👉🖥️ Bastion Excel Terminal

The core idea behind the terminal is to create a set of infographics that clearly show a company's key financial trends and how well it fits various investment strategies, without the need to read full financial reports.

What if you could look at a company and, in 30 seconds, answer:

What kind of business is this?

Is it growing or shrinking?

Is it cheap or expensive?

I built a file with key dashboards designed to give you immediate clarity. Here is a brief overview of the main infographics available in Stock Dashboards and their purposes.

1. GEAR+ Tab — Growth + Efficiency at a Reasonable Price

This is the main dashboard and my default starting point.

It gives you a visual snapshot of:

Revenue trends

Profitability

Valuation

And an overall Strategy Fit Score

That score is based on where the company ranks (from 1 to 10) across 7 key factors relative to 3,000 global companies:

Historical revenue growth

Forecasted revenue growth

Forward P/E (12 months)

Forward P/E (3 years out)

Operating margin (LTM)

1-year stock performance

The higher the score, the better the company fits the GEAR strategy.

But a low score doesn't mean the company is “bad” — it just means it's not aligned with this particular strategy.

Default threshold ratings:

Score ≥ 60 → BUY candidate

50–60 → HOLD

< 50 → SELL

I use this tab to quickly assess whether a company fits my portfolio's goals.

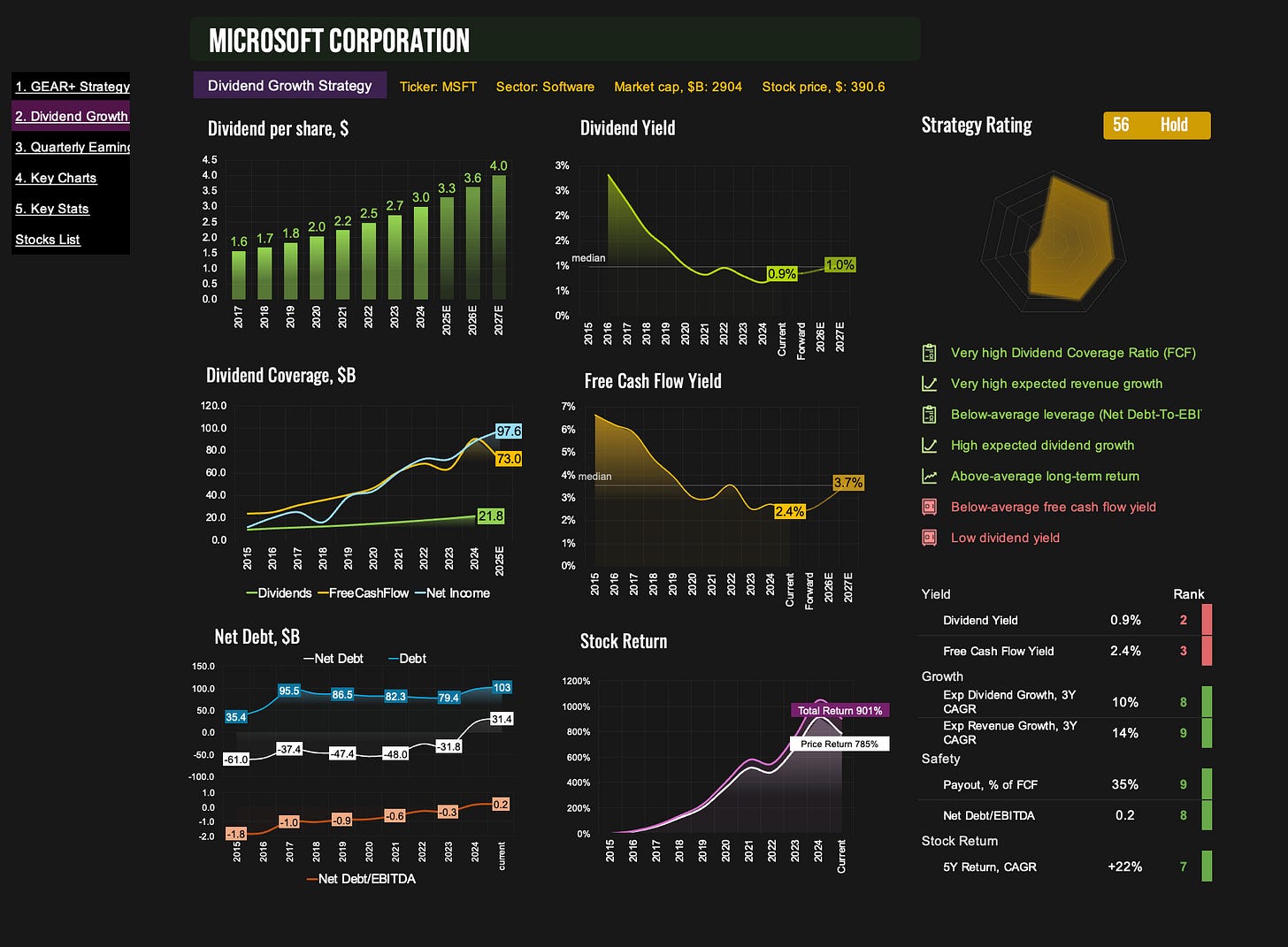

2. Dividend Tab — Dividend Growth Strategy

Same concept but with a dividend-focused lens.

This tab evaluates companies based on:

Dividend yield

Free cash flow yield

Dividend growth forecast (3 years)

Revenue growth forecast (3 years)

Payout ratio (as % of FCF)

Net Debt / EBITDA

5-year average total return

The goal is to find high-quality dividend payers that can sustainably grow those payouts.

3. Quarterly Tab — Latest Financials at a Glance

Use this dashboard to stay up to date with recent results:

Revenue

EBITDA

Net income

Operating & free cash flow

Debt and cash levels

Margins

After each earnings season, I use this dashboard to review all the market leaders and quickly identify the key trends in their businesses.

4. Key Charts — 16 Visual Trends

This is the big-picture tab — 16 charts covering long-term trends in:

Financials

Margins

Valuation

Stock performance

All in one place, no clicking around. Great for getting a feel for where the company has been and where it might be going.

5. Key Stats — 30+ Core Metrics

Here, you’ll find more than 30 metrics, including:

Growth forecasts

Valuation multiples

Yield & return metrics

Efficiency & profitability

Every metric is also scored from 0 to 10 based on its percentile vs. global peers.

For example:

A 10 in "Revenue Growth Forecast" means the company is in the top 10% globally.

This lets you instantly spot a company’s defining traits — where it excels and where it lags.

You’ll also see a “Best for Strategies” block with factor-based ratings:

Factor Strategies:

Growth

Quality

Deep Value

Buy the Dip

Stock Momentum

Multi-Factor Strategies:

FOMO Momentum

Deep Value + Momentum

Efficiency + Growth

GEAR (Growth + Efficiency at Reasonable Price)

Dividend Growth

Again, these scores don’t tell you if the company is "good" — just whether it aligns with a specific strategy or style. Each strategy will be described in more detail in a separate guide.

6. Stocks List — All Covered Companies

This tab shows you the whole universe of stocks available in the terminal:

~500 U.S. companies

~100 international names (and growing)

You can search by typing a ticker or company name, or scroll manually in cell G11 on the GEAR+ tab.

If you want access to these dashboards, subscribe below.

Other Guides: