Growth + Efficiency + Reasonable Price Systematic Portfolios - July 2025 Update

Top-ranked stocks combining growth, quality, and fair valuation

Introducing Bastion Strategy Portfolios

I'm launching Bastion's strategy-driven portfolios, built using a structured rules-based process via our Strategy Builder tool.

For a long time, I analyzed stocks manually. But then I asked myself: why not turn my investment values, strategies, and philosophy into a repeatable system?

So I created my own Excel-based terminal to systematically score and screen stocks. I design the strategy, the system assigns scores, and the output is a list of companies that match exactly what I care about.

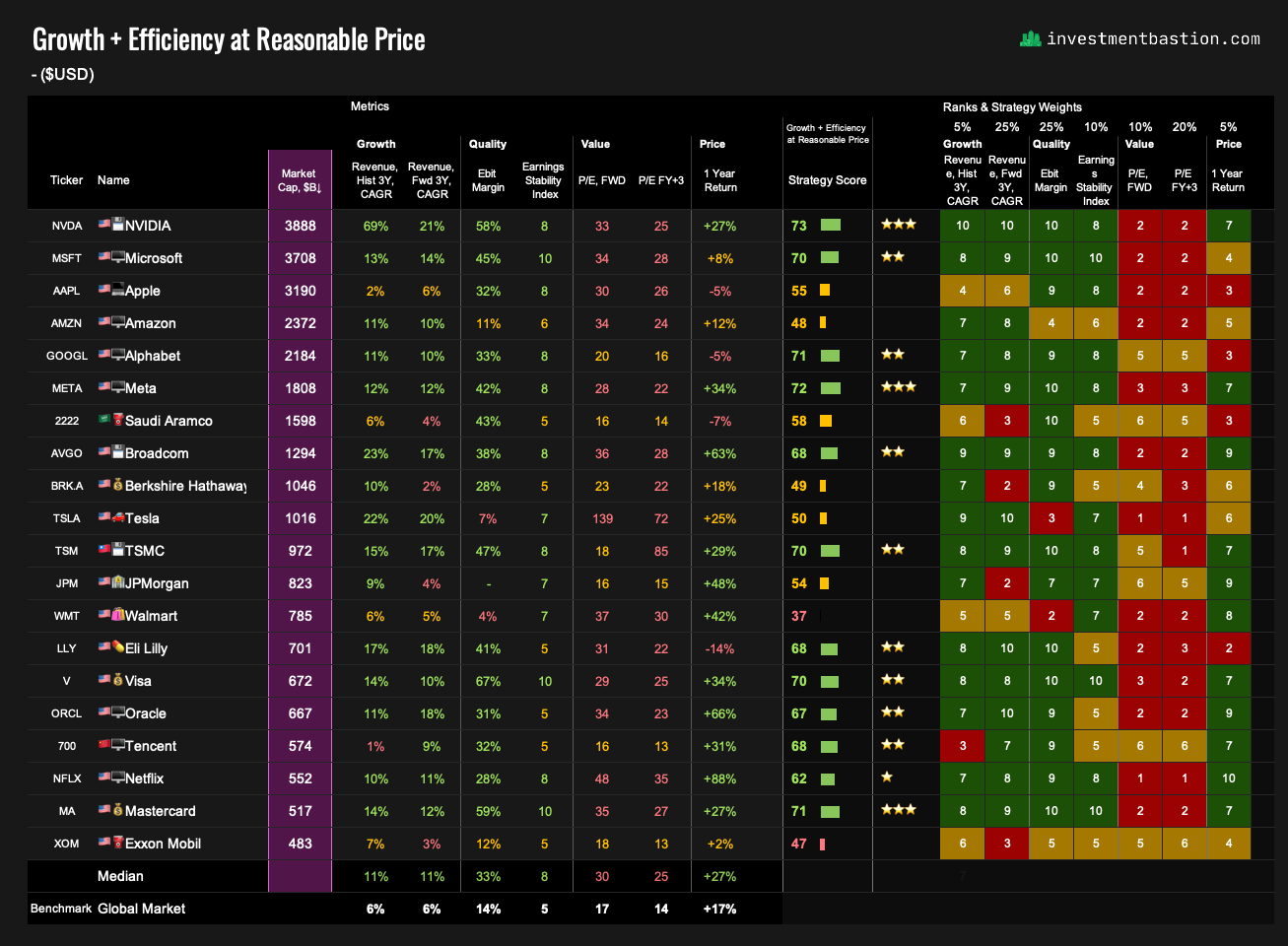

This Month’s Launch: GEAR+ Strategy

In this first strategy update, I'm sharing the GEAR+ portfolios, based on my Growth + Efficiency at Reasonable Price framework.

What is GEAR+?

It’s a strategy that selects stocks that combine:

Revenue growth above the market average

High business quality and operational efficiency

Reasonable valuation

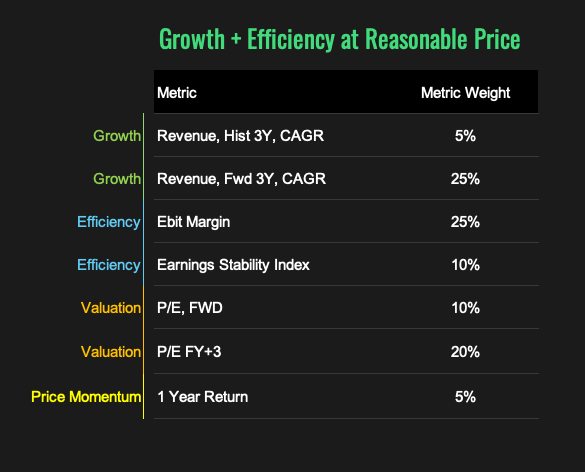

Each stock is rated on a 1–10 scale across 7 key metrics:

3-year historical revenue CAGR

3-year forward revenue CAGR (consensus)

EBIT margin

Earnings Stability Index

Forward P/E

Forward P/E (Fiscal Year +3)

1-year price momentum (to capture sentiment; minor weight)

The final score is calculated based on predefined weights assigned to each metric, reflecting their relative importance in the strategy.

For the final portfolio selection, I apply additional filters tailored to the specific objectives and risk parameters of each strategy.

Two GEAR+ Portfolios

As of now, I maintain two systematic GEAR+ portfolios, each rebalanced monthly during the second week of the month:

🇺🇸GEAR+ US Top 100 – a selection of the 15 highest-ranked stocks from the top 100 US companies by market capitalization

🇺🇸GEAR+ US Outside Top 100 – a selection of 20 top-ranked stocks from US companies ranked 101 to 800 by market capitalization.

In future updates, I plan to expand the GEAR+ portfolio offering to include additional regions such as Europe, Developed Markets, and Emerging Markets.

Below, you'll find the latest portfolio compositions, strategic criteria, and performance results over the past year.

Keep reading with a 7-day free trial

Subscribe to Investment Bastion to keep reading this post and get 7 days of free access to the full post archives.