Stablecoin Shockwaves, Solar Burns, Labubu Falls – Bastion Trend Tracker

Momentum moves, worldwide — in one shot.

Your fast, focused hit of the biggest market trends from thousands of global stocks. Designed for active investors, momentum traders, and strategy-driven PMs who want signal, not noise.

🖥️ The Bastion Terminal powers every insight. My custom analytics engine that ranks over 4,000 stocks globally by momentum and trend strength.👇

Terminal – Updated on June 21, 2025.

The Bastion Terminal is a set of Excel-based tools that I use for stock analysis and generating investment ideas.

📡 For deeper dives, check out Market Intel — a digest of top institutional ideas, annotated with Bastion dashboards and my critical take.👇

Market Intel #3: The U.S. Mining Revival, Top Rare Earth Pick, Powering AI Winners

Welcome to Market Intel — an investor briefing built for investors, analysts, and portfolio managers.

☕This Week’s Key Moves:

Stablecoins go legit: Circle +80%, Visa and Mastercard slide on U.S. Senate bill shock.

Crypto rails rally: Coinbase +27% as markets bet on tokenized payments infrastructure.

AI hardware roars back: Jabil +17%, AMD +9%, Micron re-rated on improving memory cycle.

Korea’s tech play: Naver +34%, top global large-cap, amid national push for AI sovereignty.

Solar scorched: Enphase -21% on GOP-backed plan to phase out green energy tax credits.

China’s IP boom under fire: Pop Mart -12% as regulators crack down on blind-box sales.

Israel surprises: Country ETF +7% defies geopolitical risk on investor optimism and military momentum.

Gaming rerated: Entain +14% as BetMGM guides up on U.S. market expansion.

Leadership shock hits autos: Renault -11%, worst EU megacap, as CEO exits for Kering.

Now, let’s break it down by chart.

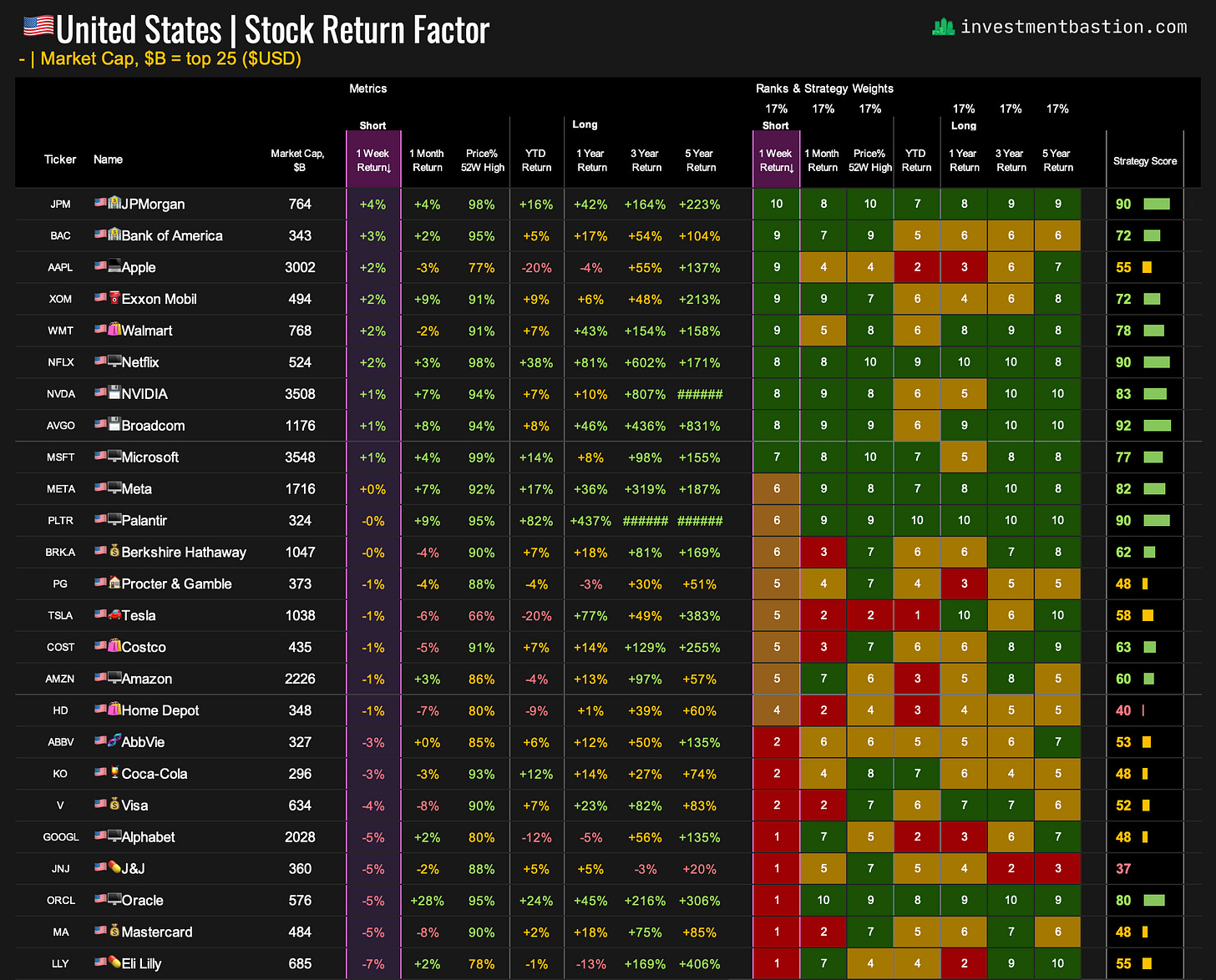

1. 🇺🇸US Top 25 Stocks

💳 Stablecoin Shockwave

Visa and Mastercard each dropped over 5% this week as Washington moved closer to legitimizing stablecoins. A Senate-passed bill and reports that Amazon and Walmart may issue their own tokens sparked fears that merchants could bypass traditional card networks. Meanwhile, Coinbase jumped 27%, highlighting growing investor interest in crypto-native payment rails.

2. 🇺🇸US Top 100 Stocks

Gainers

🚀 AMD Snaps Back

AMD surged 10% after Piper Sandler upgraded the stock, citing a likely Q4 rebound in its GPU business. The $800M China-related export hit is expected to fade by year-end, just as AMD rolls out its new Instinct MI400 chips and Helios server rack, key infrastructure for large AI workloads. Analysts see this hardware shift as pivotal for regaining momentum in the AI arms race.

🧠 Memory Momentum

Micron jumped as Wedbush raised its target to $150, pointing to stronger DRAM and NAND pricing and better-than-expected ASPs this quarter. While expectations for a 2025 rebound were dialed back, High Bandwidth Memory forecasts were lifted through 2026, reinforcing the AI-driven demand story.

Losers

📉 AdTech Under Pressure

AppLovin fell another 11% this week, extending its slide after last week's short-seller report from Culper Research alleging undisclosed Chinese ownership. While the company firmly denies the claims, the selloff reflects lingering concerns around regulatory risk.

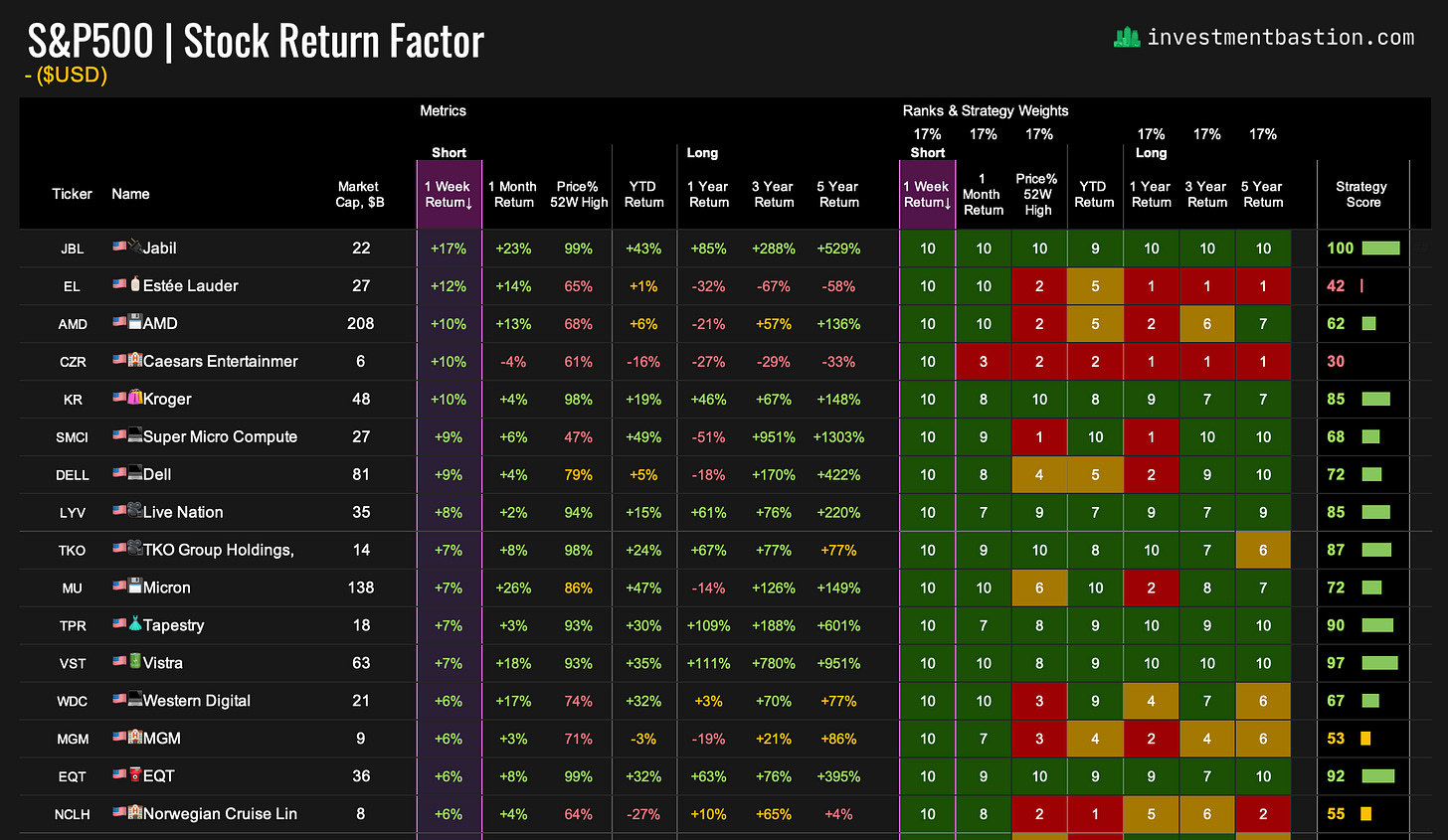

3. 🇺🇸S&P500

Gainers

🏭 Jabil Breaks Out

Contract manufacturer Jabil surged 17% this week after smashing earnings estimates and raising full-year guidance. Management lifted FY25 outlook to $9.33 EPS on $29B revenue, citing strong demand in cloud and data center infrastructure. Jabil also announced a $500M U.S. manufacturing expansion to support AI-focused customers, positioning itself as a key beneficiary of the AI infrastructure boom.

Losers

🌞 Solar Slammed

Solar stocks collapsed after Senate Republicans proposed phasing out solar and wind tax credits by 2028 in the revised budget bill. Enphase dropped 21%, First Solar - 17%. The bill preserves incentives for nuclear and hydro through 2036, but the rollback hits residential installers and solar manufacturing hardest, signaling political risk remains a key overhang for clean energy equities.

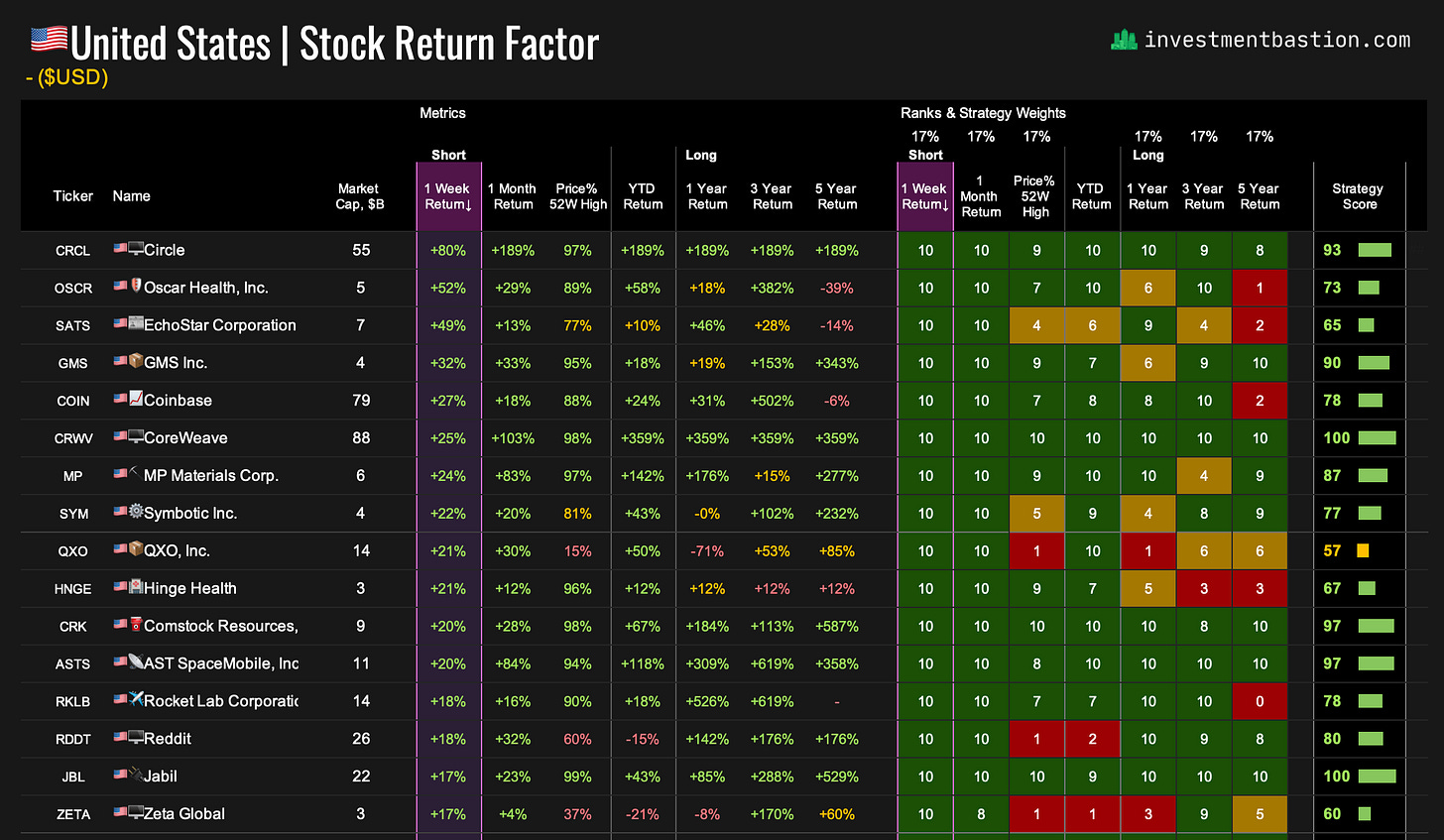

4. 🇺🇸US Broad market

Gainers

💵 Circle Surges on Stablecoin Bill

Circle soared 80% this week after the Senate passed the GENIUS Act, a landmark bill establishing full-reserve rules and regulatory clarity for stablecoins. As the issuer of USDC, Circle is now seen as a prime beneficiary of growing institutional confidence and future Treasury demand. With its stock up 5x from IPO and U.S. lawmakers eyeing stablecoins as a strategic asset, the regulatory overhang is fast turning into a growth catalyst.

Losers

5. 📊100 key ETFs

6. 📊Country ETFs

🇮🇱 War Rally

Israel’s stock market jumped 7% this week despite escalating conflict with Iran, defying risk-off logic. The rally was driven by investor optimism surrounding rapid military gains, fueling hopes for a swift and decisive outcome.

7. 📊Sector ETFs

8. 🗺️ Ex USA 500 Stocks

Gainers

🇰🇷 Naver Leads Global Gains

Naver Corp, Korea’s internet, search, and maps giant, surged 34% this week, topping all non-U.S. large caps, as Korea’s government unveiled a 100 trillion won (US$73 billion) AI investment plan centered on “AI sovereignty.” As a core infrastructure partner, Naver is emerging as a national champion, bolstered by JPMorgan’s target hike and rising interest in its fintech arm, Naver Pay, a likely beneficiary of stablecoin legislation abroad.

Losers

🧸 Pop Mart Gets a Policy Warning Shot

Pop Mart fell 12% this week after Chinese state media called for tighter rules on “blind-box” toys, sparking concern over its wildly popular Labubu doll franchise. While the company wasn’t named, the warning reignited regulatory fears just as Pop Mart stock had surged 170% YTD. Despite the pullback, it remains the top performer in the MSCI China Index; however, the boom around collectible IP, such as Labubu, is now overshadowed by renewed scrutiny.

9. 🇪🇺 Europe 500 Stocks

Gainers

🎯 Entain Rallies on U.S. Upside

Entain surged 14% after raising guidance for BetMGM, its 50-50 U.S. joint venture with MGM Resorts. 2025 EBITDA is now projected to top $100M, with a long-term target of $500M. UBS upgraded the FTSE 100 betting group to Buy, citing accelerating U.S. momentum and a 20% valuation discount vs peers. While Entain still trades at a steep 25x earnings and carries regulatory baggage, its global portfolio — including brands such as Ladbrokes, Coral, bwin, and BetCity — reinforces its scale in the recovering gaming sector.

Losers

🚗 Renault Skids -11%

Renault was the worst-performing European megacap this week, sliding 11% after its CEO, Luca de Meo, announced his departure to lead the luxury group Kering. The abrupt exit raised investor concerns over leadership continuity, despite Renault's recent turnaround under de Meo. While Kering stock jumped on hopes of a revival, Renault now faces uncertainty just as the auto sector navigates an EV transition and rising Chinese competition.

10. 🗺️Bastion Global 4000 Stocks

Gainers

Losers

That’s your shot.

☕ See you next week for more charts, sharper signals, and no-nonsense market intel.