Bastion Trend Tracker: AI Mania Reloaded, China Roars Back, Superman Saves Warner Bros

Top recent momentum moves across global markets

Bastion Trend Tracker – your fast, focused hit of the recent market trends.

Its purpose:

to track key financial news that drives price movements

to spot early breakouts

to filter out the noise (so you don’t have to read daily market news)

📁Each chart is generated using the Bastion Terminal — my analytics platform that processes and ranks over 4,000 stocks globally by momentum and price change.

Highlights:

Last week saw strong momentum across AI, financials, and entertainment, with several breakout moves in both U.S. and international markets. Notable winners included Lucid (+36%) on robotaxi news, AMD (+10%) on China chip approvals, and DiDi (+21%) after a bullish call from Goldman Sachs. Meanwhile, Europe’s Nebius Group continues to lead in AI infrastructure growth, and Chinese equities are staging a powerful comeback.

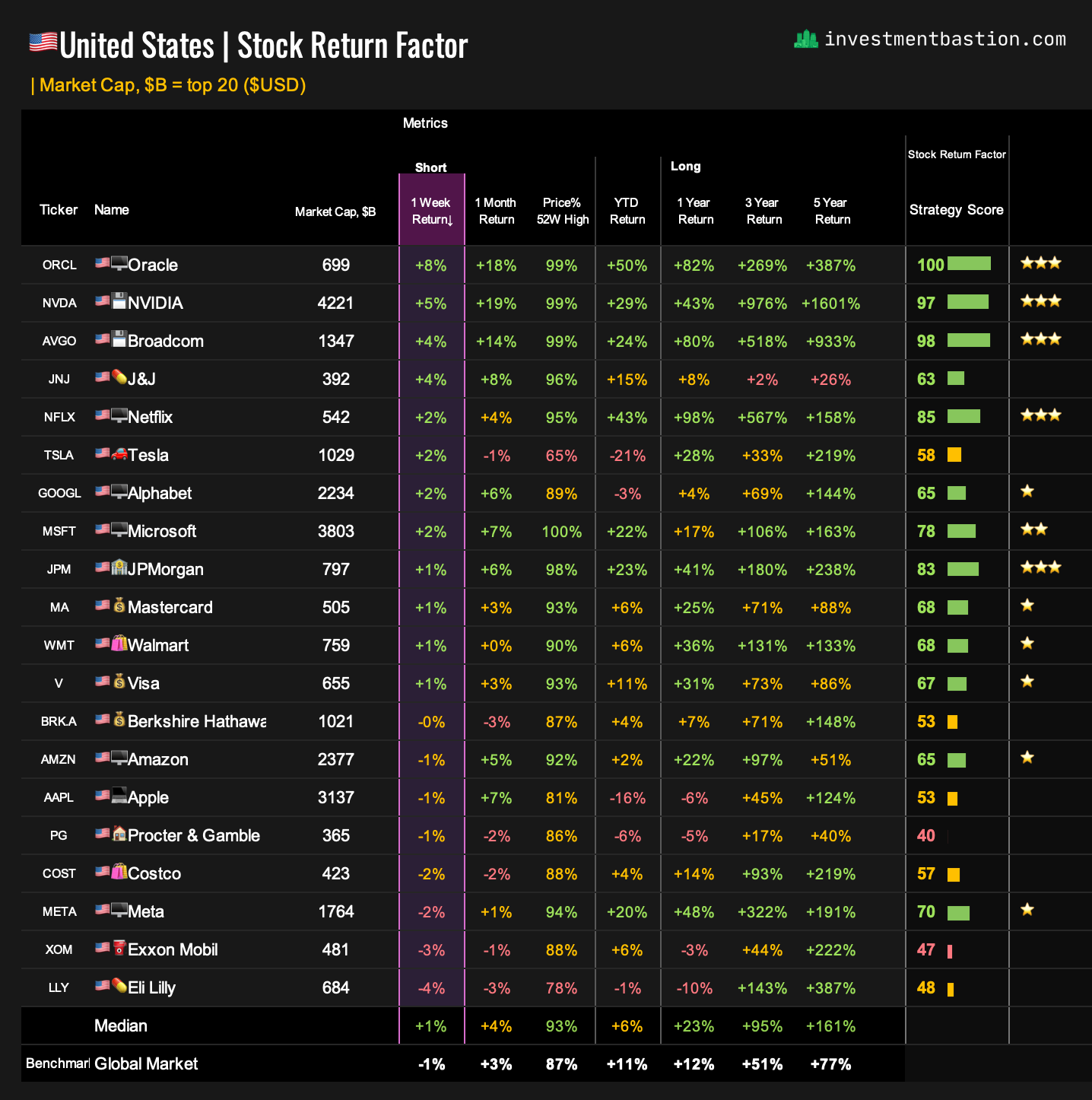

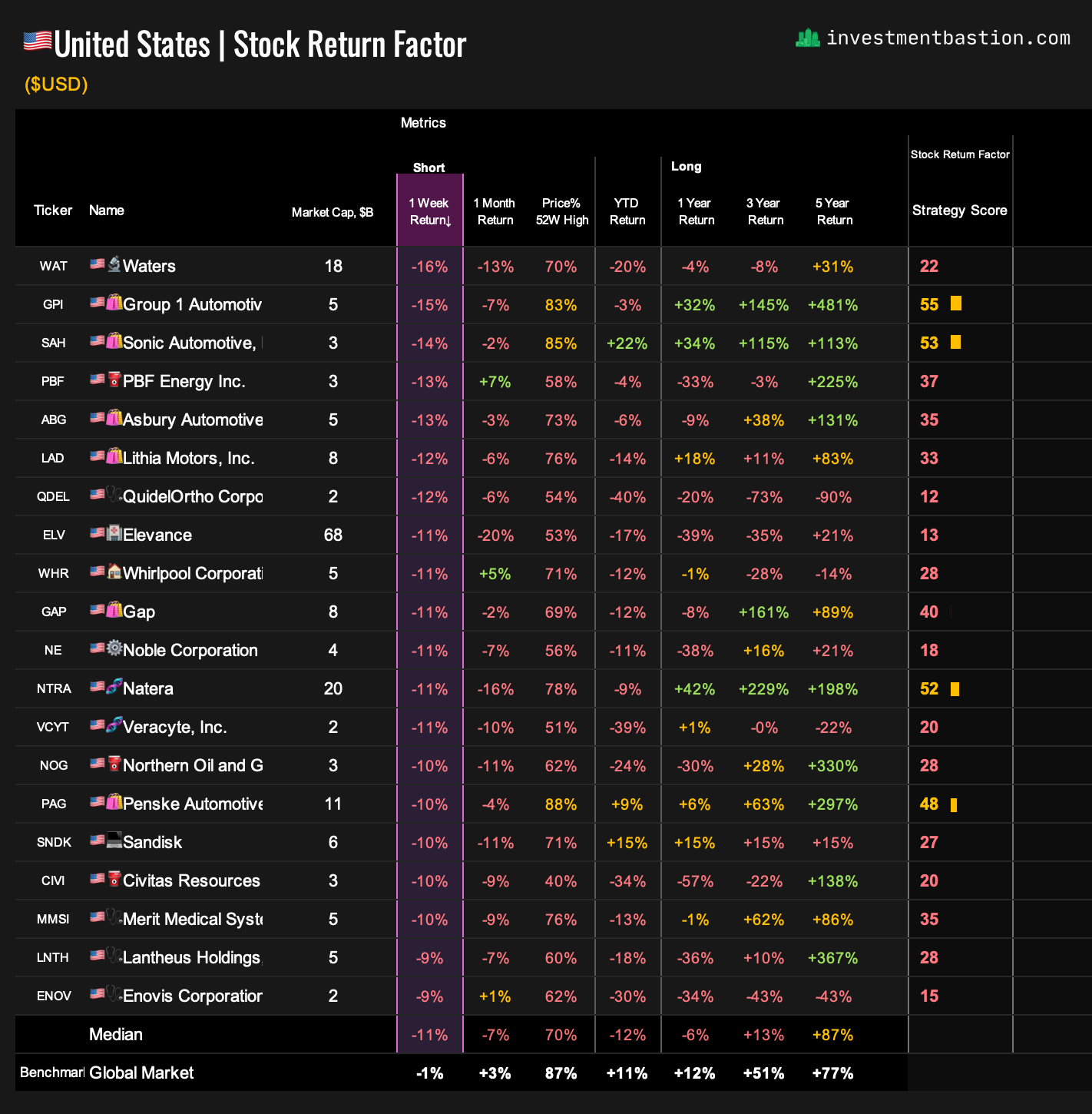

1. 🇺🇸US Top 20 Stocks

🚀 Oracle (ORCL, +8%)

Another monster week for a company well-positioned to benefit from AI-driven growth. UBS raised its price target, estimating that by fiscal 2029, Oracle will generate $134 billion in revenue with operating margins of 38%. For context, revenue in the most recent fiscal year was $57 billion, implying more than 2x growth ahead.

Oracle also announced a $3 billion investment in Germany and the Netherlands over the next five years to expand its AI and cloud infrastructure across Europe.

The stock is part of the GEAR+ strategy portfolio.

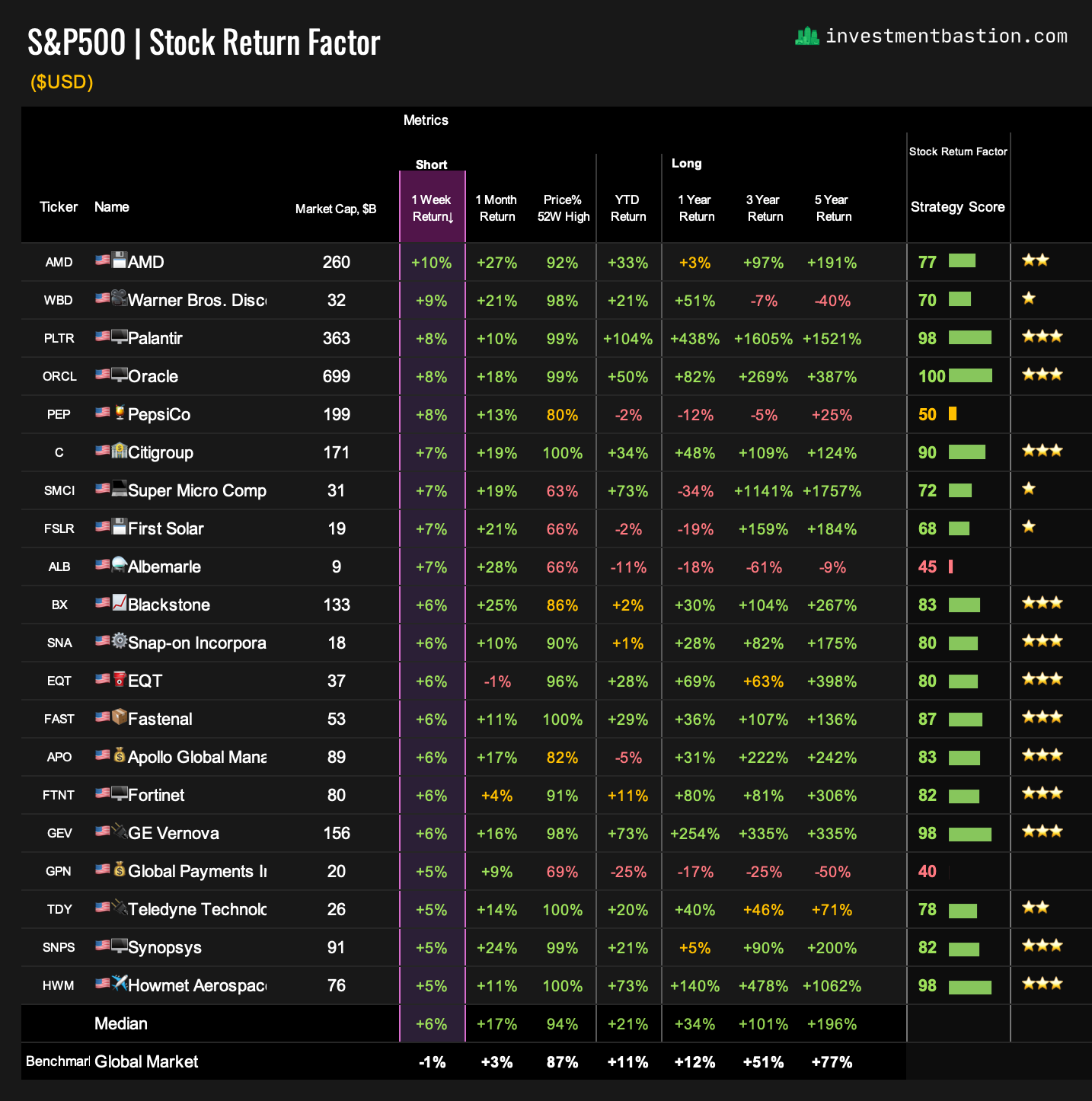

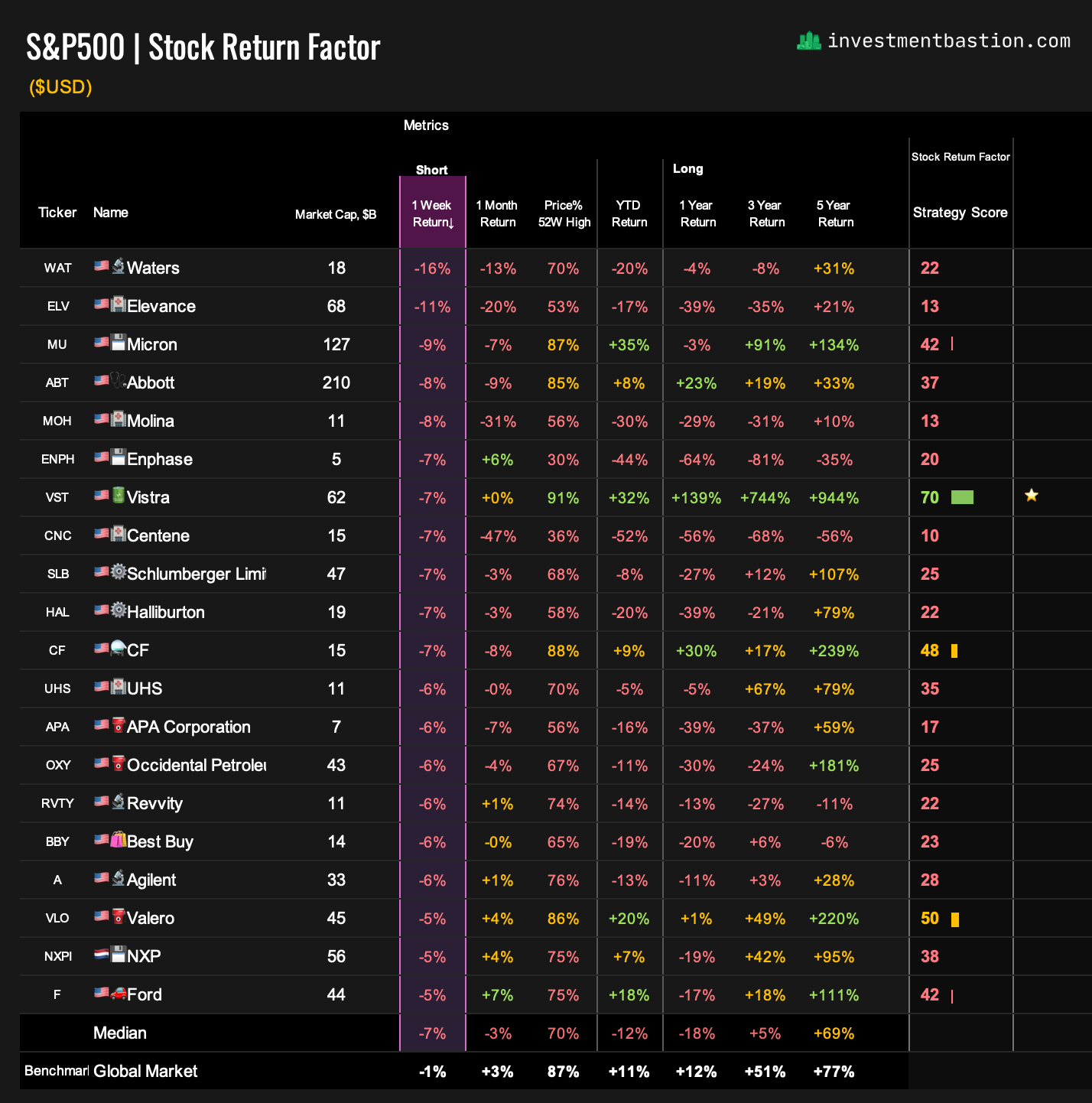

2. 🇺🇸S&P500

🟢 Gainers

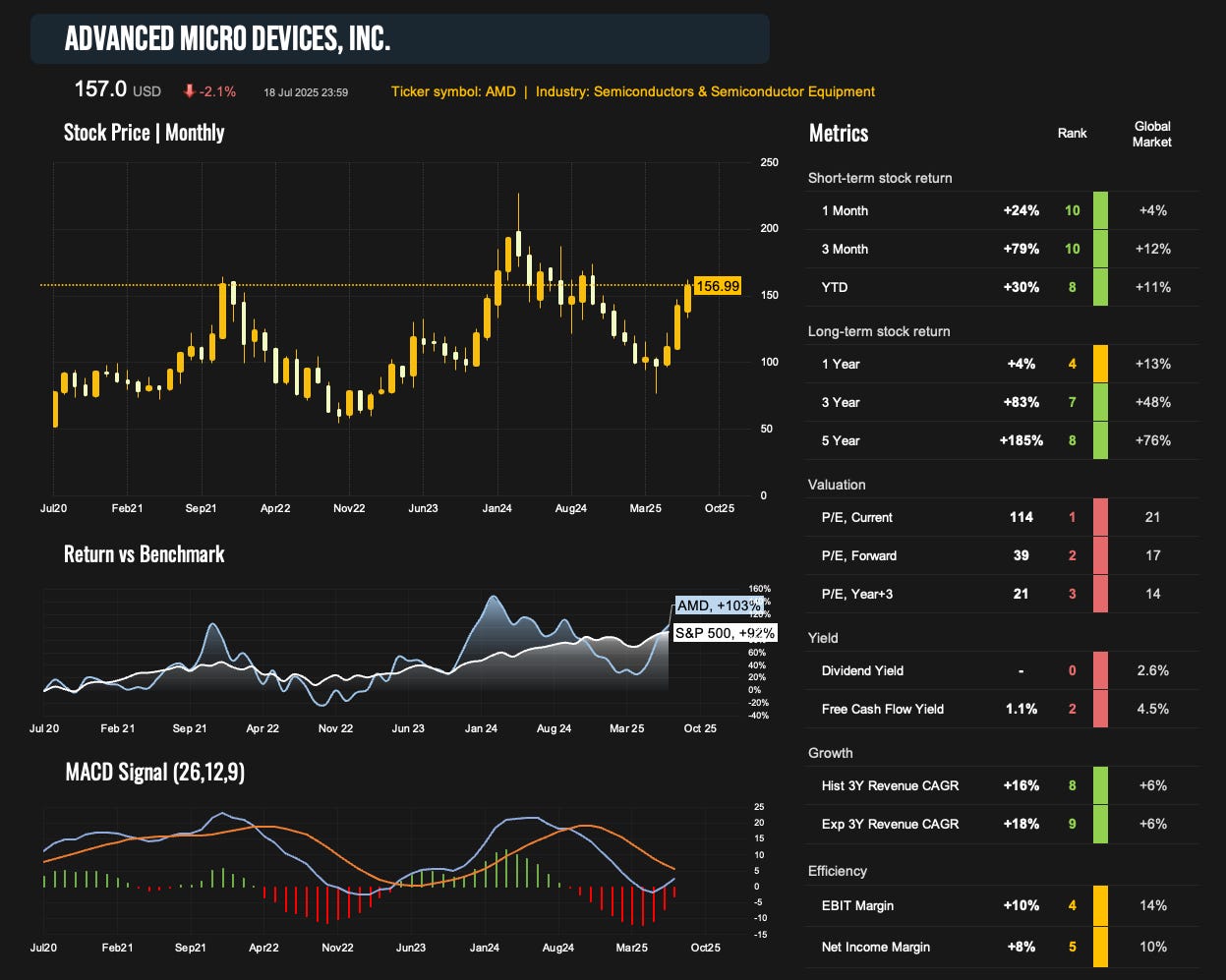

💾 AMD (AMD, +10%)

Nvidia and AMD received approval to resume sales of some of their AI chips in China (specifically Nvidia’s H20 and AMD’s MI308). This could be a major win for the entire AI sector.

HSBC analysts also noted that AMD’s upcoming MI350 series is on par with Nvidia’s current Blackwell chips, and the next-gen MI400 (expected next year) may be able to compete with Nvidia’s future Vera Rubin platform.

AMD was the top-performing stock in the S&P 500 last week.

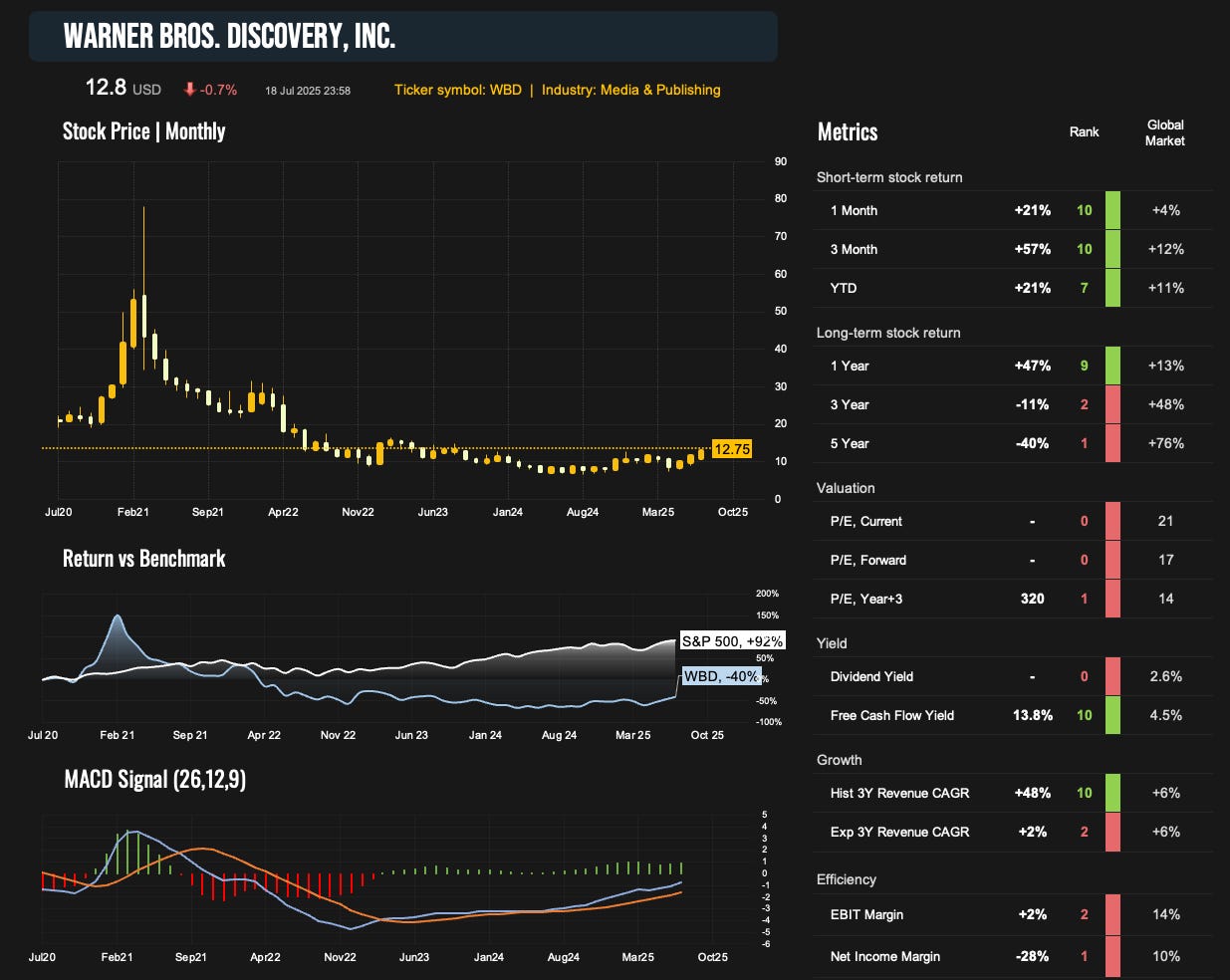

🎬 Warner Bros. Discovery (WBD, +9%)

Shares of the entertainment giant surged following the strong global debut of the superhero movie Superman, which brought in $217 million over its opening weekend, well above expectations.

Superman is the latest summer hit for the studio. In April, the Minecraft movie also exceeded forecasts with a $163 million domestic opening and has since grossed $955 million worldwide.

WBD shares reacted positively, climbing to new 52-week highs.

🏦 Citigroup (C, +7%)

Citigroup posted strong quarterly results and raised its full-year revenue outlook to $84 billion, the high end of its previous guidance. The CEO also revealed that the bank is exploring the use of stablecoins. The broader banking sector is performing well, and Citigroup stands out with powerful momentum. Shares are breaking out to multi-year highs.

🔴 Losers

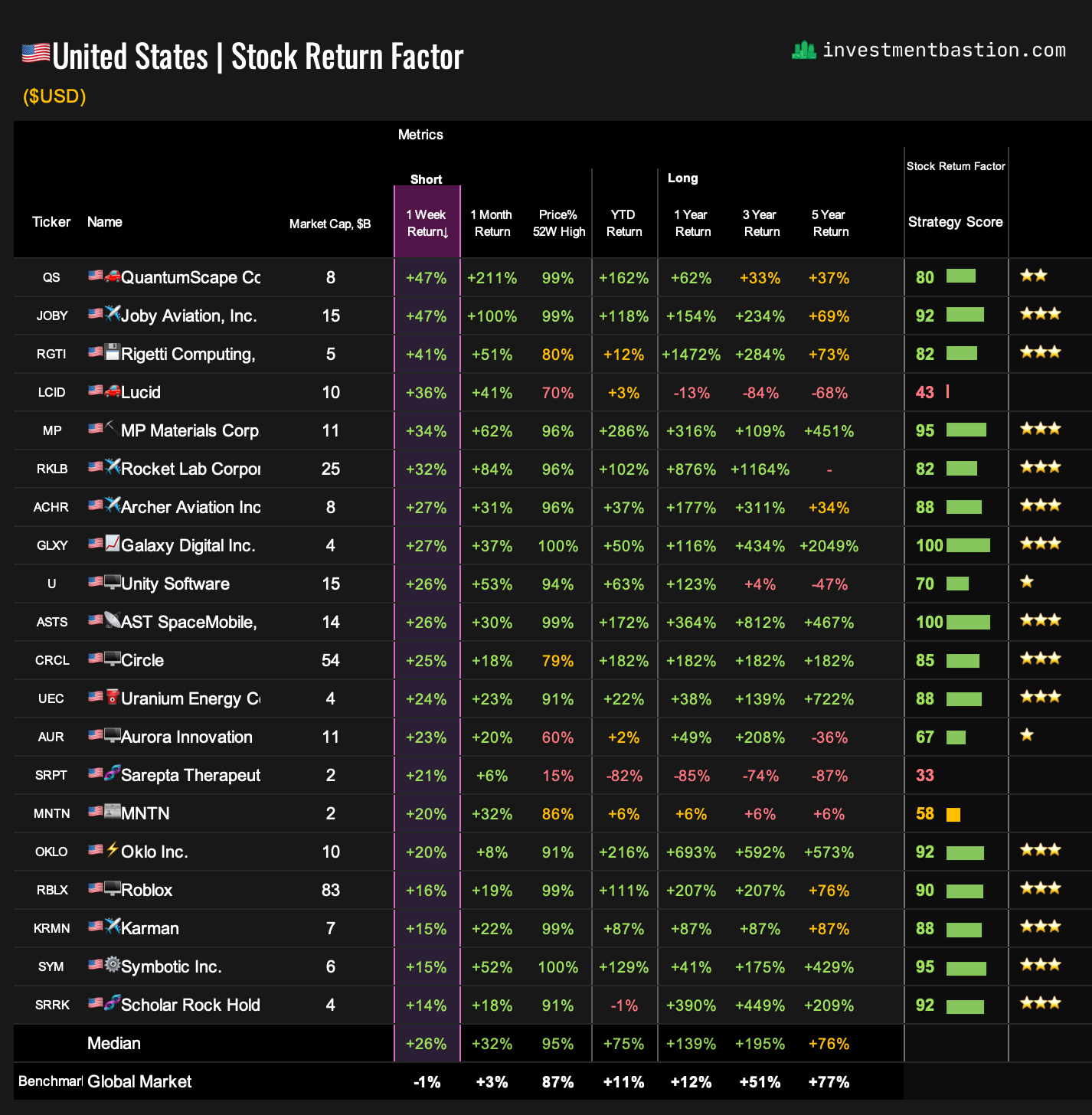

3. 🇺🇸US Broad market

🟢 Gainers

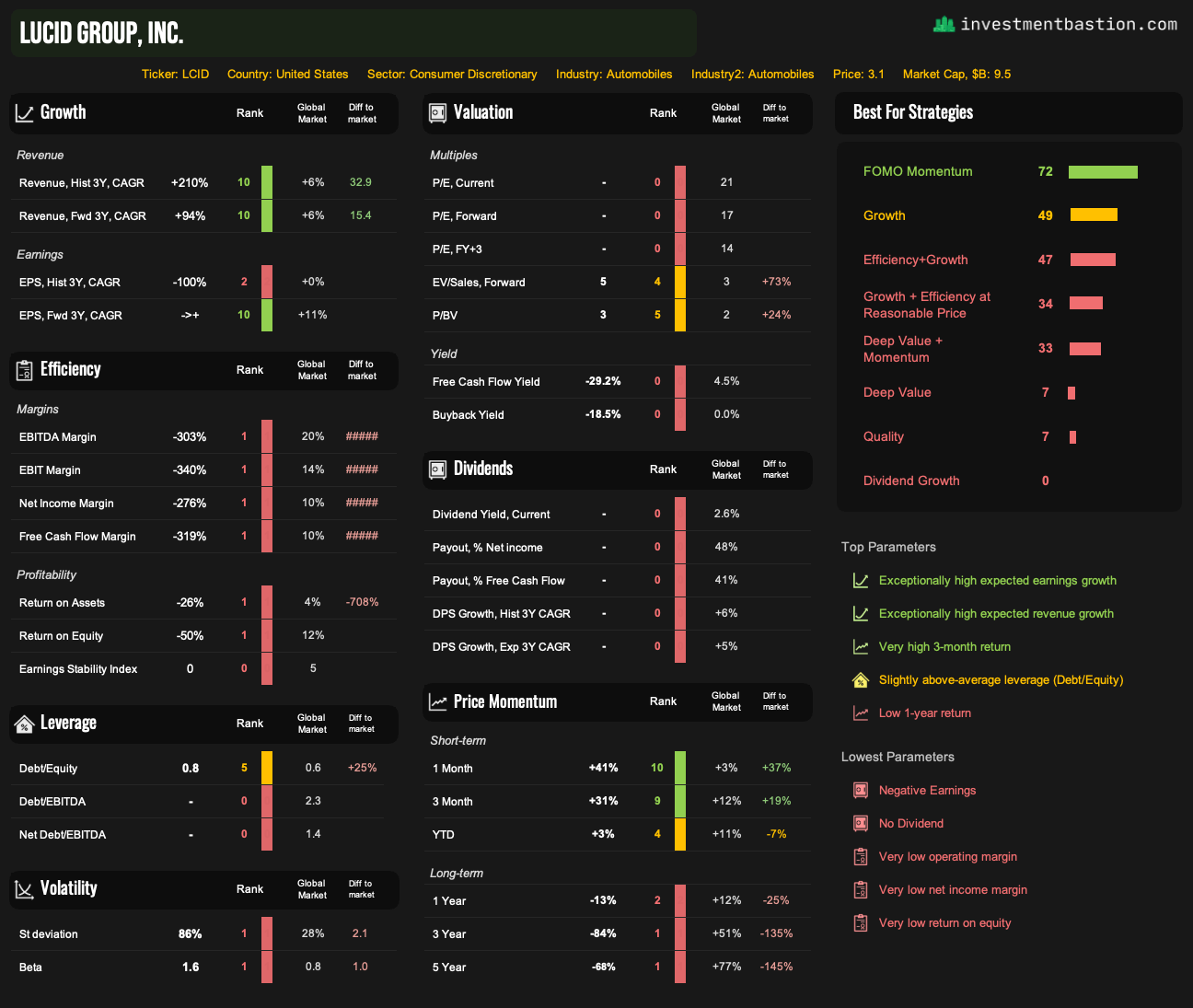

🚗 Lucid (LCID, +36%)

Lucid surged after announcing a partnership with Uber to deploy over 20,000 robotaxis. For context, Lucid produced only 9,029 vehicles in all of 2024, making this a massive leap in ambition.

Robo-taxi expansion, powered by advances in AI computing, is fueling investor excitement. But with production still far from scale, profitability remains a distant dream. Lucid's quality metrics are disastrous.

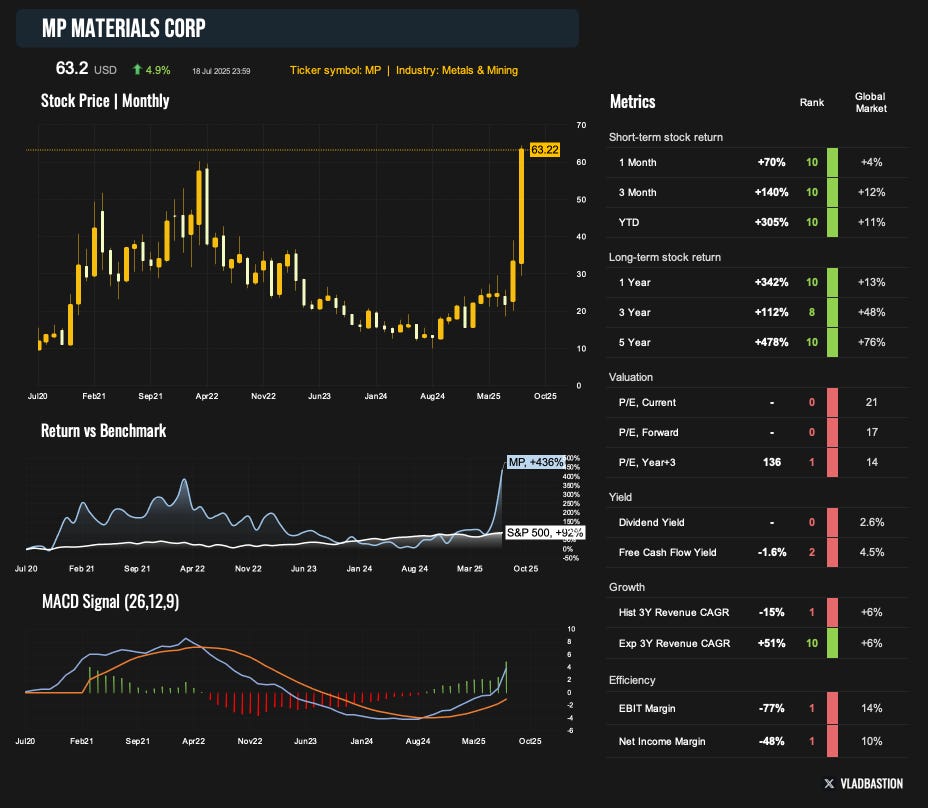

🧲 MP Materials (MP, +34%)

Shares had already been on a tear and last week they surged even higher. MP Materials first spiked on news of a U.S. government contract to supply rare earth products at double the market price. Momentum accelerated after Apple announced a $500 million deal to buy magnets from MP and co-build a rare-earth recycling facility.

The stock is part of Bastion’s Momentum + Growth strategy portfolio, with a full deep-dive report coming in August.

🔴 Losers

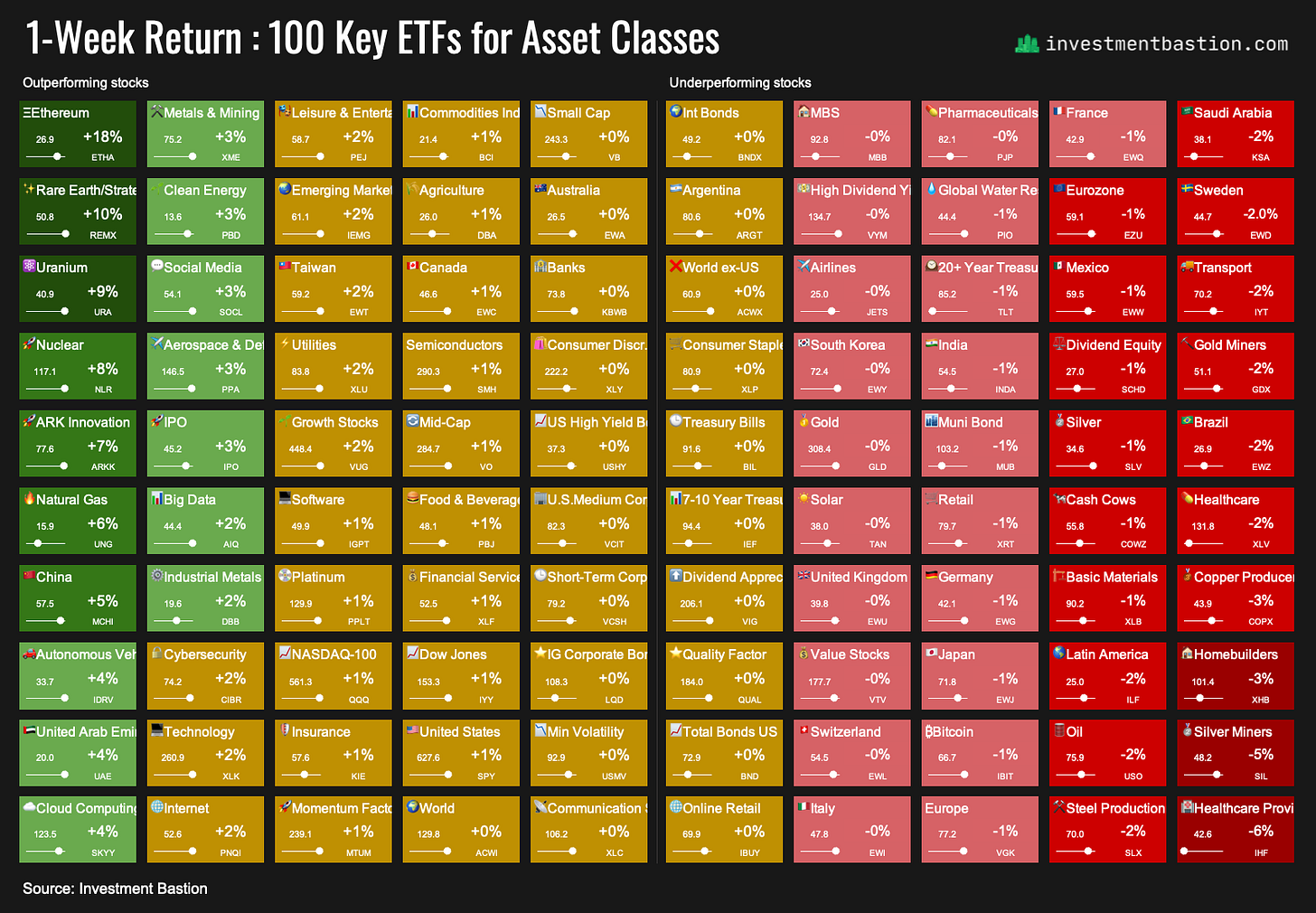

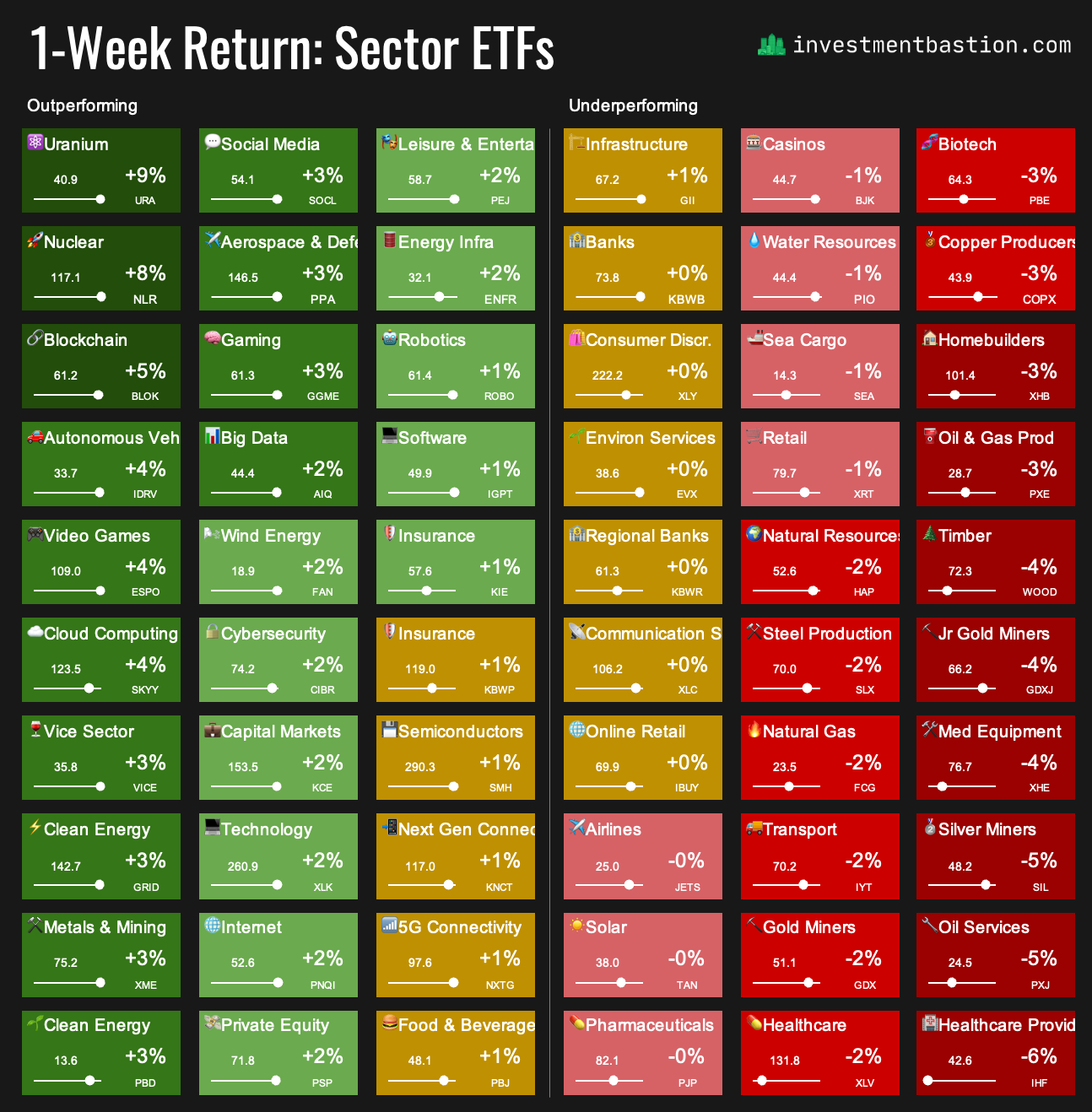

4. 📊100 key ETFs

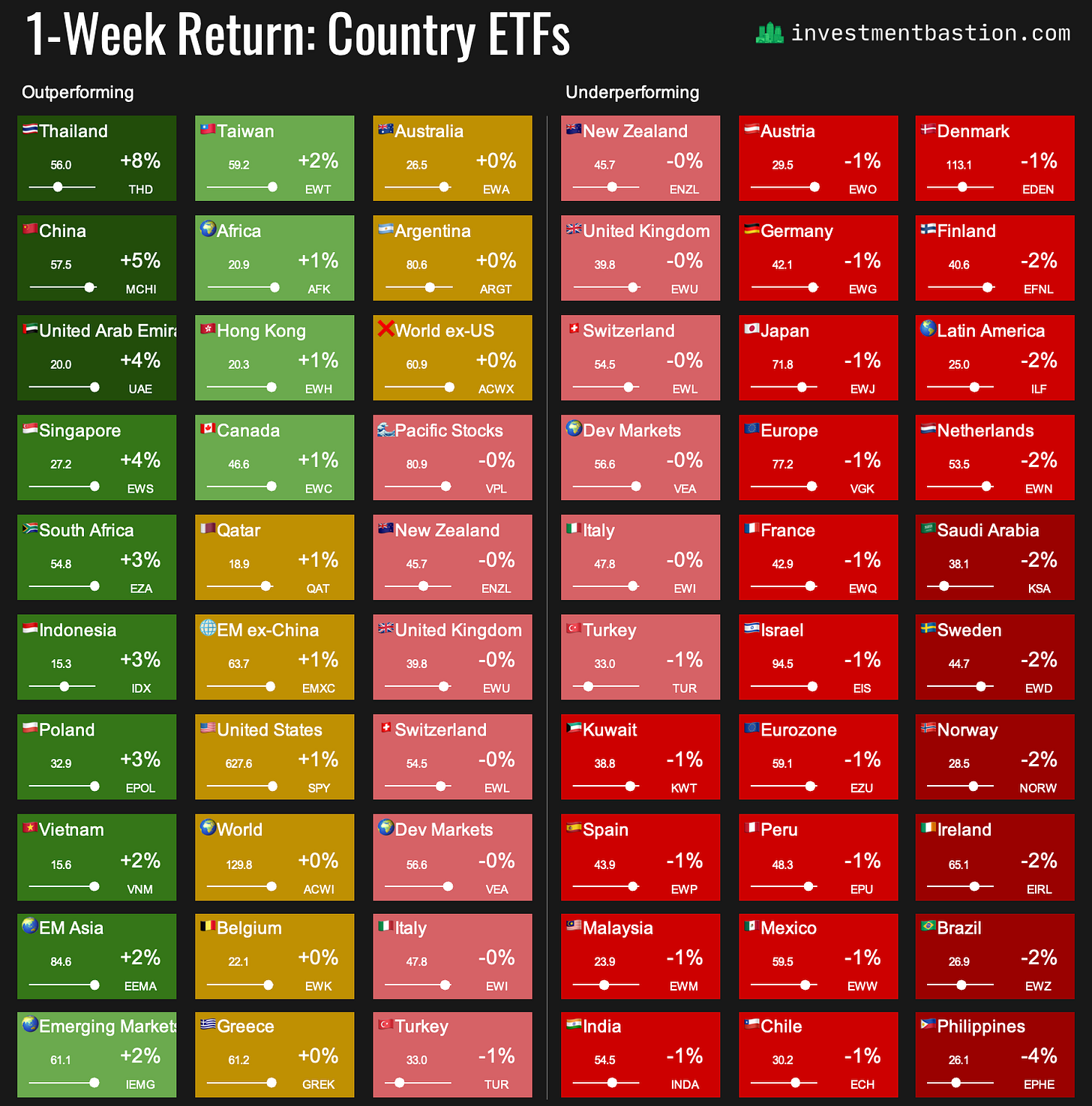

5. 📊Country ETFs

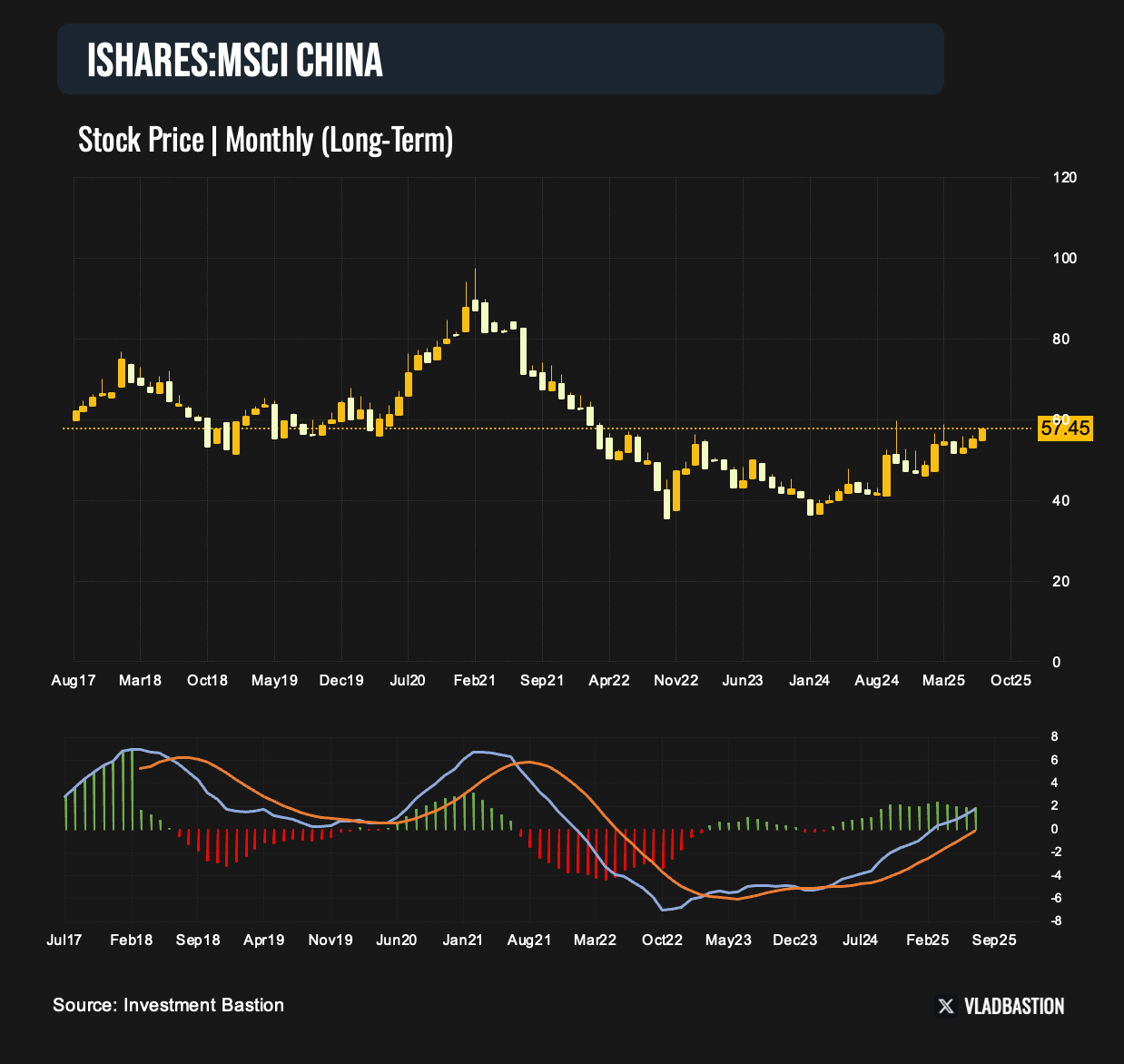

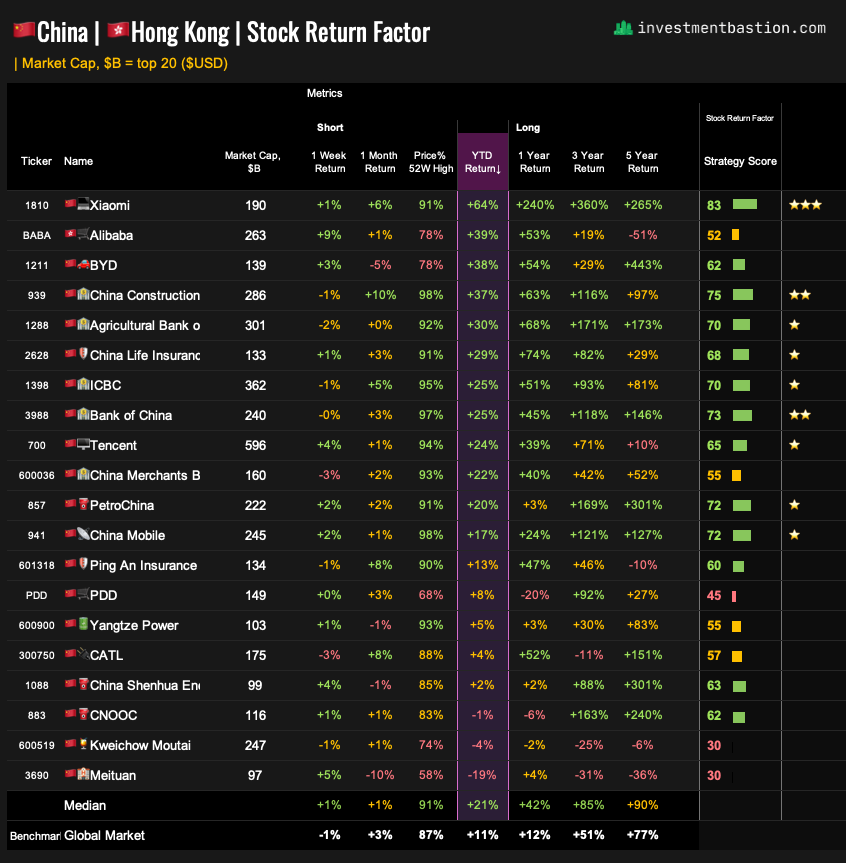

🇨🇳 China ETF (MCHI, +5%)

China’s stock market is hitting 52-week highs and approaching a breakout above four-year resistance levels. The latest move signals a strategic momentum shift. The impact of tariffs and trade tensions has proven much weaker than many expected, and sentiment is rapidly improving.

Xiaomi is currently the hottest MegaCap in China, up 64% year-to-date in 2025.

6. 📊Sector ETFs

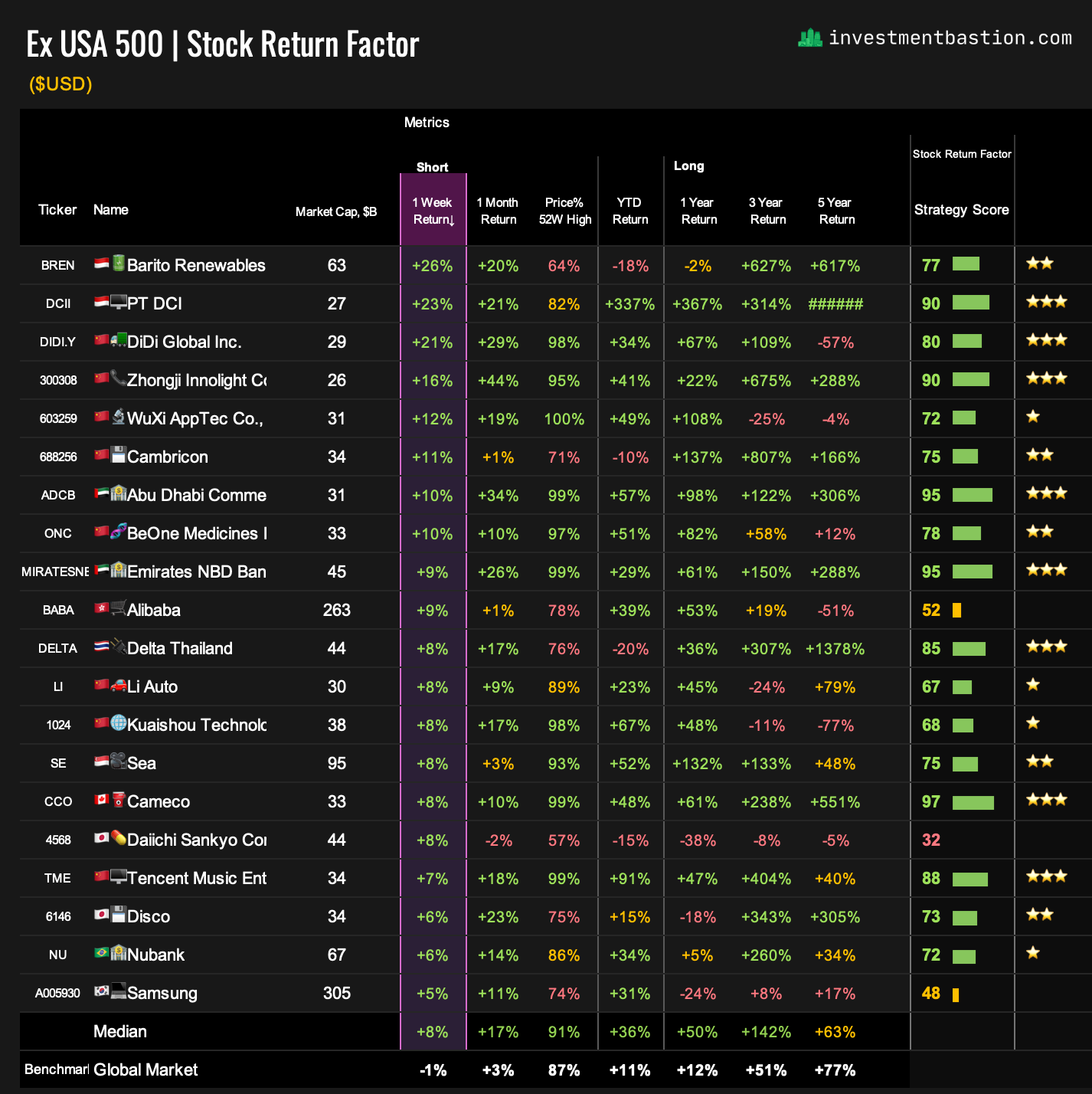

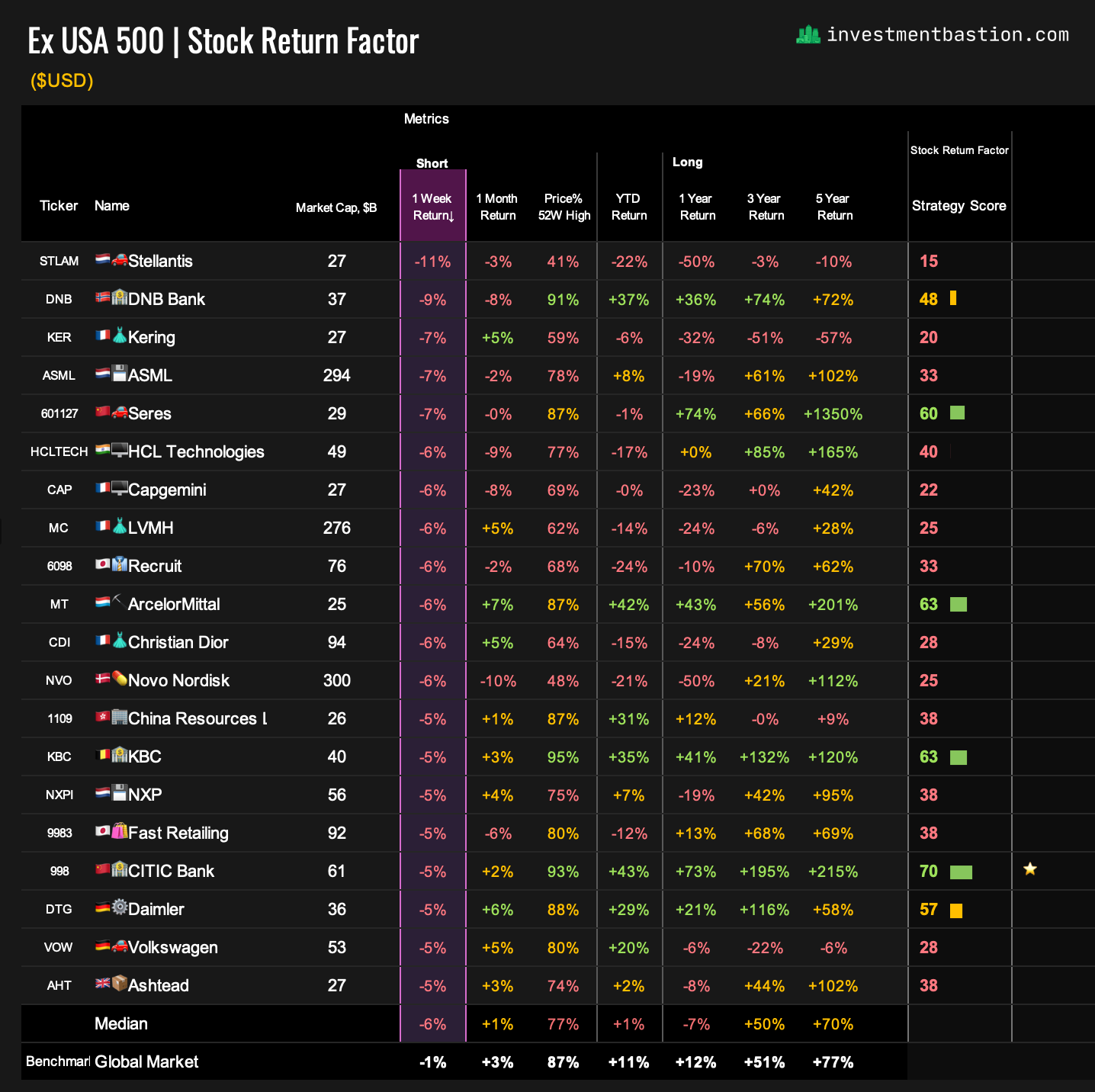

7. 🗺️Global 500 ExUS Stocks

🟢 Gainers

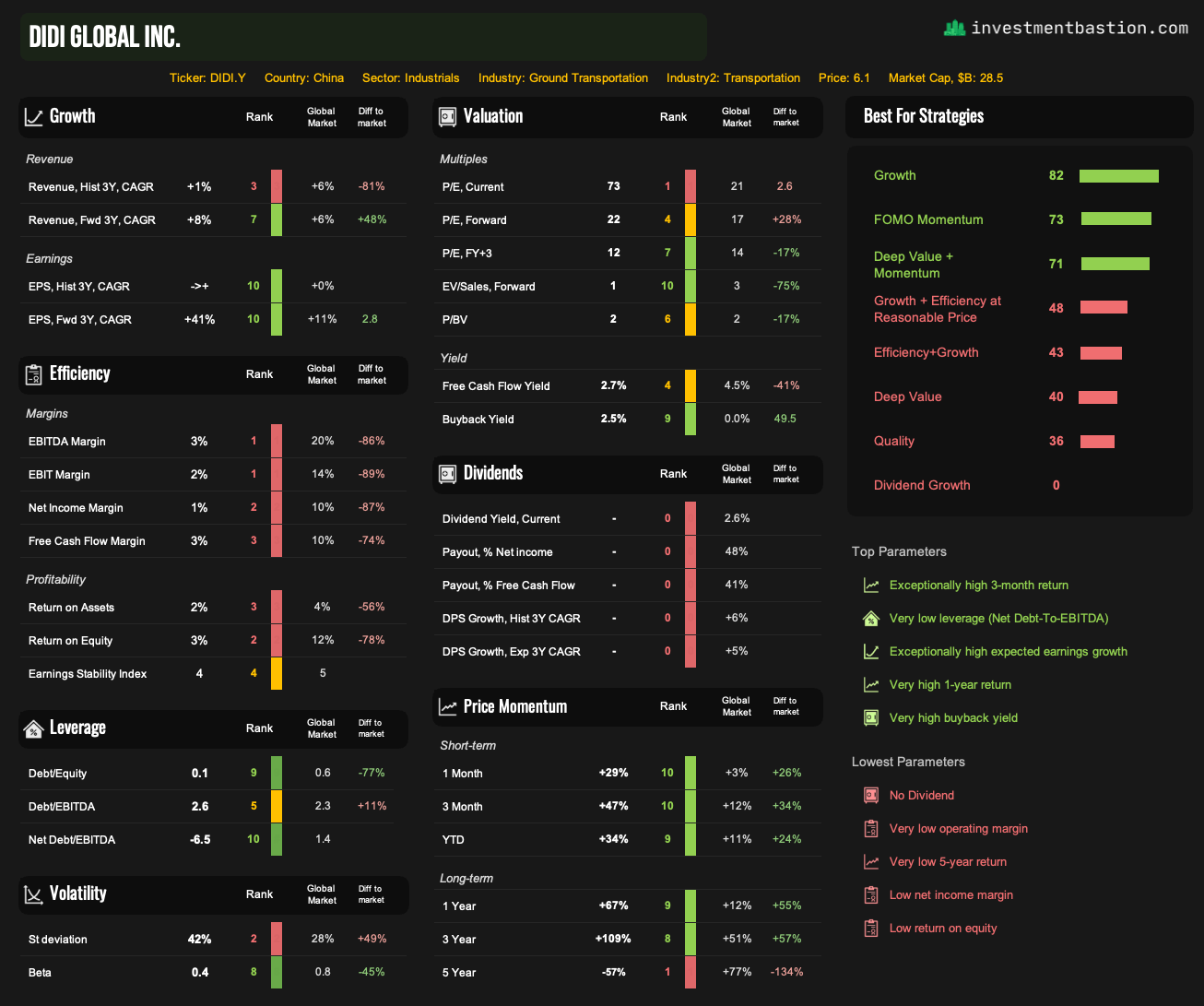

🚕 DiDi Global (DIDI.Y, +21%)

Massive upside momentum for the Chinese ride-hailing giant after Goldman Sachs initiated coverage with a Buy rating.

Analysts see DiDi as well-positioned to capitalize on global mobility trends and lead in autonomous driving. With shares trading at just 14x 2026E P/E, valuation looks “undemanding” given projected 8% revenue and 44% earnings CAGR from 2024 to 2027.

Upside drivers include: expansion into lower-tier Chinese cities, international growth, and improving margins as user subsidies decline.

The stock also has an excellent Deep Value + Momentum rating in Bastion’s framework.

🔴 Losers

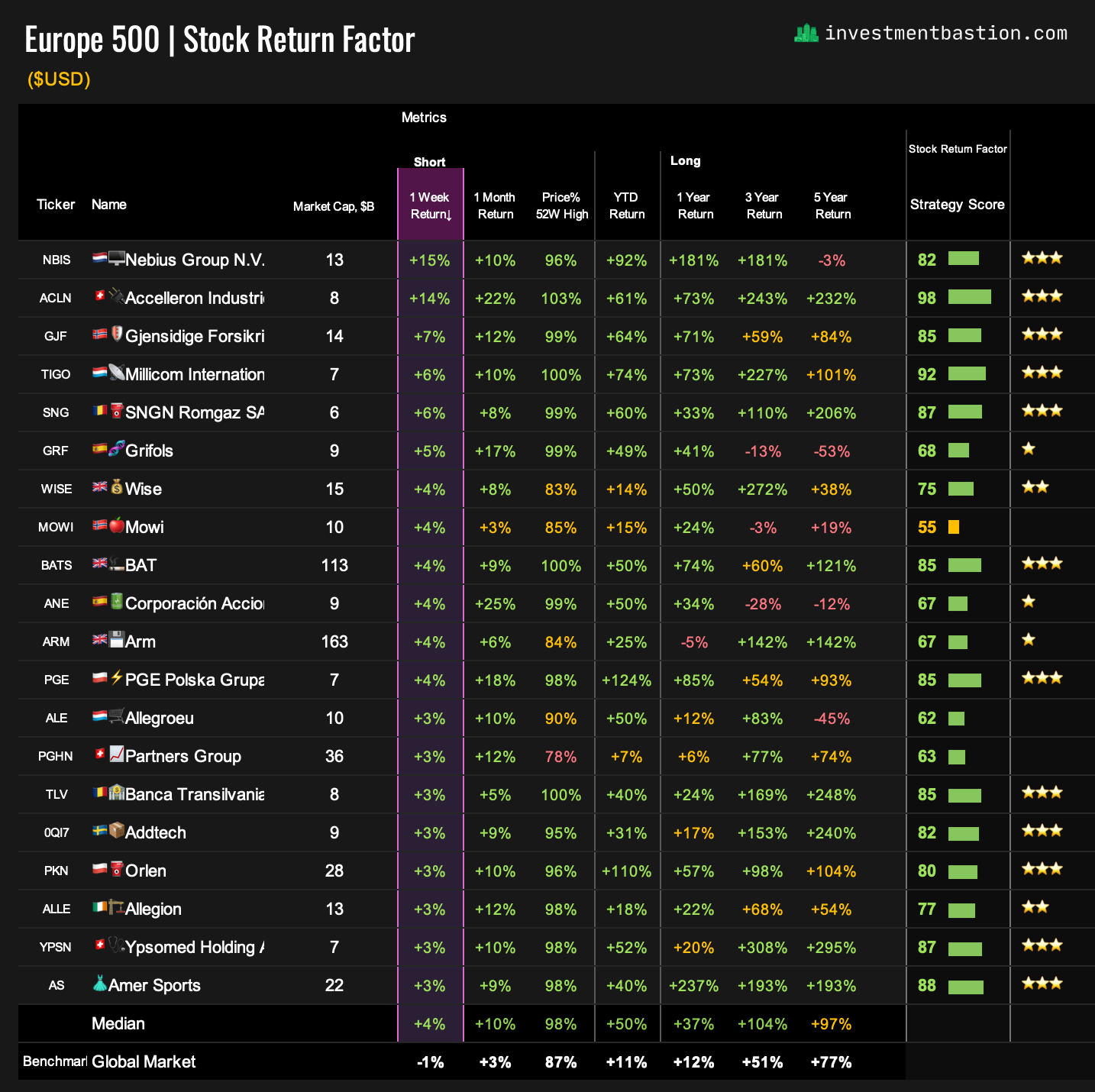

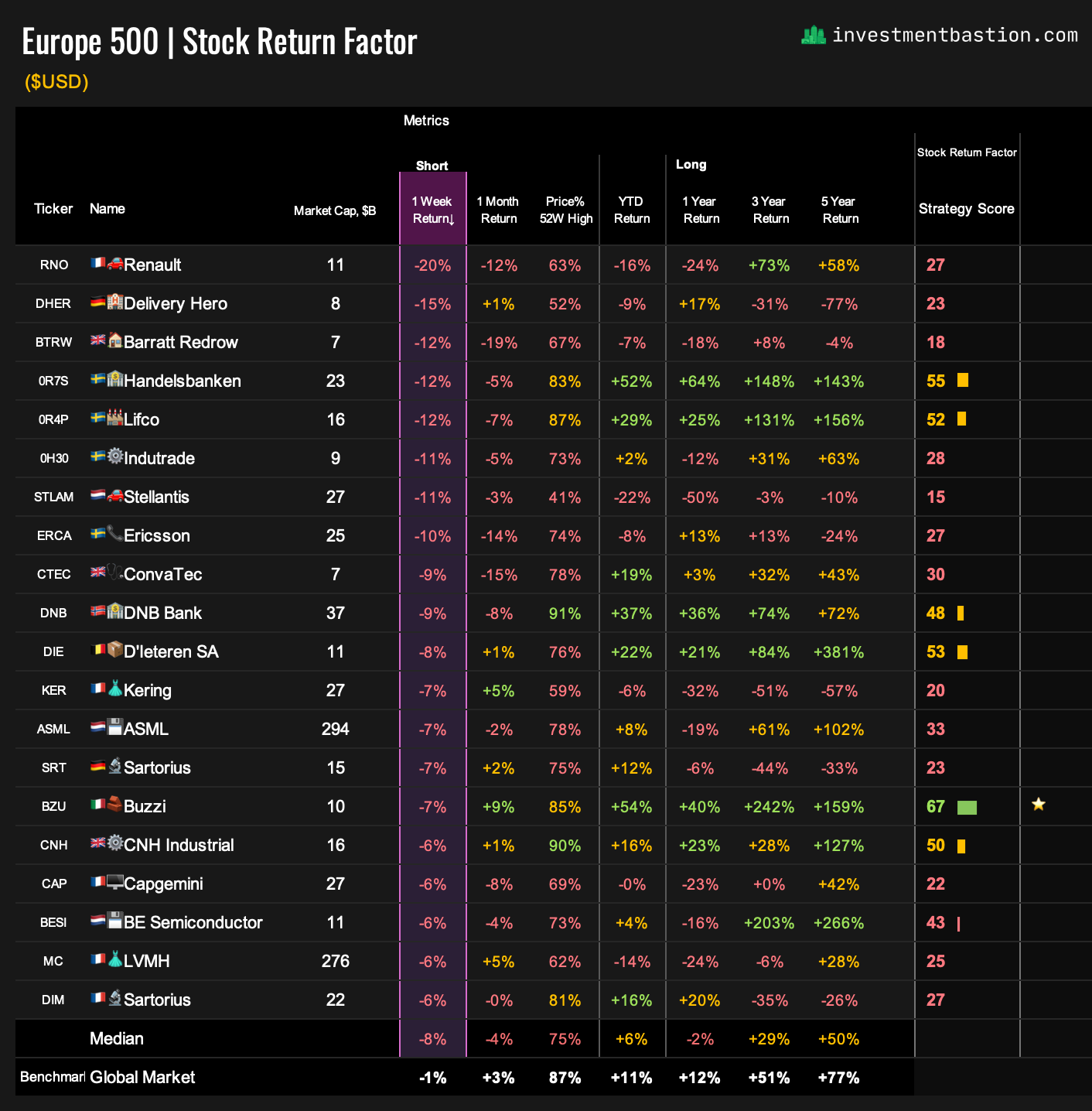

8. 🗺️Europe 500 Stocks

🟢 Gainers

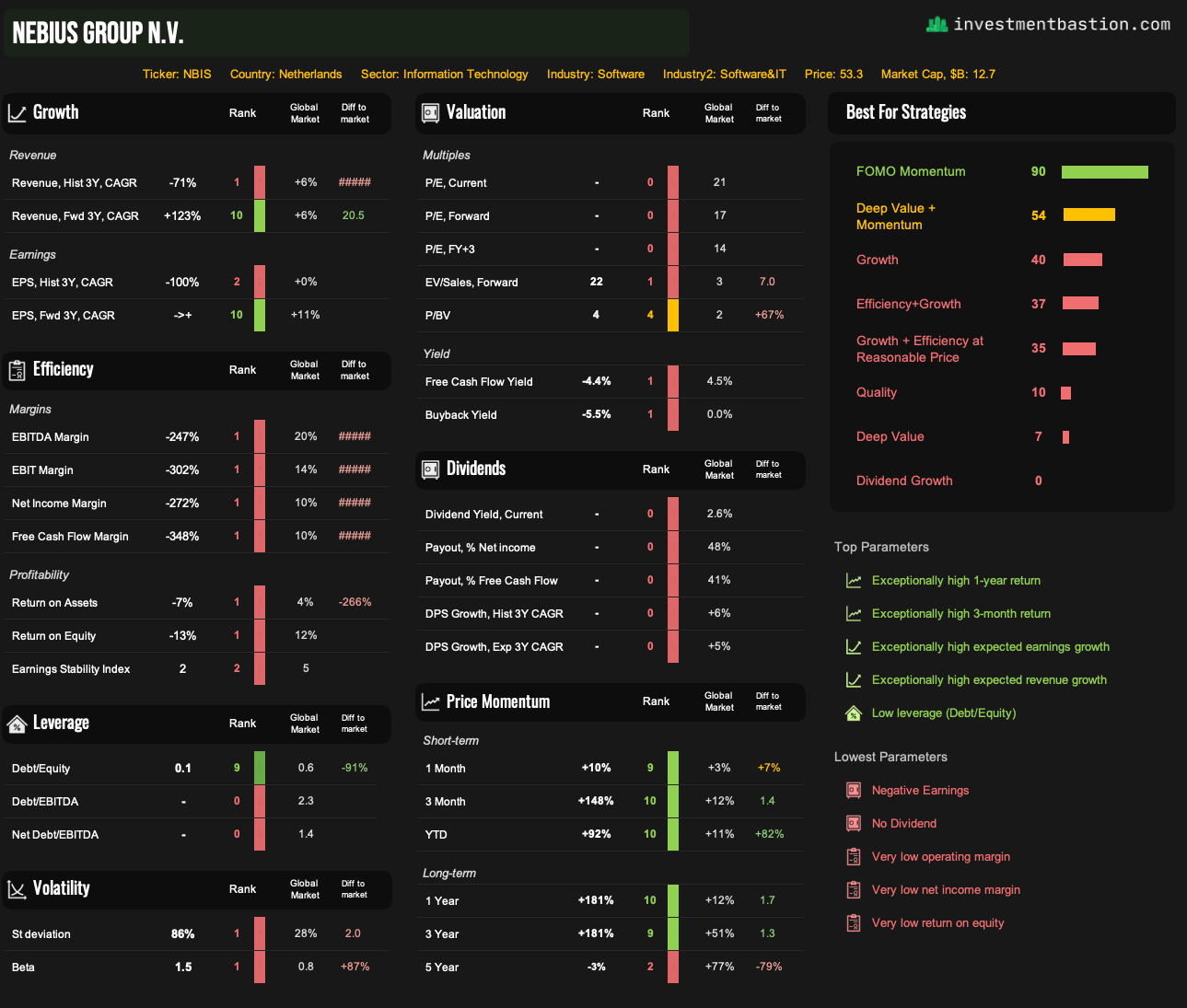

🌐 Nebius Group (NBIS, +15%)

One of Europe’s top AI movers this week. Nebius builds scalable AI infrastructure, ranging from cloud platforms to autonomous systems, serving the global AI ecosystem.

In Q1 2025, revenue grew 4x year-over-year, with a 7x jump in annualized run rate. The company remains deeply unprofitable as it reinvests aggressively into growth.

Among 3,500+ stocks tracked by Bastion, Nebius has the highest expected 5-year revenue growth rate.

🔴 Losers

📧 ❤️ Thanks for reading! If you found this report helpful, consider liking or commenting. Your feedback helps shape future editions. More trend insights coming next week.