Israel Stocks Slide, Oil Surges, Oracle Breaks Out – Bastion Trend Tracker

This week’s top market movers across stocks, sectors, and global ETFs

The Bastion Trend Tracker — a weekly snapshot of the biggest moves across thousands of stocks worldwide. This report is designed for active investors, trend followers, and portfolio managers who want to stay ahead of the market without the noise.

📁Each chart is generated using the Bastion Terminal — my analytics platform that processes and ranks over 4,000 stocks globally by momentum and price action.

📚 Also, don’t miss the latest Market Intel – a weekly book of investment ideas from top-tier banks.

This week’s sections include:

🇺🇸 US Top 25 Stocks

🇺🇸 US Top 100 Stocks

🇺🇸 S&P 500 Movers

🇺🇸 US Broad Market Trends

📊 100 Key ETFs

📊 Country ETFs

📊 Sector ETFs

🗺️ Top 500 Global Stocks

🗺️ Bastion Global 4000 Universe

Check out this week’s trends:

1. 🇺🇸US Top 25 Stocks

Note: Oracle (+24%) just had its best week since 2001, driven by soaring demand for its cloud business. The company expects cloud infrastructure revenue to grow over 70% next year, with total orders more than doubling.

Chairman Larry Ellison said:

“The demand is astronomical. We will build and operate more cloud infrastructure data centers than all of our competitors.”

2. 🇺🇸US Top 100 Stocks

Gainers

Note: Oil prices surged after Israel’s attack on Iran. Energy stocks led the rally, with ConocoPhillips up +11% and ExxonMobil +8%.

Palantir (+8%) also gained, as rising geopolitical tensions boost demand for defense and intelligence technologies.

Losers

Note: Shares of Robinhood and AppLovin dropped on Monday after S&P Dow Jones Indices made no changes to the S&P 500 in its latest quarterly rebalancing, despite many expecting new additions.

AppLovin ended the week as one of the biggest losers (-13%), while Robinhood finished flat.

HeatMap

3. 🇺🇸S&P500

Gainers

Note: Tesla (+10%) was among the top 10 performers in the S&P 500 this week. The stock rose after Elon Musk appeared to soften his stance toward Donald Trump, even apologizing for some recent comments.

Investor optimism also grew ahead of the anticipated robotaxi launch. Tesla was reportedly set to begin autonomous operations in Austin on June 12, but the date has now been pushed to June 22, according to Bloomberg.

Losers

Note: J.M. Smucker (-14%) was the worst-performing stock in the S&P 500 this week. Shares fell after the company forecast full-year profit below expectations. Tariff uncertainty and repeated price hikes are weighing on demand for its dog snacks and sweet baked goods.

4. 🇺🇸US Broad market

Gainers

Note: Insmed (+34%) surged after reporting positive results from a Phase 2b trial of its experimental inhaled PAH treatment, treprostinil palmitil. Patients with pulmonary arterial hypertension (PAH) saw a 35% reduction in pulmonary vascular resistance compared to placebo, a key indicator of improved blood flow from the lungs to the heart.

Losers

Note: Newsmax (-26%) continued to slide this week following its recent IPO. The conservative media company has struggled to gain investor confidence amid a volatile post-listing environment.

5. 📊100 key ETFs

Note: Global airline and travel stocks sold off sharply on Friday, as Israel’s strikes on Iran triggered a surge in oil prices and forced carriers to reroute flights away from Middle Eastern airspace. Airlines ETF fell -7% on the week.

6. 📊Country ETFs

Note: The Israel ETF was the worst-performing country ETF this week (-5%), hit by rising geopolitical tensions and regional conflict. Meanwhile, Norway’s ETF gained, supported by rising oil prices following the escalation in the Middle East.

7. 📊Sector ETFs

Note: The Gold Miners ETF added +6% this week, extending its breakout to new highs. Rising geopolitical risks and a supportive U.S. monetary backdrop continue to drive investor demand for precious metals.

8. 🗺️Global 500 Stocks

Gainers

Note: This week’s top performers in the Global 500 were dominated by oil and resource producers, as rising commodity prices and geopolitical tensions boosted the sector.

Losers

Note: Intuitive Surgical (-8%) dropped after Deutsche Bank downgraded the stock to Sell — its first such rating. The bank cited rising competition from lower-cost remanufactured tools as a long-term risk to the company’s flagship da Vinci robotic system.

9. 🗺️Bastion Global 4000 Stocks

Gainers

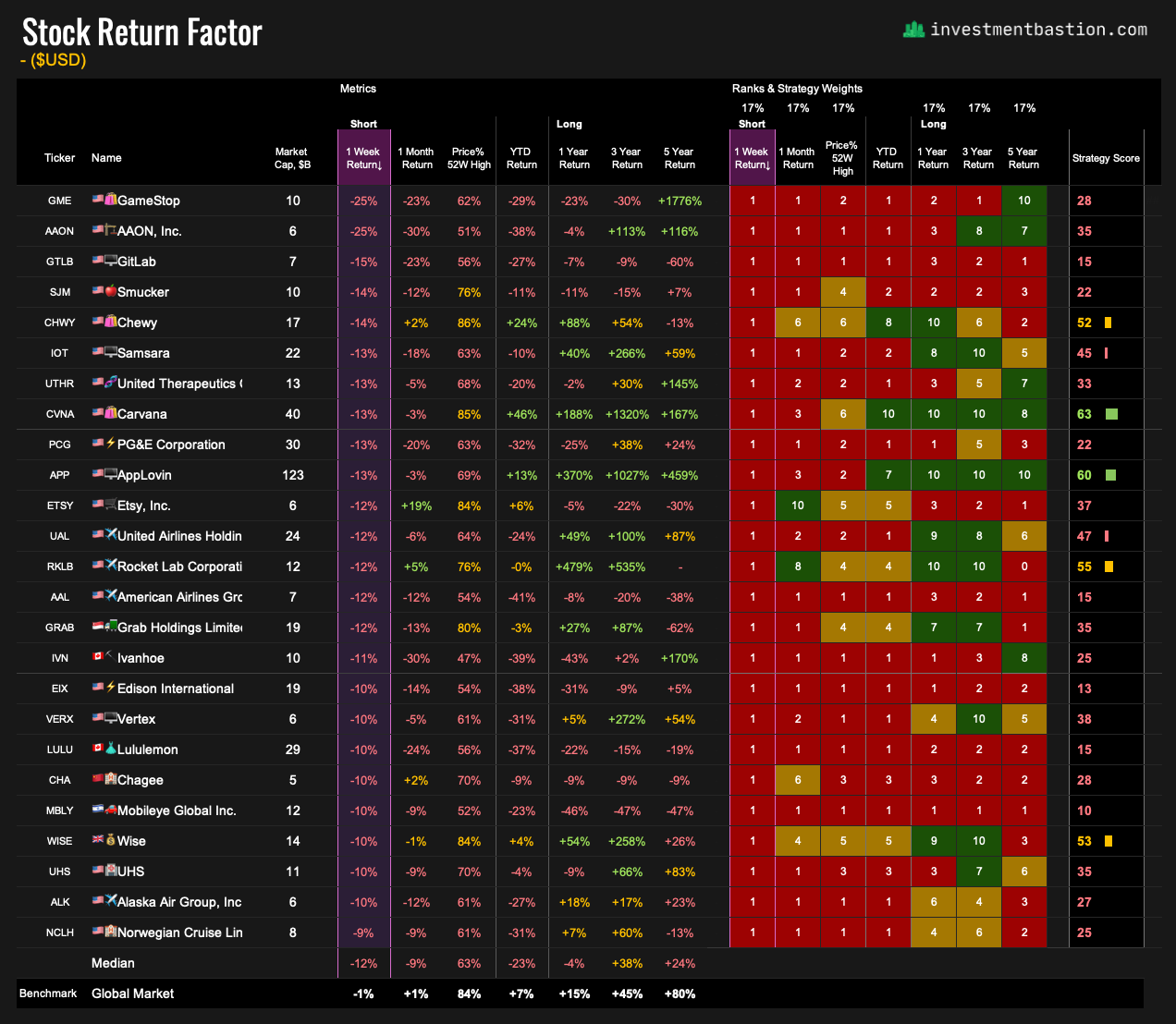

Losers

Note: GameStop (-25%) was the worst performer on Bastion’s watchlist this week. Shares plunged after the company announced a $1.75 billion convertible notes offering, which could help fund its new bitcoin-focused strategy.

🧭 Wrapping Up – What We’re Watching

📈 Oracle – watching for potential follow-through after its breakout

💊 Insmed – needs deeper analysis after promising trial results

🛢️ Oil – staying cautious long term, but monitoring short-term momentum

🪙 Gold miners – strong performance in our speculative portfolio

🇮🇱 Israel ETF – watching for a potential rebound and recovery opportunity

🏥 Intuitive Surgical – reassessing long-term positioning after the downgrade

At Bastion, we track over 4,000 stocks across the globe — ranking them by momentum, volatility, and fundamental strength to help you cut through the noise and focus on what matters.

📬 If you found this useful, consider subscribing to our Monday deep-dive – Market Intel – for investment ideas and research from leading banks, enhanced with Bastion visuals and analysis.

Stay sharp,

– Vlad Bastion