Growth + Efficiency + Reasonable Price Portfolio. May 2025 Update

15 Stocks for the GEAR+ Strategy

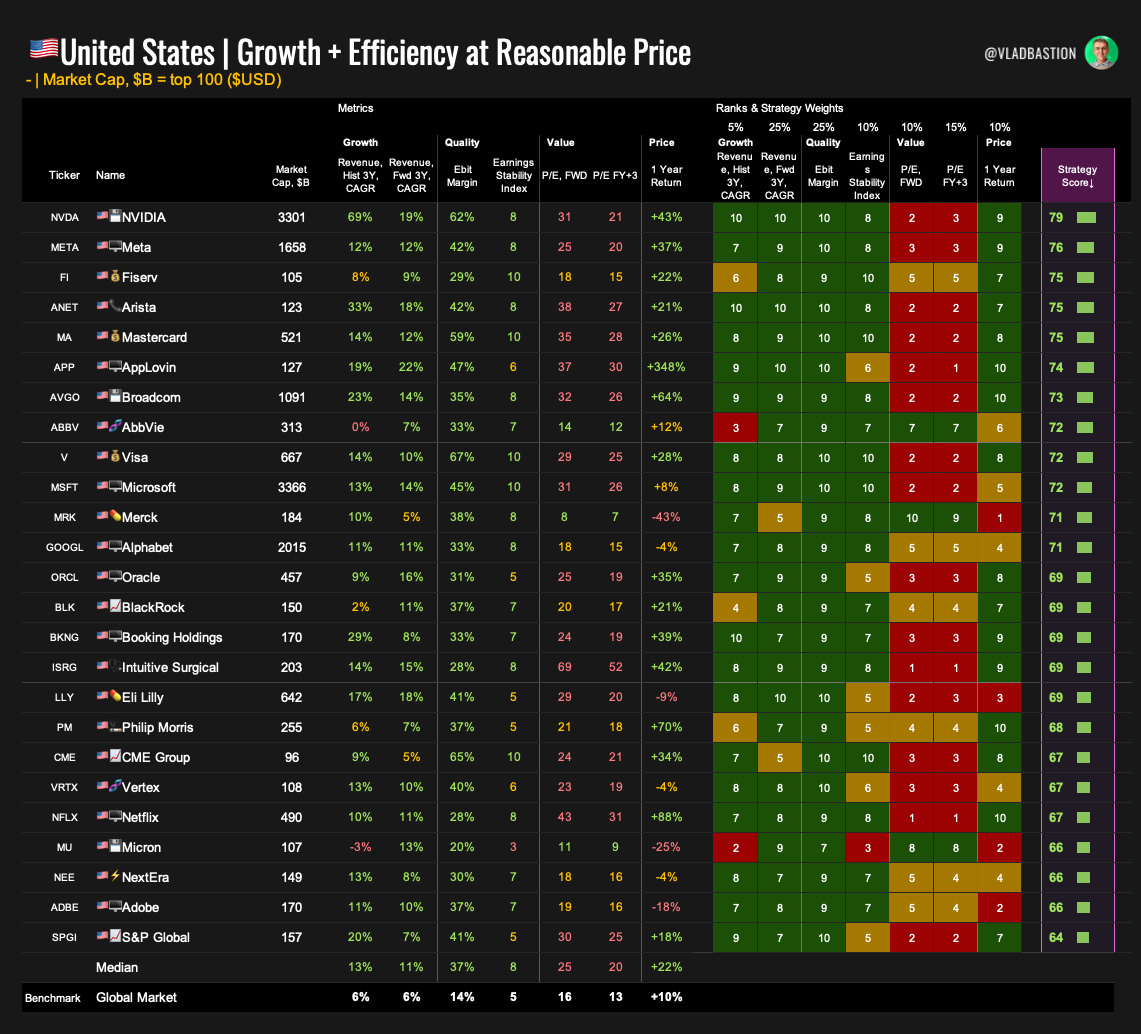

The Growth + Efficiency at Reasonable Price (GEAR) portfolio is built around a simple idea: I look for companies that are growing, operating efficiently, and still trading at a valuation that makes sense.

To identify these names, I evaluate each company across seven key metrics, scoring them from 1 to 10. These scores combine to form a total rating, which helps highlight the investment ideas. If you’re curious about the details, the methodology is described in more detail in the Valuation Strategies guide.

A few important things to note:

My focus is on tech, consumer, and industrial sectors. These areas tend to offer more predictable cash flows, more stable business models, and are typically less cyclical. With so many companies available, narrowing the scope is crucial.

Within each sector, there are still plenty of companies that meet the core criteria. That’s where I apply additional filters—raising the bar on growth, efficiency, or valuation—and spend time digging deeper into the fundamentals. I also assign a subjective confidence level to each name based on my own research.

This isn’t a purely algorithmic strategy. The scoring model helps with initial screening, but final portfolio decisions depend on subjective judgment. The scores are a recommendation, not a rulebook.

Next, I’ll review the highest-rated names across the market and key sectors, share current recommendations, and update the portfolio accordingly.

Top-Rated Companies Among the U.S. Top 100

Four of the seven "Magnificent 7" names stand out in the GEAR ranking: NVIDIA, Meta, Microsoft, and Alphabet. These companies continue to show strong long-term growth profiles combined with relatively reasonable valuations.

Keep reading with a 7-day free trial

Subscribe to Investment Bastion to keep reading this post and get 7 days of free access to the full post archives.