Idea Radar #2: Big Beautiful Breakouts, Magnificent Nvidia, Top 100 Humanoid Stocks

Top Ideas from Top Investment Banks Through the Bastion Lens

In this post, we break down the most interesting ideas from recent investment bank reports. Use them to strengthen your watchlist and sharpen your view of the market.

Don’t miss our weekly newsletter, where we track performance trends and potential market signals.

All infographics in this post were created using the Bastion Terminal.

Highlights from this week’s market intelligence:

🔹 7 Big Beautiful Breakouts

🔹 How to Detect Breakouts

🔹 Are Optimistic Expectations for Nvidia Not Optimistic Enough?

🔹 Top 100 Humanoid Stocks

🔹 Top Speculative Stock Idea from Australia

1. 7 Big Beautiful Breakouts

Bank of America recently published a report highlighting notable breakout moments in asset prices—that is, when a price breaks through a support or resistance level and sets new highs or lows over an extended period.

The idea is that when an asset has been stuck in a sideways trend for a long time, such a breakout can act as a catalyst for a medium-term rally. Portfolio managers can capitalize on this momentum-driven move.

The investment bank's analysts point out seven such breakout trends:

MSCI World ex-US: The next big opportunity for the rest of the world to outperform the US.

Intuit Inc: Bullish breakout through $700 opens the door to 2025 upside targets of $808 and $873.

US 30-year Treasury yield: Broke above 5%. Watching 5.18% as a possible double top risk.

BUXL-Schatz spread (30Y vs 2Y German yields): Steepened above two trendlines, now testing the 100bps level.

Swiss Franc (CHF): Broke down in April, retested in May—another plunge ahead.

Euro: Broke out to the upside in April, dipped in May. Summer rally to 1.185?

Platinum: Bullish triangle breakout points to a rally toward the $1,300s.

A lot of these moves seem to reflect a broader trend of a weakening dollar, mostly driven by shifts in U.S. policy. The Trump administration appears to favor a weaker dollar as a way to give the U.S. a competitive edge in manufacturing. But to get there, they’ll need foreign investors to start selling U.S. assets. That’s why betting on international stocks outperforming the U.S. market has become one of the most popular themes across markets.

2. How to Detect Big Beautiful Breakouts

At Bastion, while our philosophy is firmly rooted in fundamental analysis, we also recognize the importance of price action and market sentiment. This is why we’ve launched tools like the Weekly Trend Tracker, designed to help investors never miss key shifts in the market.

From Tesla’s Drop to a Stablecoin Giant’s Surge — Bastion Trends Tracker

If you're a portfolio manager, analyst, or just someone who likes to stay on top of the markets, tracking key trends is a must. It helps you spot where the momentum is, understand what's happening across sectors and regions, and find new investment ideas early.

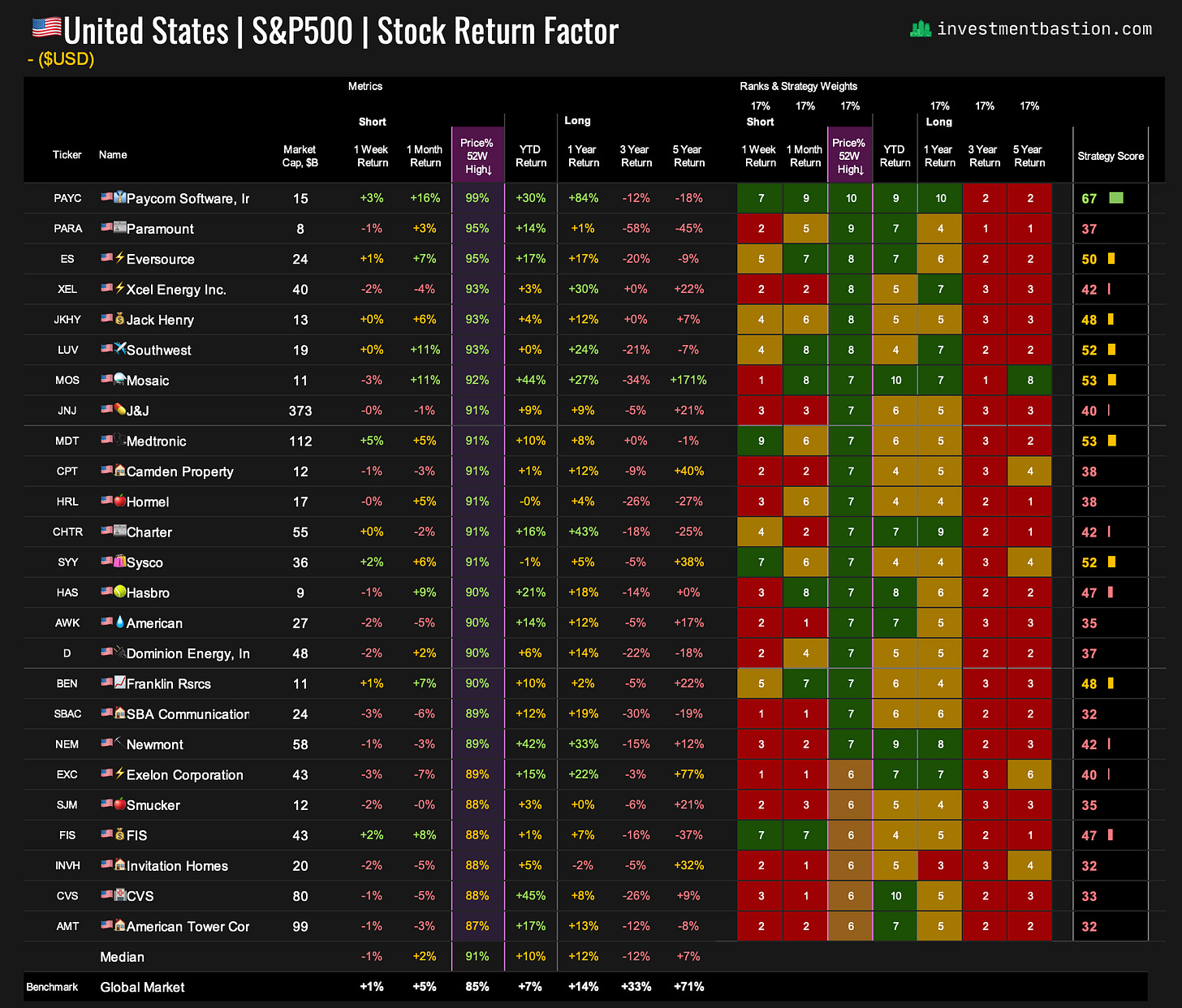

One particularly helpful metric for identifying breakouts across a large universe of assets is Price vs. 52-Week High. In the 🖥️Strategy Builder, you can, for example, sort S&P 500 stocks by this metric and instantly spot which names are hitting new yearly highs.

We’ve integrated this into:

FOMO Momentum Strategy (replacing standard deviation),

and into our Stock Return Factor (replacing 3-month return).

One of the current leaders on this metric is Intuit, which also features in Goldman Sachs’ breakout list.

We believe this metric becomes even more powerful when combined with others. For example, you could add a filter for 3-year total return underperformance (Score: 3Y Return ≤ 4). This setup helps identify stocks that have been beaten down in recent years but are now showing signs of recovery.

One stock that stood out on this dashboard is Paycom, a provider of online payroll and HR software. It’s not only recovering from a prolonged period of underperformance…

… but also scores extremely high on our GEAR strategy.

The GEAR+ portfolio already includes a stock from the HR tech space — Paychex. I don’t think it makes sense to add Paycom right now, but it’s definitely worth keeping an eye on the human capital management sector. The whole industry is showing strong momentum at the moment.

3. Are Optimistic Expectations for Nvidia Not Optimistic Enough?

Keep reading with a 7-day free trial

Subscribe to Investment Bastion to keep reading this post and get 7 days of free access to the full post archives.