Dividend Growth Portfolios – 3Q 2025

High-Quality Dividend Compounders with Strong Payout and Revenue Growth Potential

Investment Bastion builds regularly updated investment portfolios based on proven fundamental strategies. These portfolios are not just subjective stock picks. They are the result of a comprehensive scoring system that filters companies using dozens of metrics for growth, efficiency, and valuation.

The portfolio and strategy construction process looks like this:

Defining the Asset Universe

Selecting Valuation Metrics

Creating a Scoring System based on relevant metrics

Applying Additional Filters

Generating the Final Portfolio List

In this report, I present two Dividend Growth portfolios focused on U.S. equities. While their expected long-term return is generally lower than that of GEAR+ portfolios (~ global equity index +1–2%), these portfolios typically offer lower market correlation and reduced volatility, making them a valuable diversification tool for investors.

Bastion Terminal powers all analytics and infographics in this research report.

Terminal – Updated on July 28, 2025.

The Bastion Terminal is a set of Excel-based tools that I use for stock analysis and generating investment ideas.

What is the Dividend Growth Philosophy?

This strategy selects stocks that:

Pay dividends

Are expected to grow both dividends and sales at or above the market average

Demonstrate dividend safety (low leverage, strong free cash flow)

Have a history of creating value for shareholders

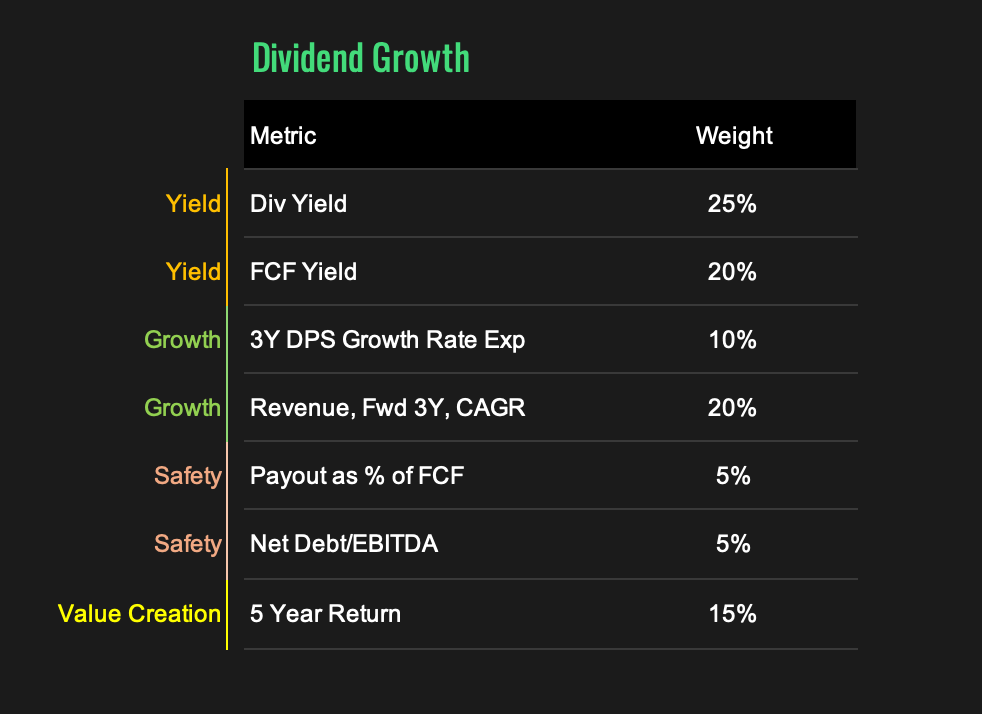

To identify suitable candidates, each stock in the Bastion Terminal is rated on a 1–10 scale across seven key metrics:

Dividend Yield

Free Cash Flow Yield

3-Year Forward Dividend Growth Rate

3-Year Forward Revenue Growth Rate

Dividend Payout Ratio as a % of Free Cash Flow

Net Debt to EBITDA

5-Year Total Return

The final score is calculated using predefined weights that reflect the importance of each metric to the strategy. For comparability across different strategies, I add 10 bonus points to the raw Dividend Growth score. This adjustment helps align the scale with other strategies, such as GEAR+.

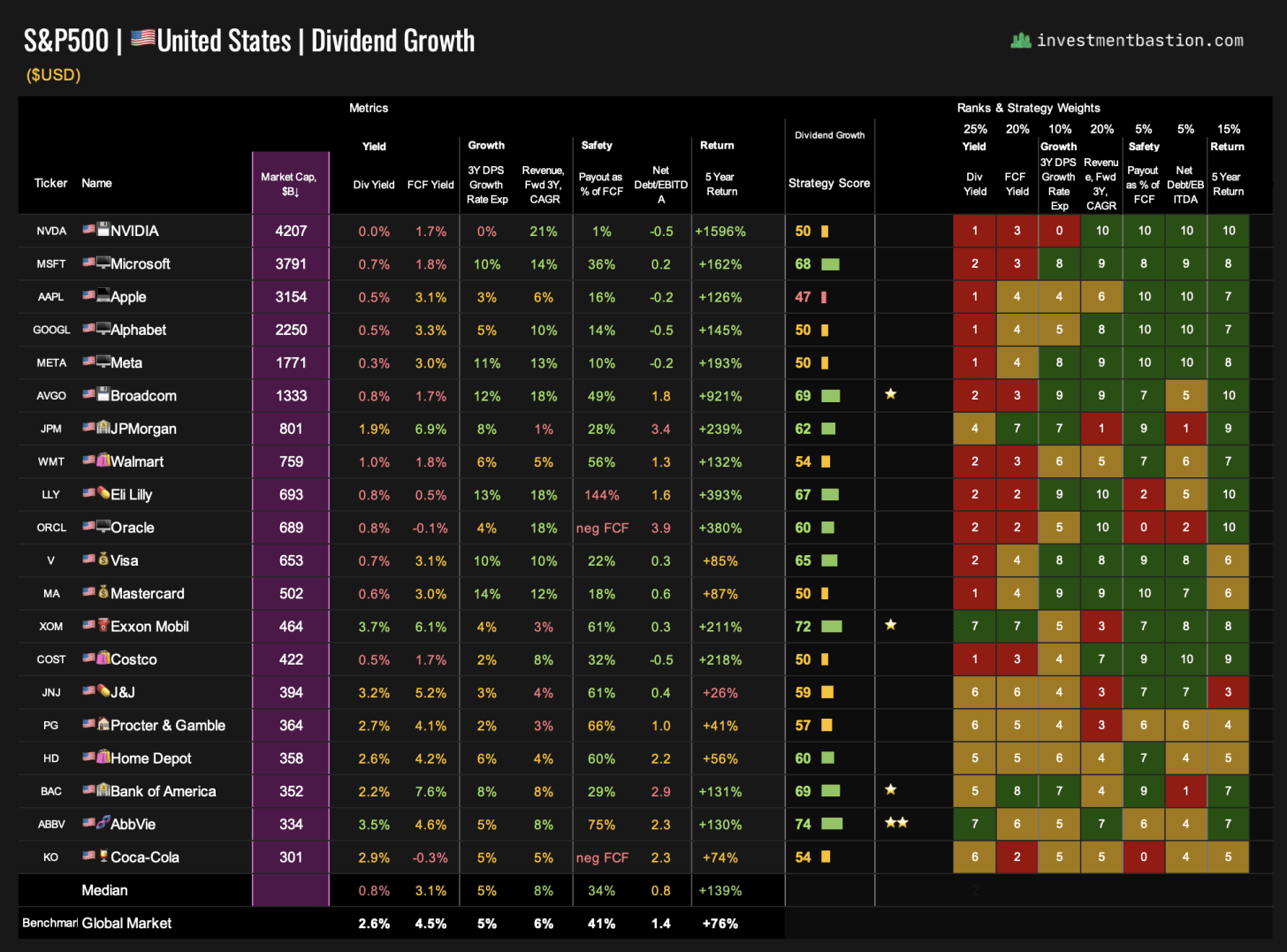

Here’s an example of the ratings for the top 20 U.S. dividend-paying stocks.

For final portfolio selection, I apply additional filters tailored to the specific goals and risk profile of each portfolio. These will be discussed in more detail below.

Two Dividend Growth Portfolios

Bastion Aristocrats – 12 top-rated U.S. Dividend Aristocrats, all of which have raised dividends for at least 25 consecutive years.

S&P 500 Dividend Growth – 20 top-rated dividend stocks from the S&P 500 index, selected based on Bastion’s Dividend Growth score and additional quality filters.

Below, you'll find the latest portfolio constituents, performance results, and my personal favorite picks.

Keep reading with a 7-day free trial

Subscribe to Investment Bastion to keep reading this post and get 7 days of free access to the full post archives.