semiconductors.

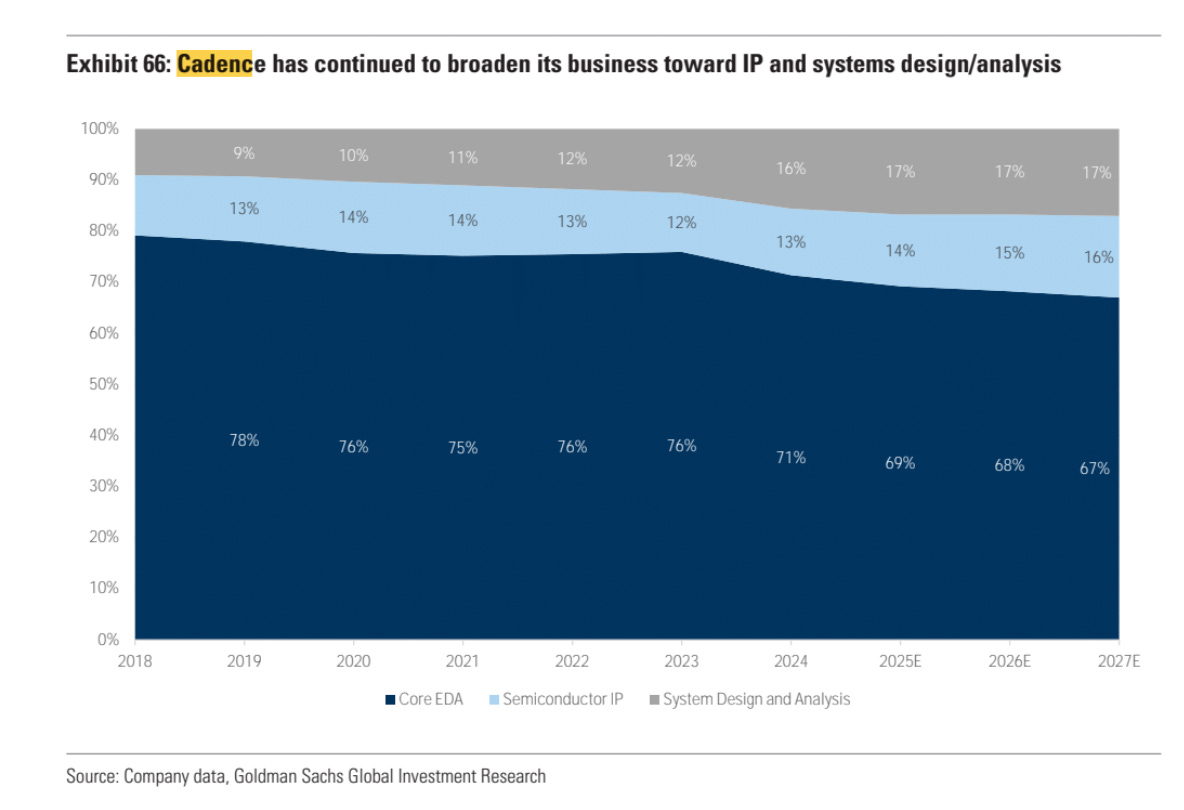

The company generates most of its revenue from Electronic Design Automation (EDA) software, which helps engineers design, simulate, and prepare chips for manufacturing.

Its fastest-growing segment is Semiconductor IP, which comprises licensable design blocks that semiconductor firms use to streamline and accelerate the development of complex chips.

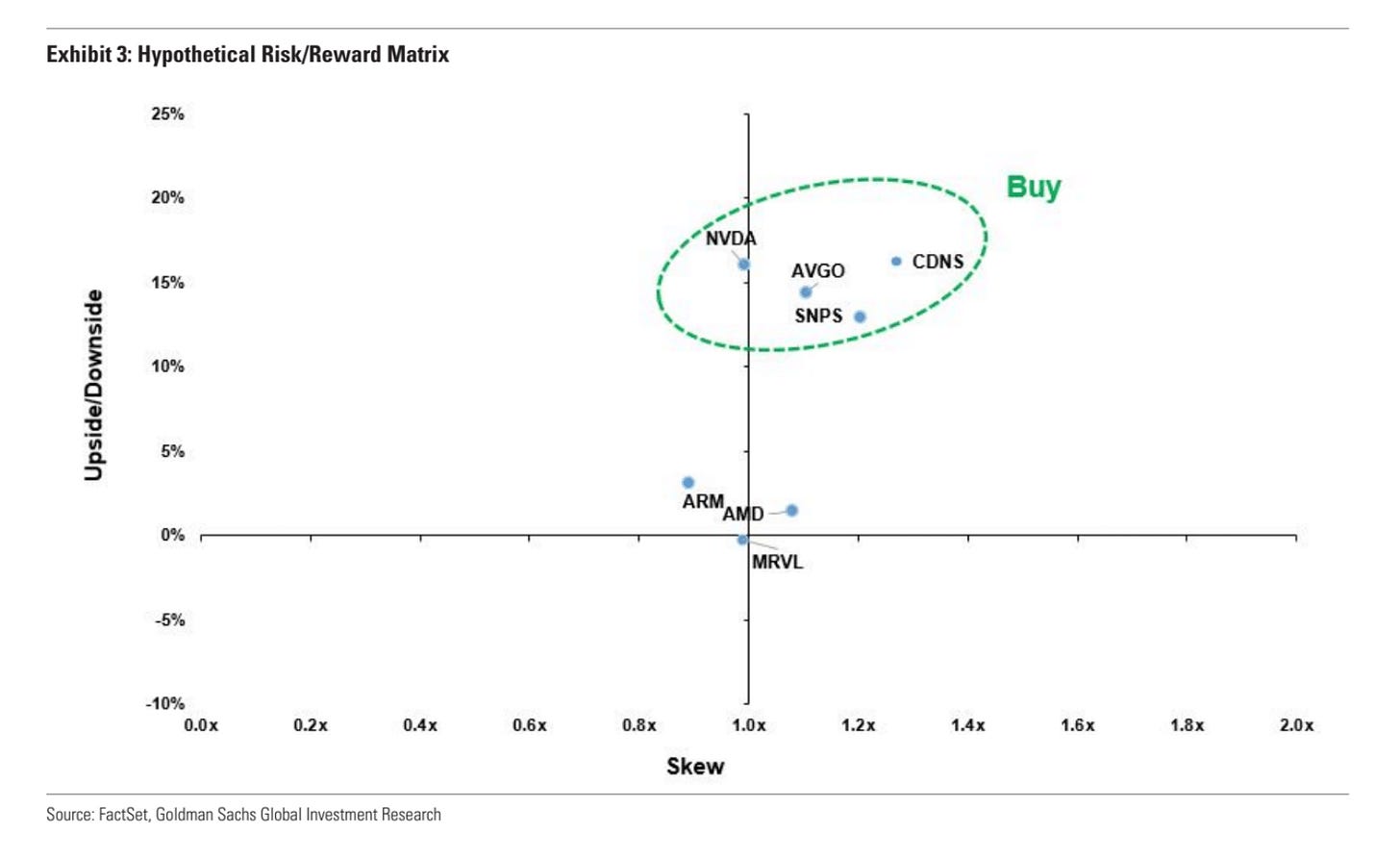

Goldman Sachs highlights Cadence as a structural winner:

“We see Cadence as one of the highest-quality compounding businesses in our coverage, with exposure to multiple growth drivers across the industry. Long-term growth will be supported by broader adoption of custom chip design and rising demand for IP blocks, though we acknowledge potential headline risk related to China export controls.”

Bastion’s scoring system confirms Cadence as a high-quality growth name. The company ranks in the top 20% by expected revenue growth (+13% 3Y CAGR) and boasts an operating margin above 30%, signaling excellent business quality and pricing power in what is effectively an oligopoly (Cadence, Synopsys, and Siemens control over 70% of the EDA market).

However, valuation is a key concern. With a forward P/E of 46x (placing it among the top 10% most expensive stocks) and even a 2027 P/E near 36x, the stock screens out of Bastion’s GEAR+ portfolios due to valuation filters.

📝 Cadence is a top-tier Growth + Quality play, but for valuation-sensitive strategies, caution is warranted. A 30% discount from current levels would make it more attractive under GEAR+ criteria.

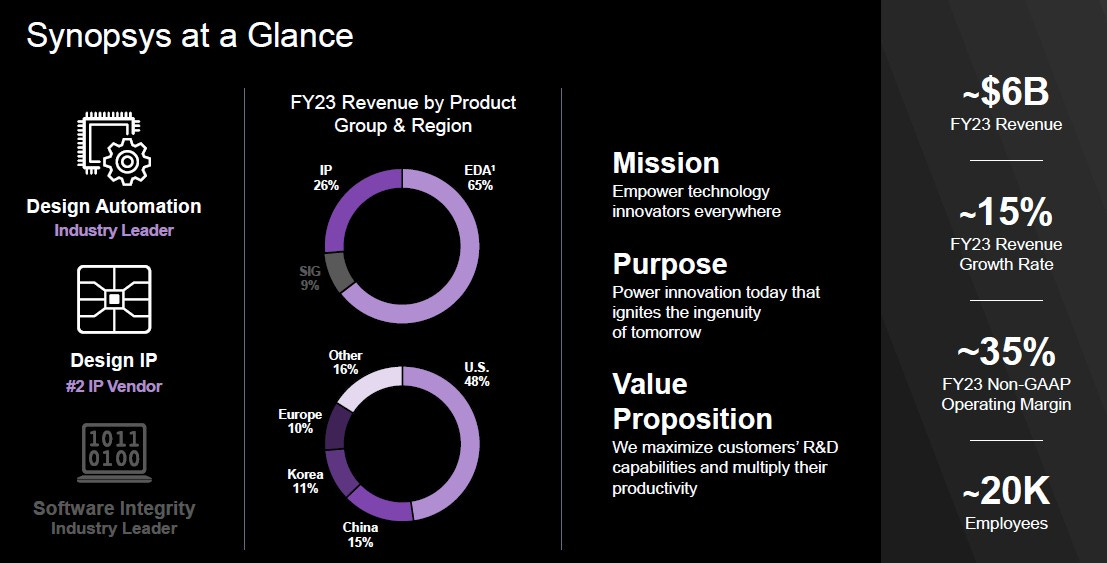

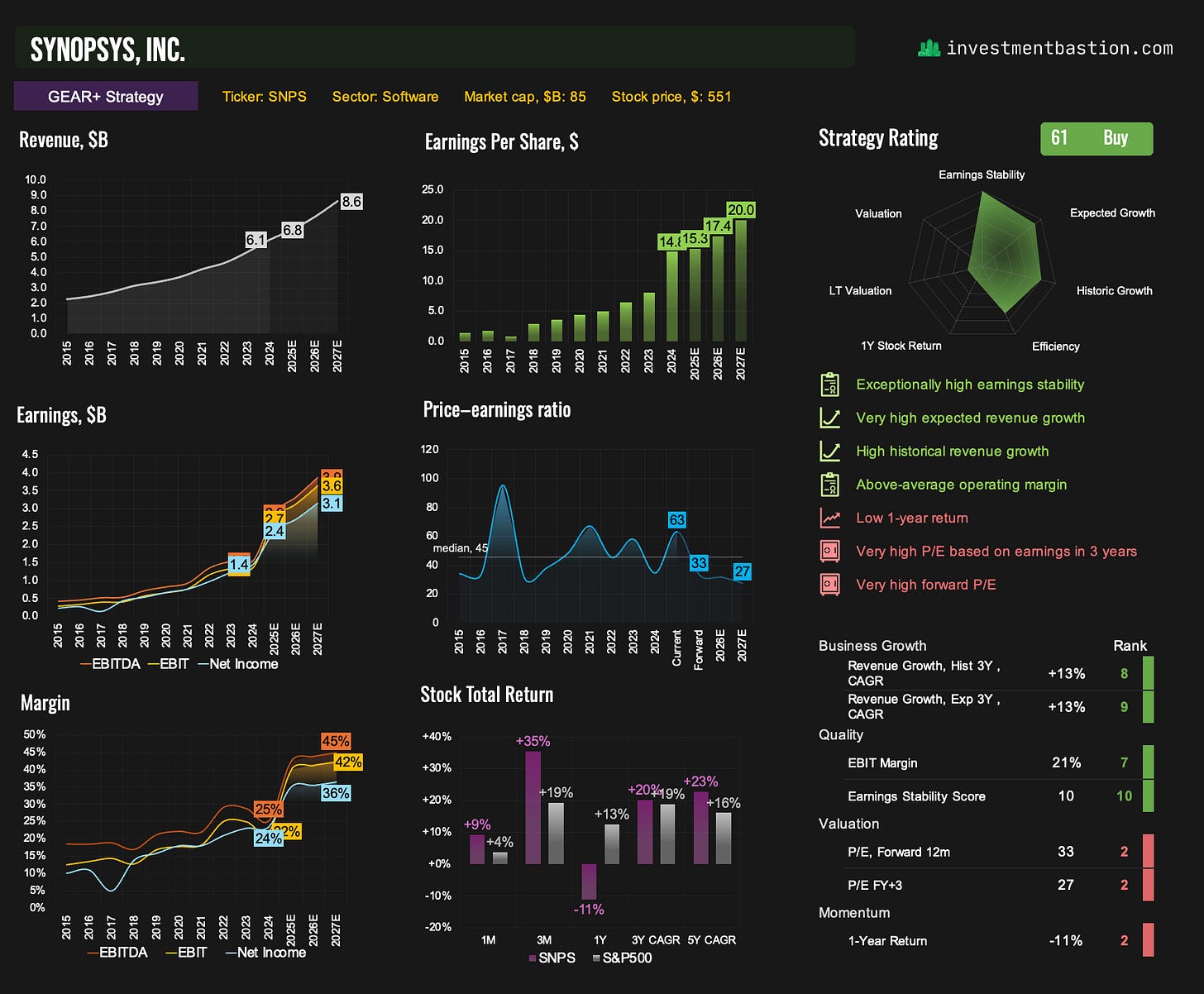

3. Synopsys: A more reasonably valued EDA leader?

Synopsys is another dominant player in the global Electronic Design Automation (EDA) and Semiconductor IP space. While Goldman Sachs assigns it a slightly lower upside potential compared to Cadence, the firm still sees strong business momentum.

“The number of chip design customers continues to grow, fueled by hyperscalers (Amazon, Google) designing custom chips for high-volume workloads at minimal cost. Synopsys’ IP licensing business has outperformed over the past two years, largely due to increased EDA adoption by non-traditional chip designers with limited in-house IP.”

📝 Synopsys shares the same strong GEAR+ score as Cadence, but its valuation is much more moderate. The stock trades at 27x 2027 P/E versus 36x for Cadence, making it more attractive from a valuation perspective.

However, the rating isn’t quite high enough to enter the GEAR+ portfolio, where multiple stocks score even better. That said, we’re keeping both Synopsys and Cadence on our watchlist. A future rebalance could bring one or both into the portfolio before year-end.

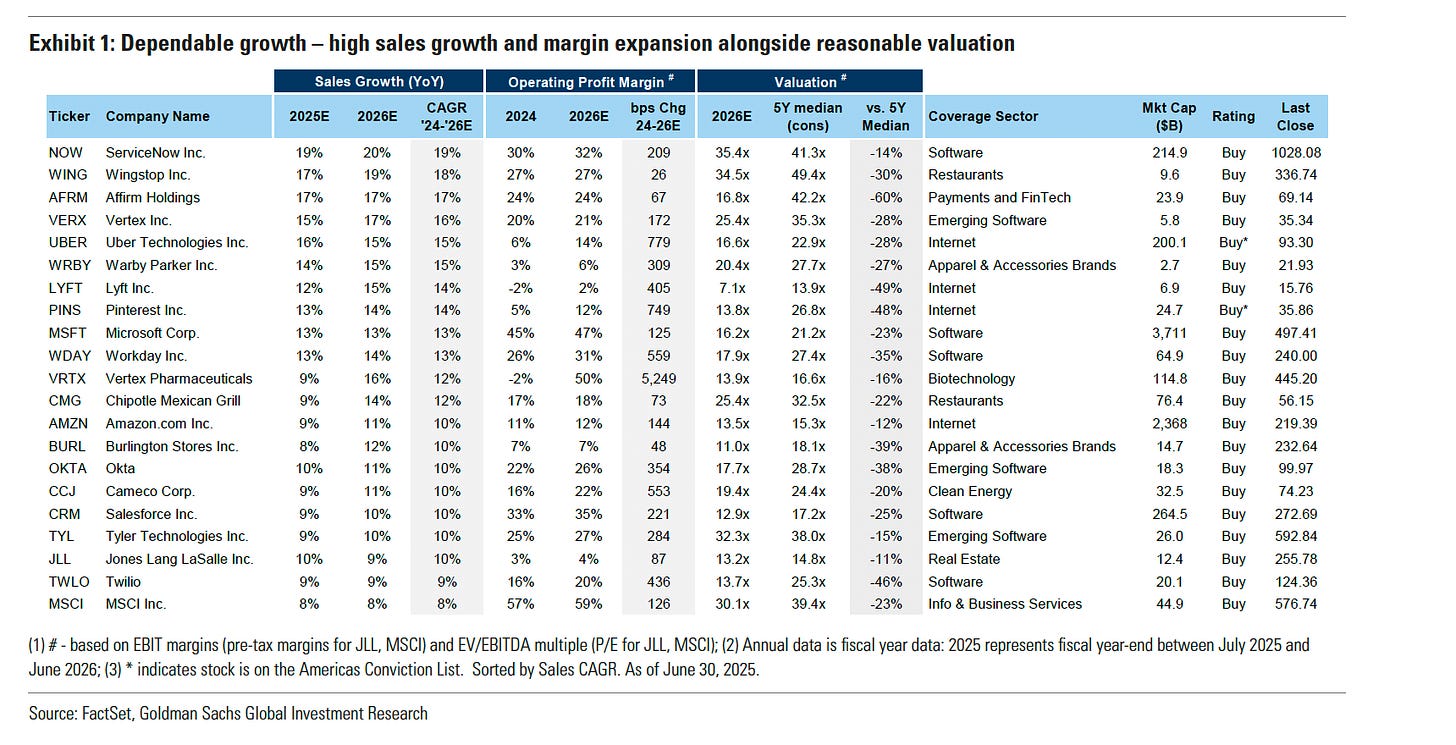

4. Screening for Dependable Growth and Inflections

Goldman Sachs recommends focusing on companies that combine strong and durable revenue growth with margin expansion and valuations still attractive relative to history.

Their screen looks for three key criteria:

Consistent topline growth — at least high single-digit YoY sales growth in each of 2024–2026E, with 2026 growth in line with or above 2025;

Operating margin expansion — increasing EBIT margins from 2024 to 2026E (or pre-tax margins for Financials);

Undemanding valuation — trading at least 5% below historical 5-year median multiples based on EV/EBITDA (or P/E for Financials), using Goldman Sachs 2026E estimates.

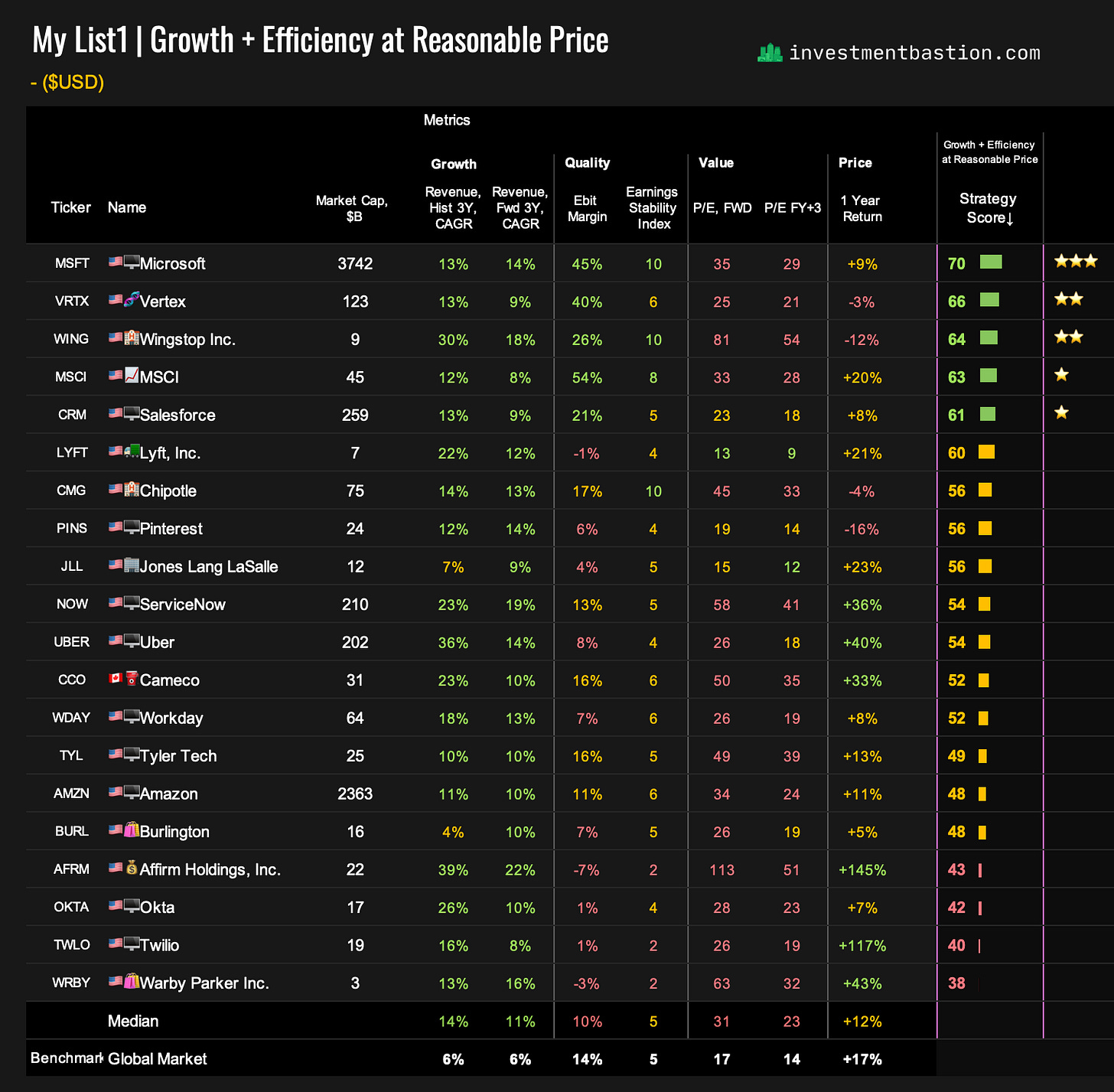

I ran this list through Bastion’s GEAR+ framework to identify the best balance of Growth, Quality, and Reasonable Valuation.

Two standouts: Microsoft and Vertex Pharmaceuticals, both with top-tier GEAR+ scores. Vertex was added to the GEAR+ Large Cap portfolio in the latest rebalance due to its strong fundamentals and improving setup.

5. Wingstop – Elite Efficiency + Growth Score

Restaurant chain Wingstop ranks exceptionally high under Bastion’s strategy framework, particularly for Efficiency and Growth. However, it doesn’t currently make it into the GEAR+ portfolio due to its very high valuation multiples. The stock trades at 81x forward P/E.

I’m working on a new strategy focused solely on top Efficiency + Growth stocks, without penalizing for valuation or price action. Wingstop would easily qualify as one of the strongest names under that lens.

If you’re interested in this kind of strategy, let me know, it's in the pipeline.

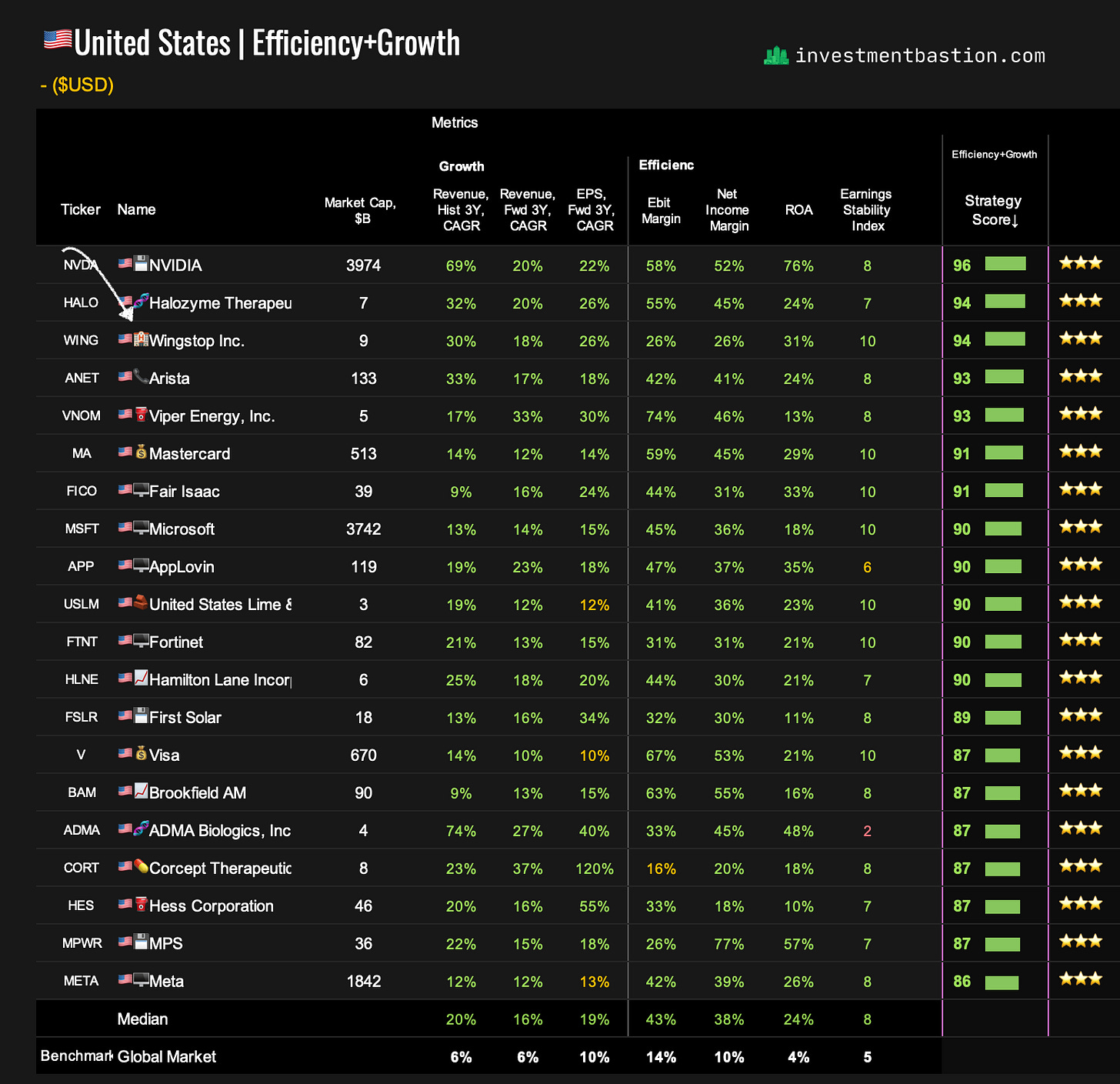

Here are the current U.S. leaders by Efficiency + Growth scores:

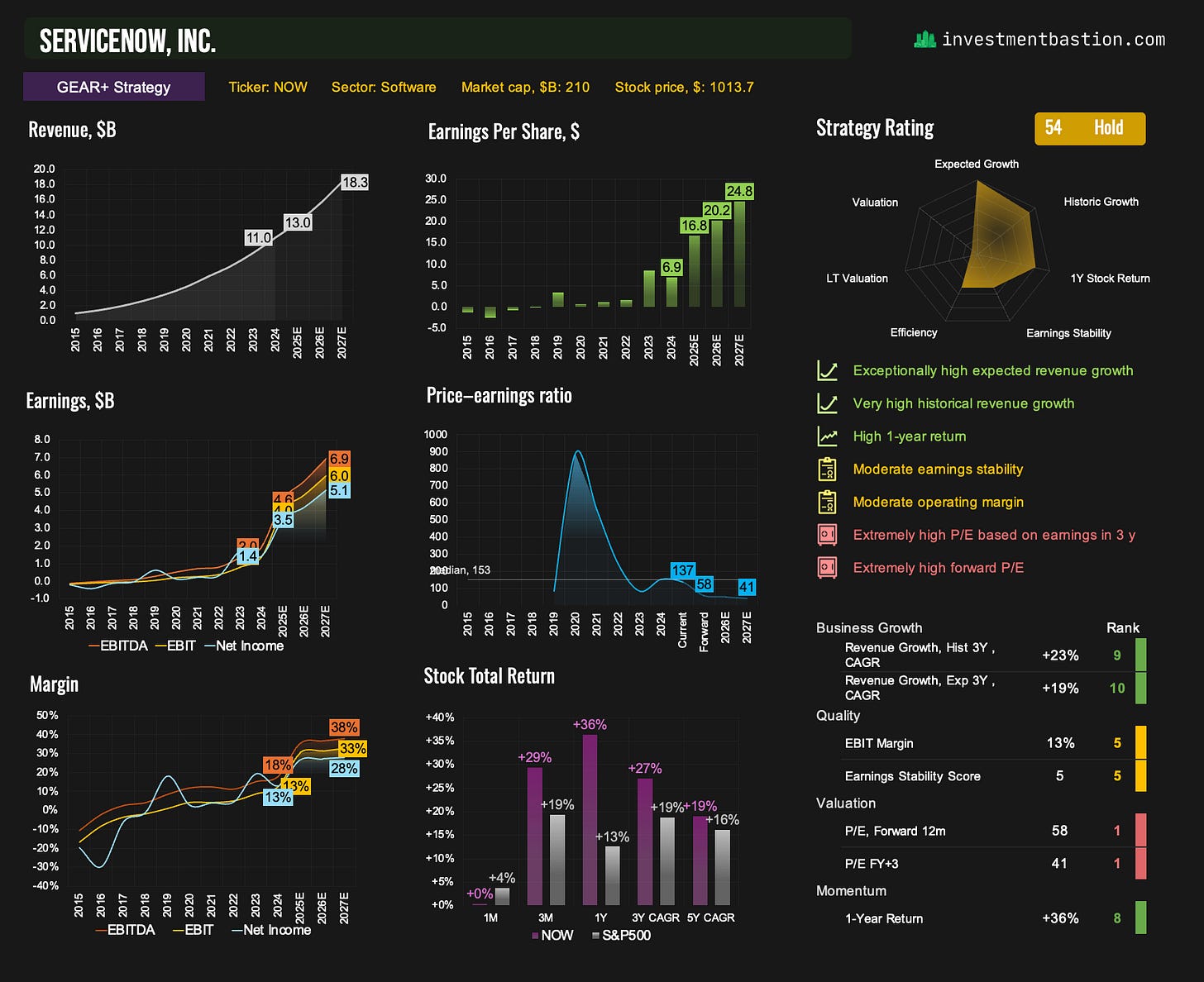

6. ServiceNow – Goldman’s Top Pick

Goldman Sachs highlights ServiceNow (NOW) as a top large-cap software name, citing its dual appeal:

“Strong revenue growth from its core IT service management business, plus new growth vectors via Gen-AI, CRM expansion, and AI product launches. ServiceNow is on a solid glide path to becoming a rare example of high-growth at scale with strong FCF.”

Goldman forecasts 19% annual revenue growth (3-year CAGR) and an operating margin expanding from 30% to 32%, placing it among the strongest names in their dependable growth screen (see Section 4).

However, ServiceNow doesn’t rank highly in Bastion’s GEAR+ strategy. Why?

Despite consensus estimates pointing to margin improvement, ServiceNow’s current operating margin is just 13%, around the market median. This keeps its Efficiency score modest for now.

Valuation is a major headwind. With a forward P/E of 58x, ServiceNow ranks among the top 10% most expensive stocks in the market, pushing it out of the GEAR+ portfolio on valuation filters.

📝 While the growth story is strong and improving margins may lift future scores, GEAR+ remains selective. For now, ServiceNow is on our watchlist, not in the portfolio.

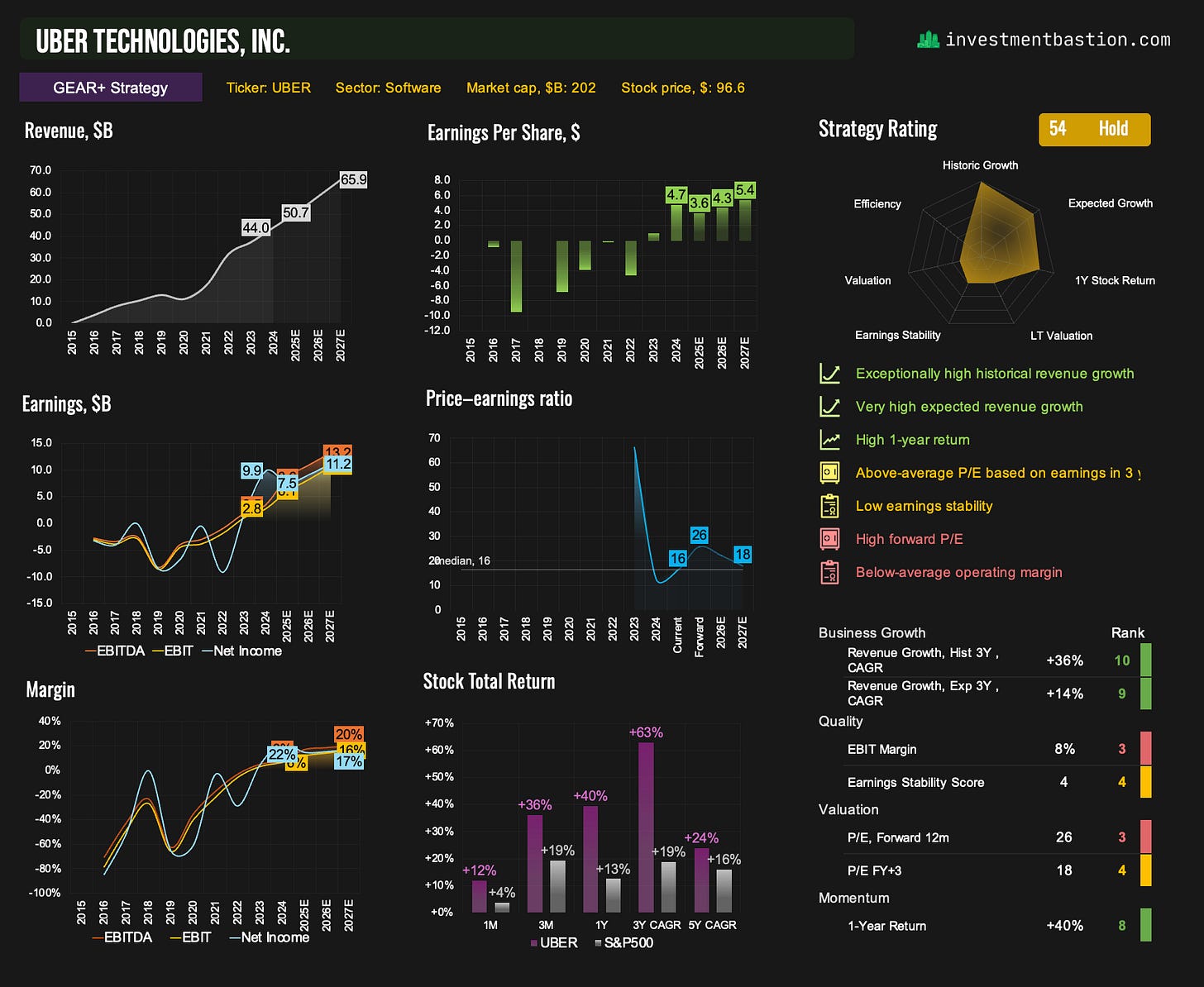

7. Uber – A Growth Story with Structural Limits on Quality and Efficiency

Goldman:

UBER (Buy, on Conviction List): Scaling end-markets, rising profitability (while remaining committed to long-term investments), and growing evidence of platform flywheel effects should support a sustained mix of growth, margin expansion, and free cash flow.

As for autonomous vehicle (AV) adoption, Goldman sees limited risk. Rideshare incumbents like Uber are expected to become asset-light marketplaces for AV fleet operators to plug into demand.

Uber does not make it into the GEAR+ portfolio, even though on paper it looks like a good fit:

Expected revenue CAGR of 14%

Reasonable valuation (P/E 2027 = 18x)

But this is where business model specifics matter:

Ride-hailing is more profitable now, but still operates on thin margins due to ~75% of gross bookings going to drivers.

Delivery (Uber Eats) runs at breakeven or negative margins, especially in competitive urban markets.

The company also has a low earnings stability score, as it only recently turned consistently profitable.

📝 Uber might qualify under a Growth at Reasonable Price strategy. But when quality and efficiency are factored in, as they are in GEAR+, it doesn’t make the cut. Still, it remains on the watchlist and could enter on future rebalances if profitability trends continue to improve.

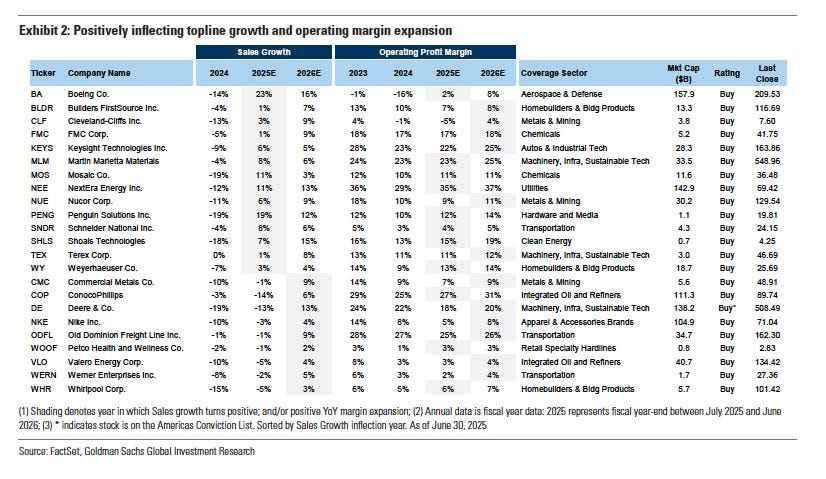

8. Rebounding Topline Growth – A Forward-Looking Screen from Goldman Sachs

Goldman Sachs shared another useful screen for spotting future opportunities: companies that saw revenue decline in 2024, but are expected to rebound in 2025–2026.

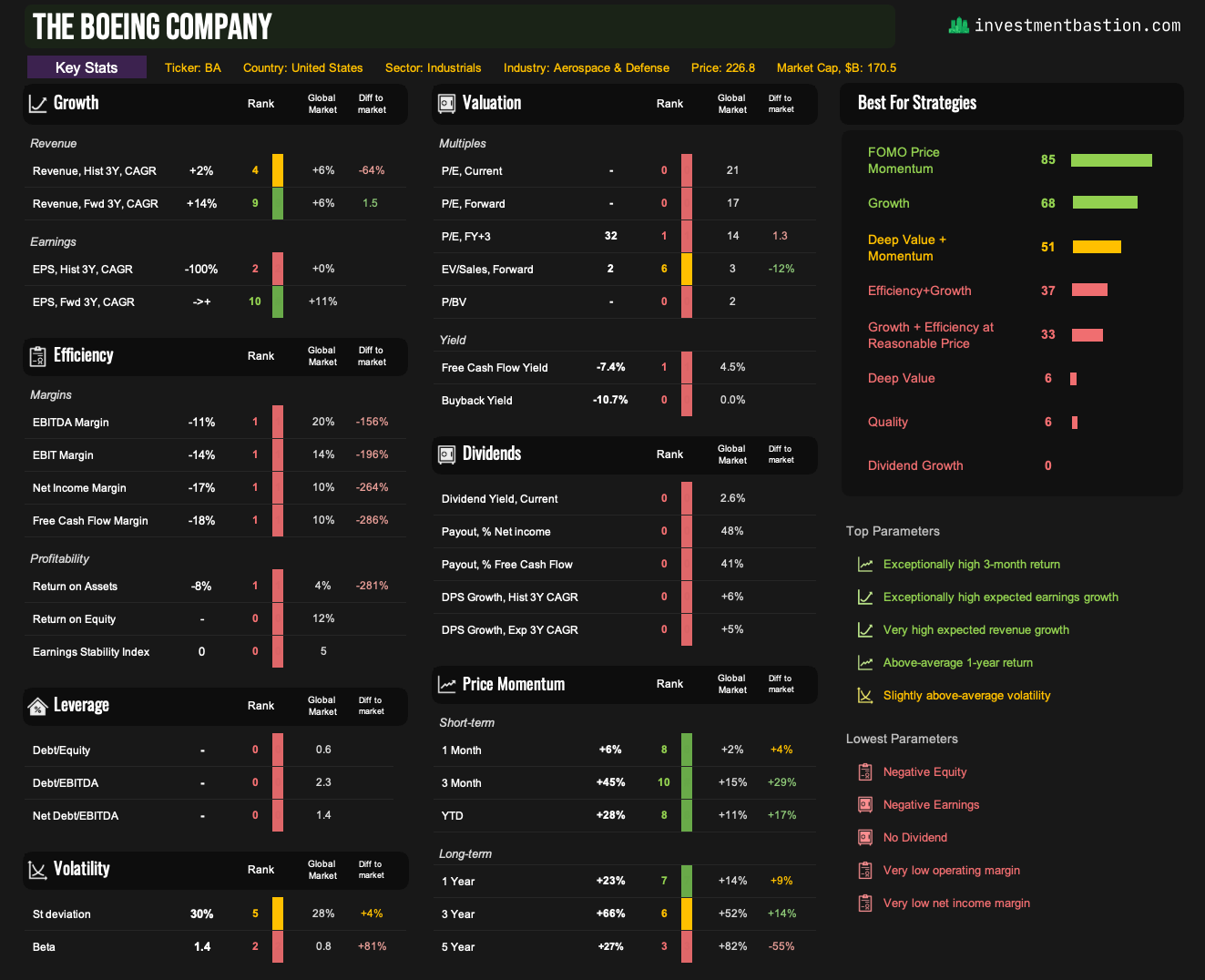

9. Boeing – the biggest potential rebound

Goldman expects double-digit revenue growth for Boeing over the next two years, and just as importantly, a recovery in operating margin from -16% to +8%.

Because of its currently disastrous fundamentals, Boeing doesn’t come close to qualifying for the GEAR+ portfolio, which filters for high-efficiency, high-quality names.

That said, the stock has very strong momentum right now and could be a theoretical candidate for a Momentum + Growth strategy.

This strategy is currently in development. If you're interested in this angle, let me know.

Thanks for reading. I’ll keep digging for more high-conviction ideas from bank research and screening them through Bastion’s strategy lens.

If you found this useful, don’t forget to subscribe to Bastion to stay ahead of the next wave of opportunities.

See you in the next edition.