The Investing Playbook Vol. 4: Google, Reddit, Top Quality + Growth Stocks Beyond the US

Top Stocks for Different Investment Strategies

The Investing Playbook is your weekly roadmap to global stocks. It ranks companies across 9 strategies so you can find the best ideas — whether you invest in Value, Growth, or Momentum.

You’ll get an interactive Excel file to explore by region and sector, plus a detailed 150-page PDF report covering the S&P 500, US Mid Caps, Europe 500, Global 500, and Ex-US 500 stocks.

Some observations from this week’s Playbook:

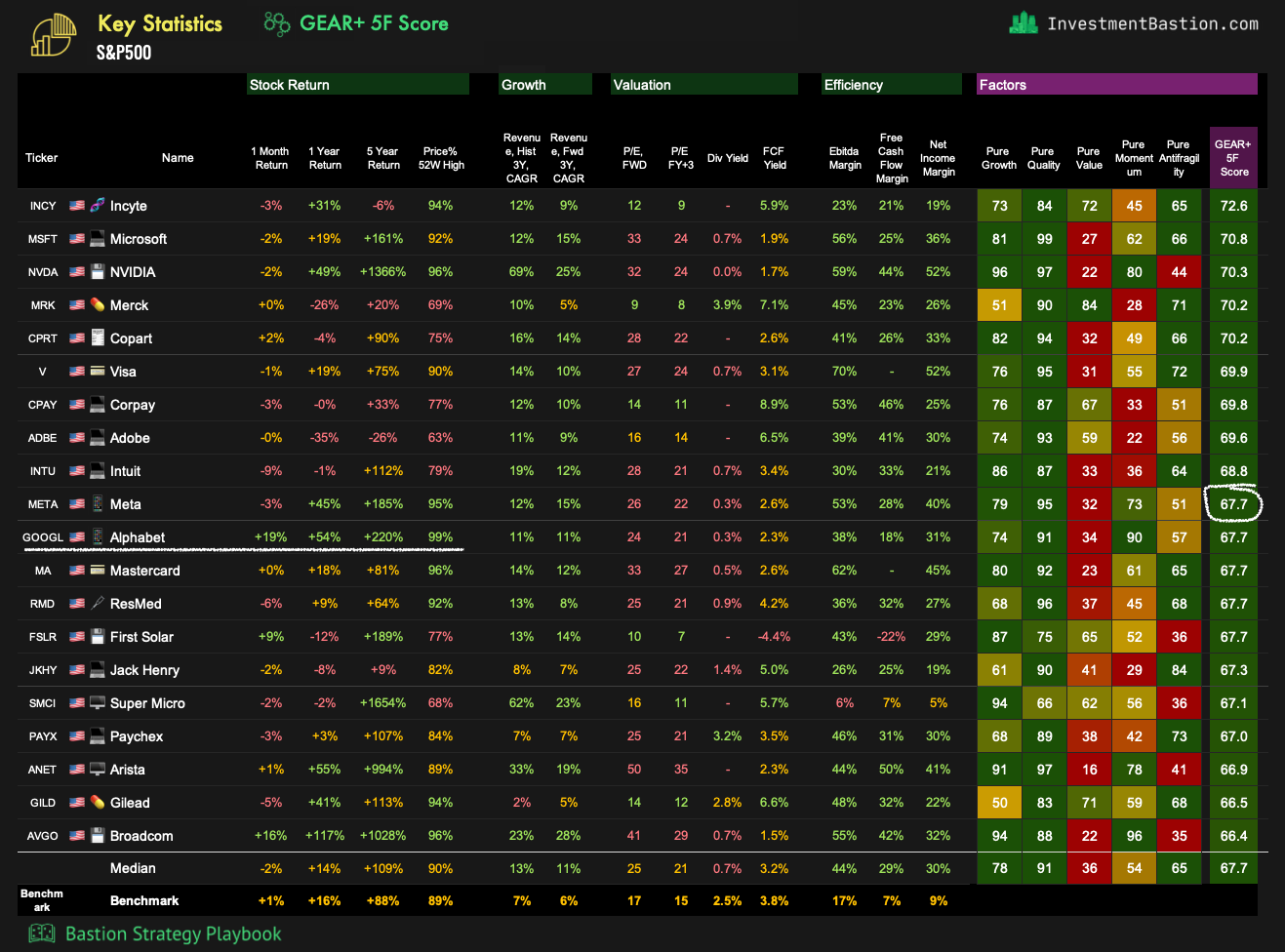

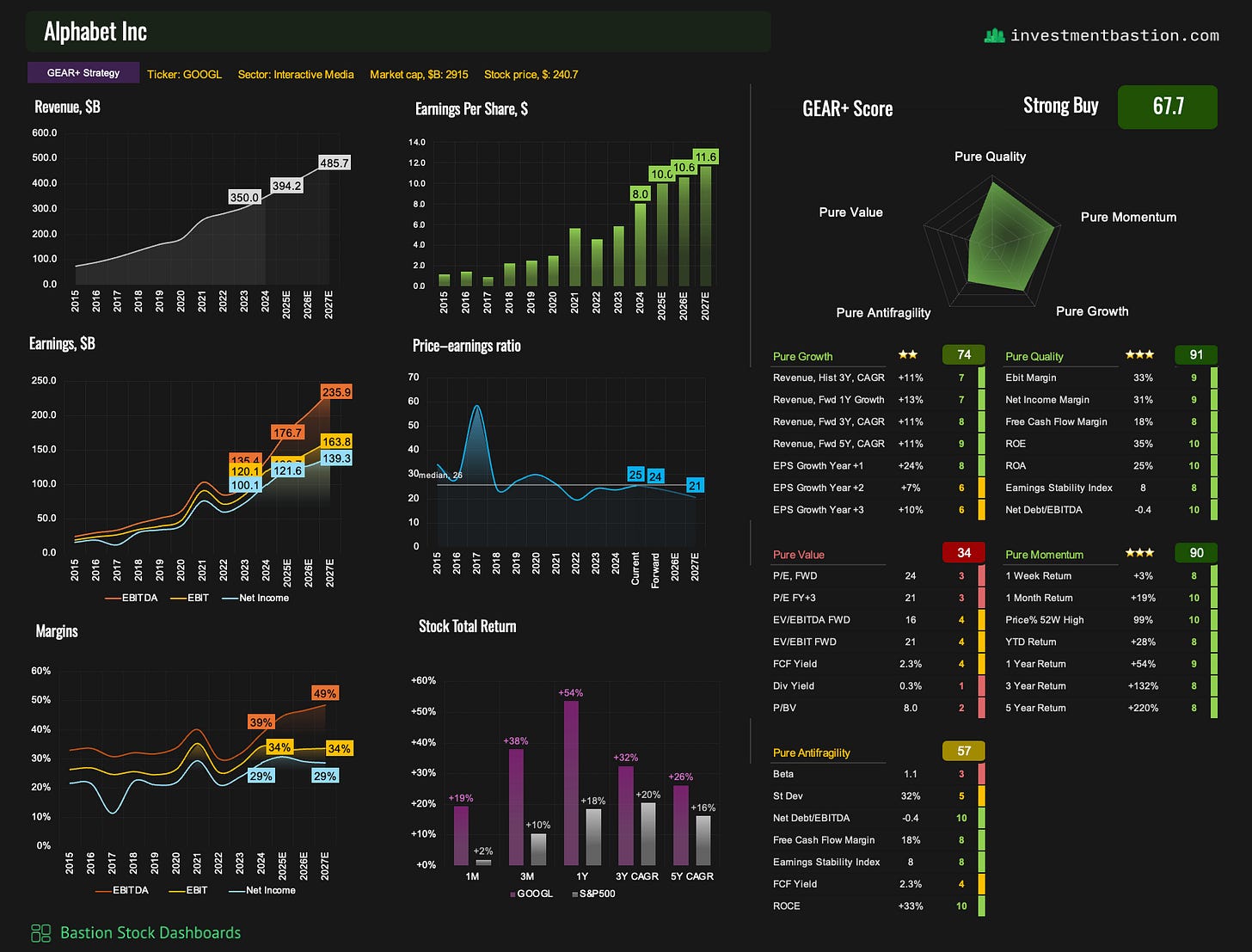

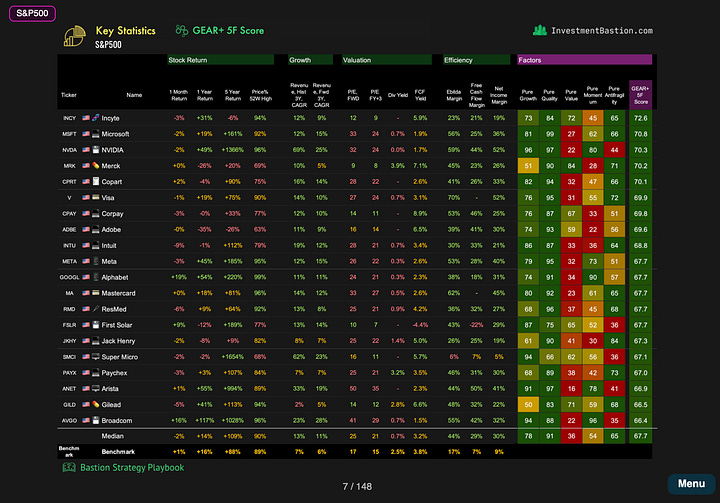

1. Alphabet – top performer in GEAR+

One of the risks weighing on Alphabet’s valuation seems to have faded into the background. In early September, it was reported that a U.S. court prohibited Google from entering into new exclusive contracts related to the distribution of Google Search, Chrome, Google Assistant, and the Gemini app. However, the company will not be forced to divest Chrome or stop making payments to Apple in order to remain the default search engine.

The market views this as highly positive. Alphabet is among the best monthly performers within the S&P 500 stocks that have a high Growth + Efficiency at Reasonable Price rating.

The company continues to deliver double-digit expected growth. A forward P/E of 24x suggests a reasonable premium to the U.S. equity market median.

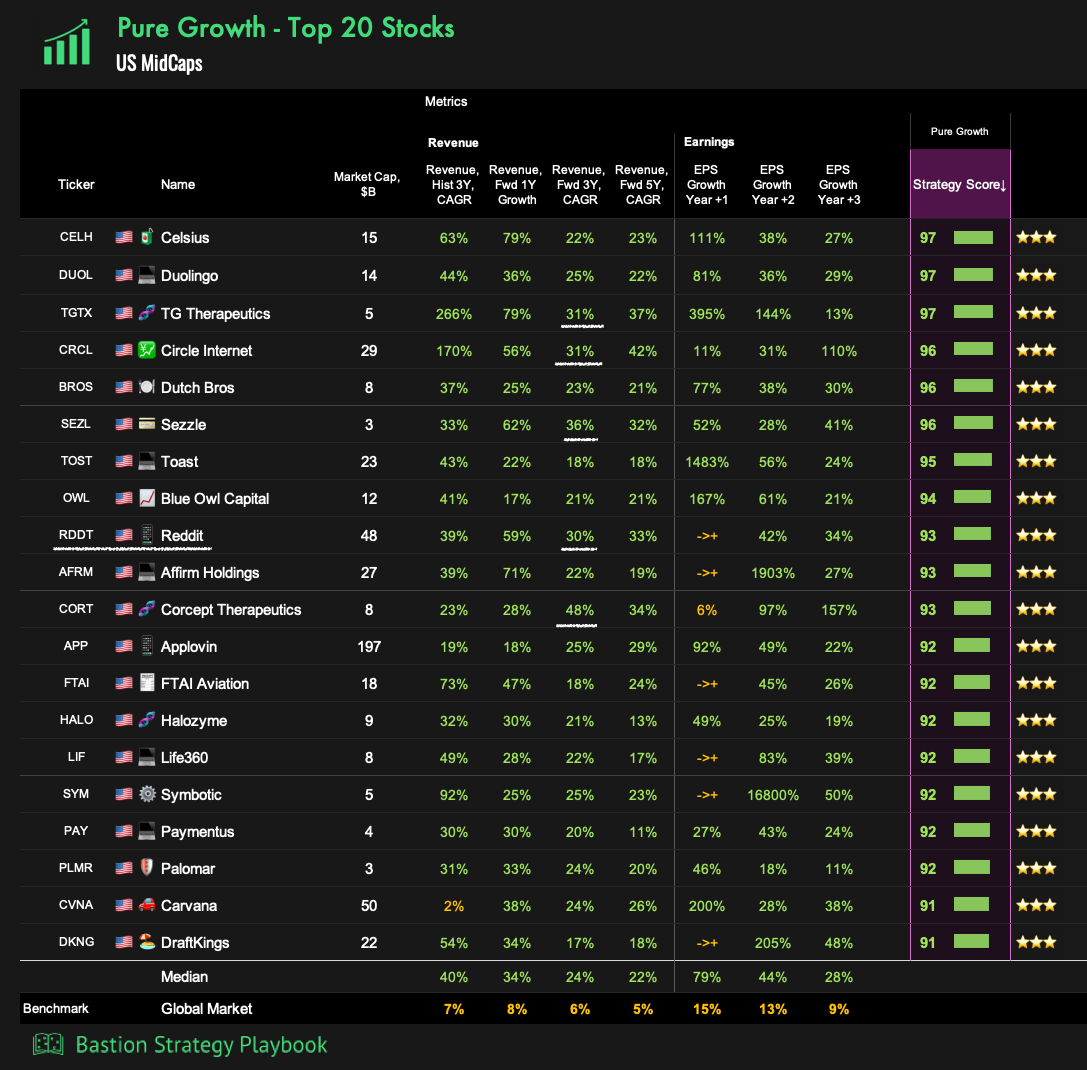

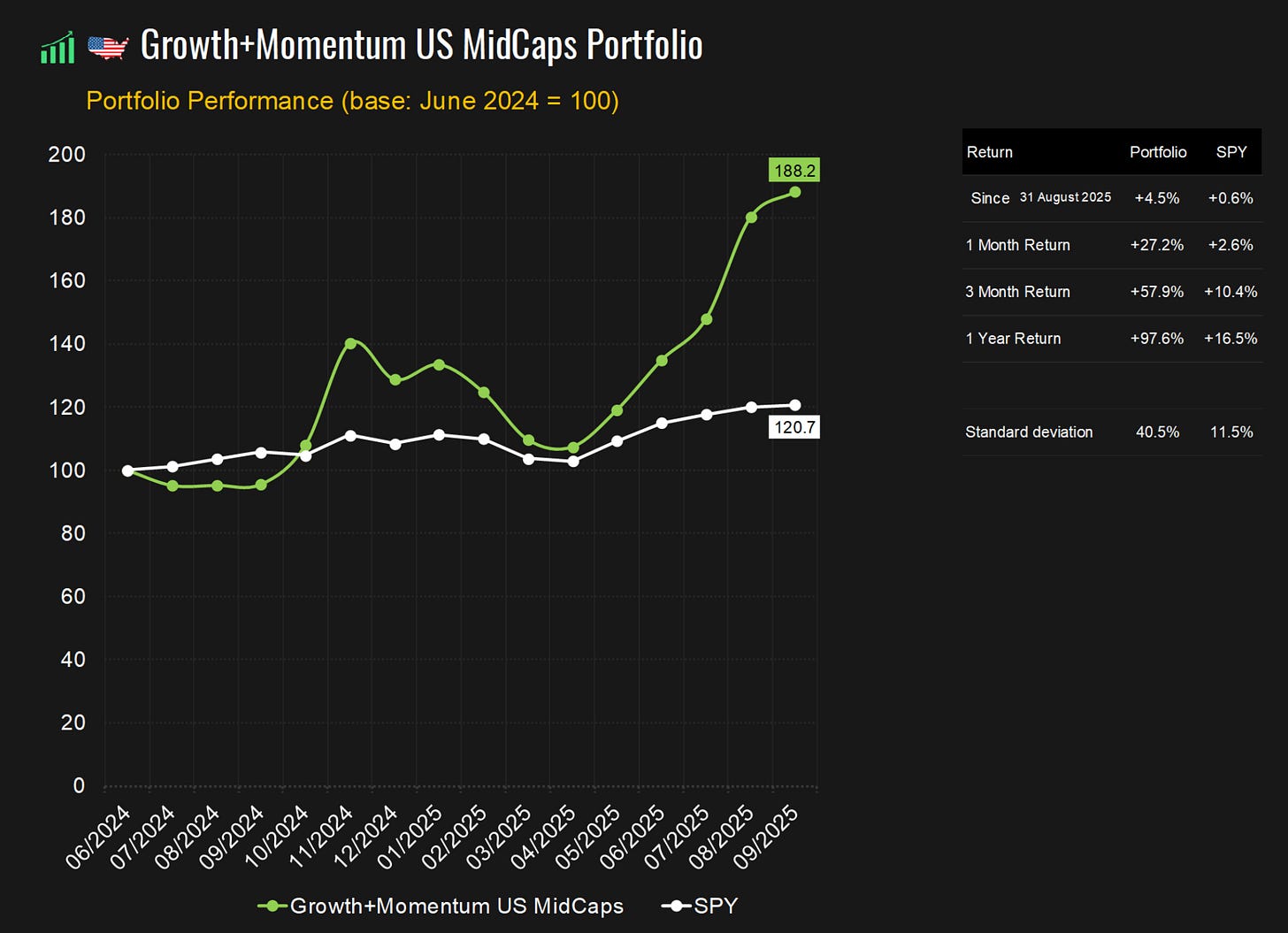

2. Top 20 Growth Stocks among US MidCaps

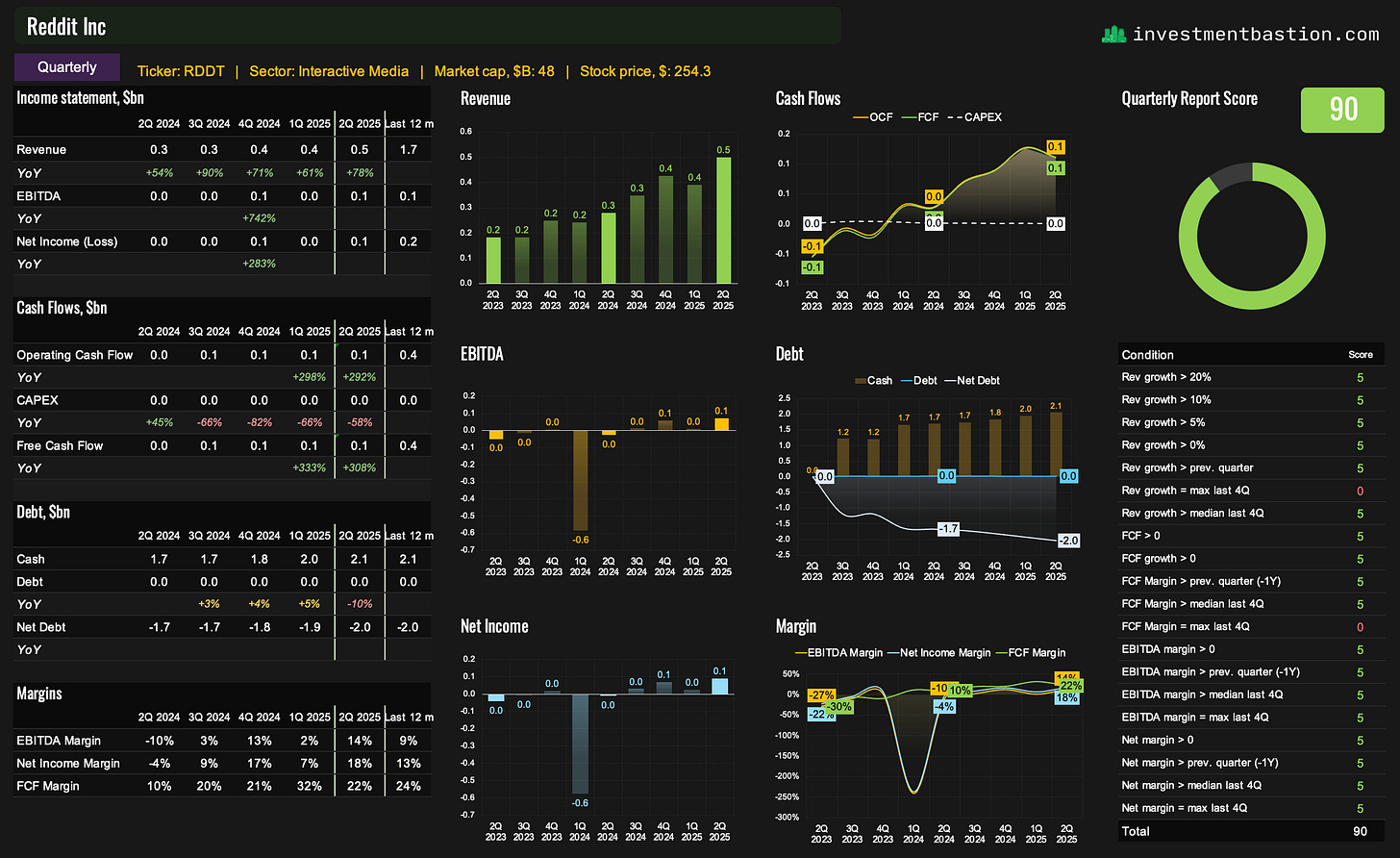

Only five companies on the list have expected growth rates above 30%, and one of them is Reddit. The social media platform has become the star of the Growth + Momentum MidCap portfolio, delivering outstanding returns over the past year.

What’s the secret behind Reddit’s success?

AI-powered advertising features are attracting advertisers by giving them access to advanced tools for generating ads.

Revenue growth has exceeded all expectations. In the latest quarter, revenue surged 78% year-over-year to nearly $500 million — the strongest growth in the company’s history.

Reddit is also monetizing deals with AI developers. The company signed a $60 million licensing agreement with Alphabet and a $70 million agreement with OpenAI to use Reddit content in ChatGPT search recommendations and Google’s AI Overviews.

According to WSJ, analysts noted that an August report from Ahrefs showed Reddit appearing in 5.5% of Google AI Overviews responses — more than any other source.

The valuation looks expensive: Reddit is trading at 220x trailing twelve-month earnings. But given consensus growth forecasts, the multiple doesn’t look extreme: the company is valued at 31x projected 2028 earnings.

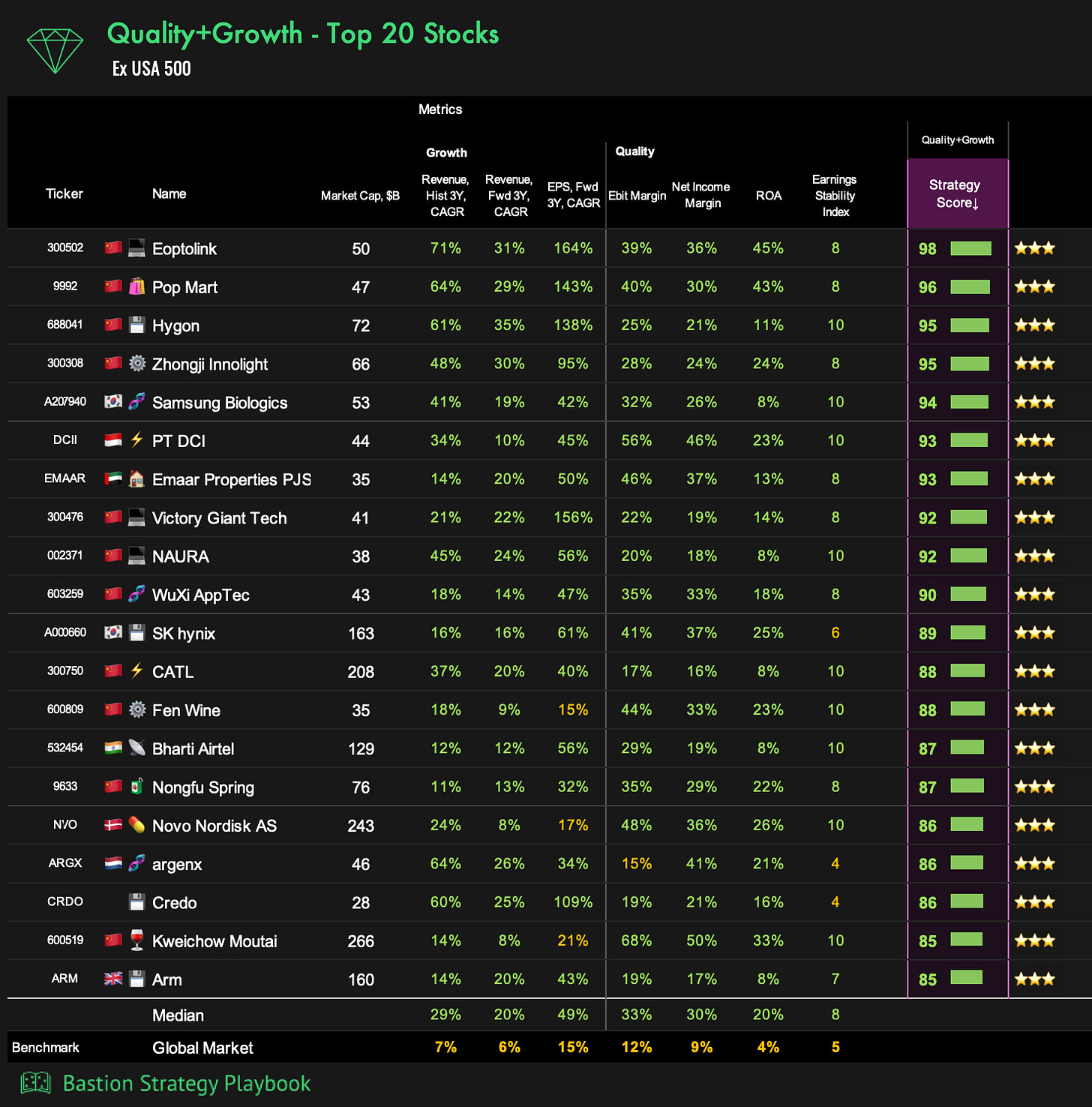

3. Best Quality + Growth Stocks outside the US

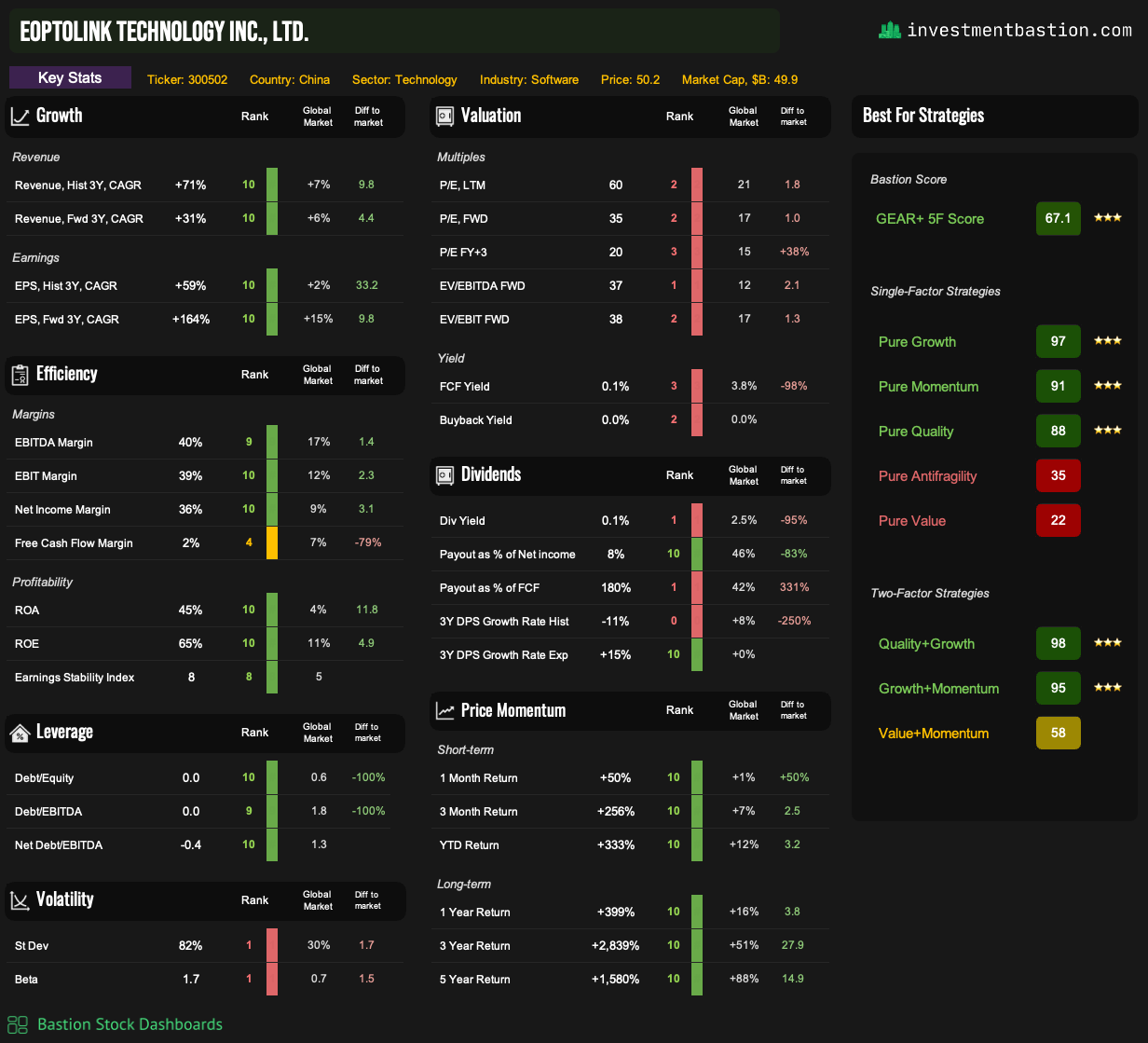

On this dashboard, my attention was drawn to China’s Eoptolink, which was already mentioned in Idea Radar #5. The company ranks among the top seven transceiver suppliers in the world.

To power large AI models, thousands of servers in data centers must exchange enormous amounts of data every second. Older transceiver standards (100G, 200G, 400G) can no longer handle the load. Eoptolink is developing 800G+ transceivers, which are becoming the new standard in modern data centers.

Eoptolink combines elite growth metrics (expected revenue growth of +30% CAGR over the next three years) and quality (net income margin of 36%), while also showing strong stock price momentum. Its 2028 P/E is 20x, with a Score of 3, which can be considered an attractive valuation compared to other growth peers.

The Terminal

All visuals are powered by the Bastion Terminal, a weekly update of stock ratings by sector and region.

Disclaimer:

This report is not investment advice. The information provided is for educational and informational purposes only and does not constitute a recommendation to buy or sell any securities. Always do your own research or consult a professional advisor.