Idea Radar #1:Buy Bond Humiliation, Golden Dome, YouTube Exceptionalism

Top Ideas from Investment Bank Research Through the Bastion Lens

Every week, I read through 100+ research reports from leading investment banks. From that flow, I extract the most noteworthy ideas, add my own commentary, and visualize the insights with custom infographics. This serves two key purposes:

To build Bastion’s expanded watchlist — identifying high-conviction ideas that can later feed into our GEAR, Dividend, Momentum, and other strategies.

To sharpen our understanding of the market by observing how major investment houses think, what themes and companies they focus on, and what arguments they make to support their investment theses.

Top insights this week:

🔹 BofA – Buy Bond Humiliation

🔹 BofA – Who Benefits from the Tax Cuts?

🔹 BofA – America Made: Tailwinds for Domestic Manufacturers

🔹 Morgan Stanley – Quality Cyclicals for This Stage of the Cycle

🔹 Goldman Sachs – Golden Dome: A Growth Catalyst for Defense Stocks

🔹 Goldman Sachs – Taiwan Semiconductor: Exceptional Growth Story

🔹 Goldman Sachs – YouTube Continues to Gain Share in the TV Streaming Market

1. Buy Bond Humiliation

The U.S. budget deficit is the dominant macro theme in recent bank research. Bank of America forecasts that, due to ongoing tax cuts, the U.S. federal budget deficit will reach 6.3% of GDP this year, a record high for a period of economic expansion (The adjusted chart shows the deficit at −7%). Looking ahead, BofA estimates that the deficit could rise to 6.9% in 2026, even accounting for increased tariff revenues.

The analysts warn that a “crisis of confidence” could emerge at any moment, potentially leading to higher inflation and a sharp sell-off in U.S. Treasuries.

And yet...

Despite this bleak macro outlook, BofA recommends a contrarian strategy: “Sell Hubris, Buy Humiliation,” which involves selling overheated assets (AI stocks, crypto) and buying those that have undergone sharp drawdowns.

Among the latter: long-duration U.S. Treasuries. BofA notes that the annual return of 15-year+ US Treasuries over the past decade has been negative, an extremely rare and “humiliating” result for what’s supposed to be a risk-free asset.

“Nothing more contrarian in ’25 than being long the long-end”

I’d challenge that view. In May, long-end Treasuries were being recommended by nearly everyone, from Wall Street strategists to Zerohedge. This contrarian call may no longer be so contrarian.

What does this mean for Bastion Strategies?

Currently, Bastion strategies don’t allocate across asset classes. However, hypothetically, we could consider adding a long-duration bond ETF to a speculative portfolio strategy. Learn more about Bastion’s core strategies here.

Still, I’m in no rush to make that move.

I remain skeptical of assets that behave like a falling knife on the chart.

U.S. Treasuries are indeed oversold, but there are real structural reasons behind it.

Unless I see signs of a sustained reversal and a medium-term recovery trend forming, I won’t be wading into this swamp.

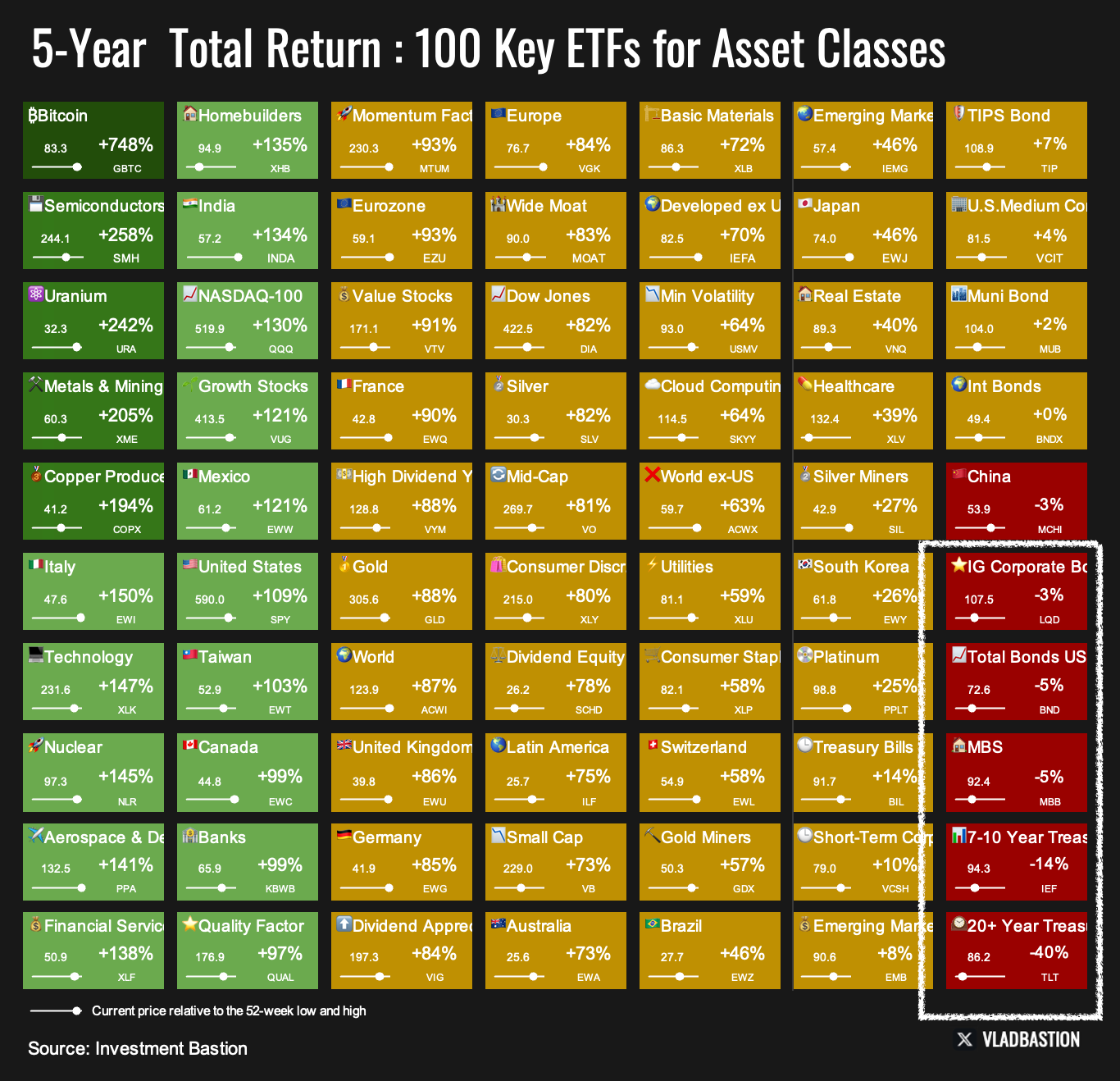

I’m working on a new infographic to help track trends across major asset classes — a heatmap dashboard.

It’s not yet available in the current version of Bastion terminal, but it’s on the way. My goal with Bastion is to make sure you never miss the signal when a new growth trend in long-duration Treasuries begins.

2. Who benefits from tax cuts?

BofA believes that the Republicans’ “Big Beautiful Bill” will have a positive impact on low- and middle-income consumers.

“The impact on overall consumption and S&P 500 earnings of benefits to lower income consumers is small, but the benefit to President Trump’s base is large and the benefit would likely accrue to lower price-point retailers (discount, grocery, personal products).”

BofA provides a very interesting screener of S&P 500 companies with the highest beta and correlation to real wage growth.

Keep reading with a 7-day free trial

Subscribe to Investment Bastion to keep reading this post and get 7 days of free access to the full post archives.