Bastion Trend Tracker: Boeing Takes Off Again

Your briefing on key price moves, breakouts, and shifting market sentiment.

Bastion Trend Tracker – your fast, focused hit of the biggest weekly market trends.

Its purpose:

to track key financial news that drives price movements

to spot early breakouts

to filter out the noise (so you don’t have to read daily news)

Why do I create this report? Because on a weekend morning, with a cup of coffee, I want to quickly see how asset prices moved around the world over the past week.

Since I couldn’t find a detailed review, I decided to make one myself.

📁Each chart is generated using the Bastion Terminal — my analytics platform that processes and ranks over 4,000 stocks globally by momentum and price change.

Key Moves This Week:

Nvidia breaks $4T market cap

Boeing rebounds (+5%)

Delta Air Lines tops S&P 500 with strong Q2 (+11%)

Fair Isaac plunges (-17%) after mortgage rule shift

MP Materials surges (+42%) on $400M Pentagon deal

Rare Earth ETF nears 52-week breakout

Vietnam ETF hits 3-year high on tariff reprieve

BMW rallies (+9%) on reaffirmed margins

Atlassian tumbles (-12%) on insider selling

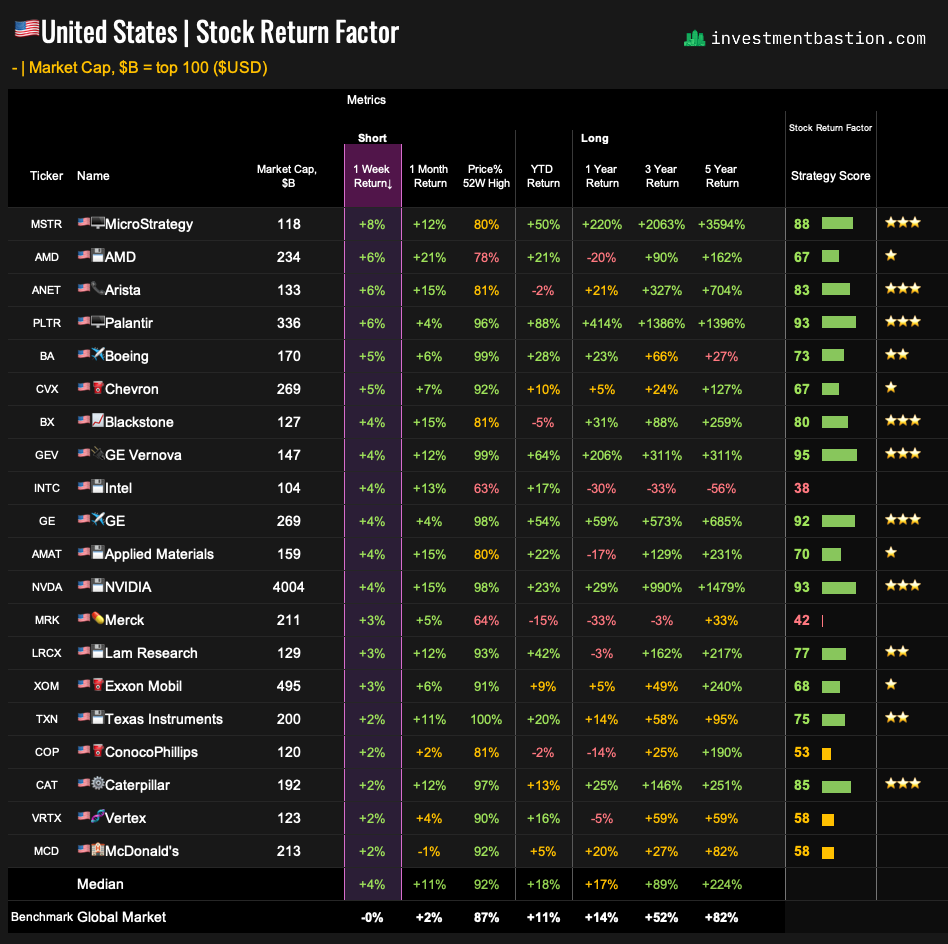

1. 🇺🇸US Top 20 Stocks

🚀 Nvidia (NVDA, +4%)

Nvidia became the world’s first $4 trillion company. For years, I’ve pointed out that many analysts are too focused on Nvidia’s stock price action, often calling the rally a bubble. In reality, the company’s potential for fundamental growth remains underestimated. The peak of the AI cycle is still ahead.

2. 🇺🇸US Top 100 Stocks

Gainers

✈️ Boeing (BA +5%)

Shares of the aerospace giant are showing signs of recovery again, ranking among the top weekly gainers across US mega caps.

According to a preliminary investigation, the likely cause of the June 12 Air India crash was a malfunction in the fuel control switches. This suggests the accident was probably not related to any design flaw in the Boeing 787.

Here’s what Barron’s reports:

“In 2018, the Federal Aviation Administration issued a special airworthiness information bulletin, or SAIB, regarding the potential for disengagement of the fuel control switch locking feature on several Boeing models, including the 787. The bulletin said it was not an unsafe condition warranting an airworthiness directive. Instead, the FAA recommended inspecting the switches to ensure they couldn’t move without physically lifting the switch. The report indicates the inspections were not carried out by Air India.”

I’m currently working on a new report featuring fresh investment ideas from the latest investment bank research. One Goldman Sachs screener highlights Boeing as one of the most promising multi-year rebound opportunities. The report will be published next week. Stay tuned.

Losers

Stock Heatmap

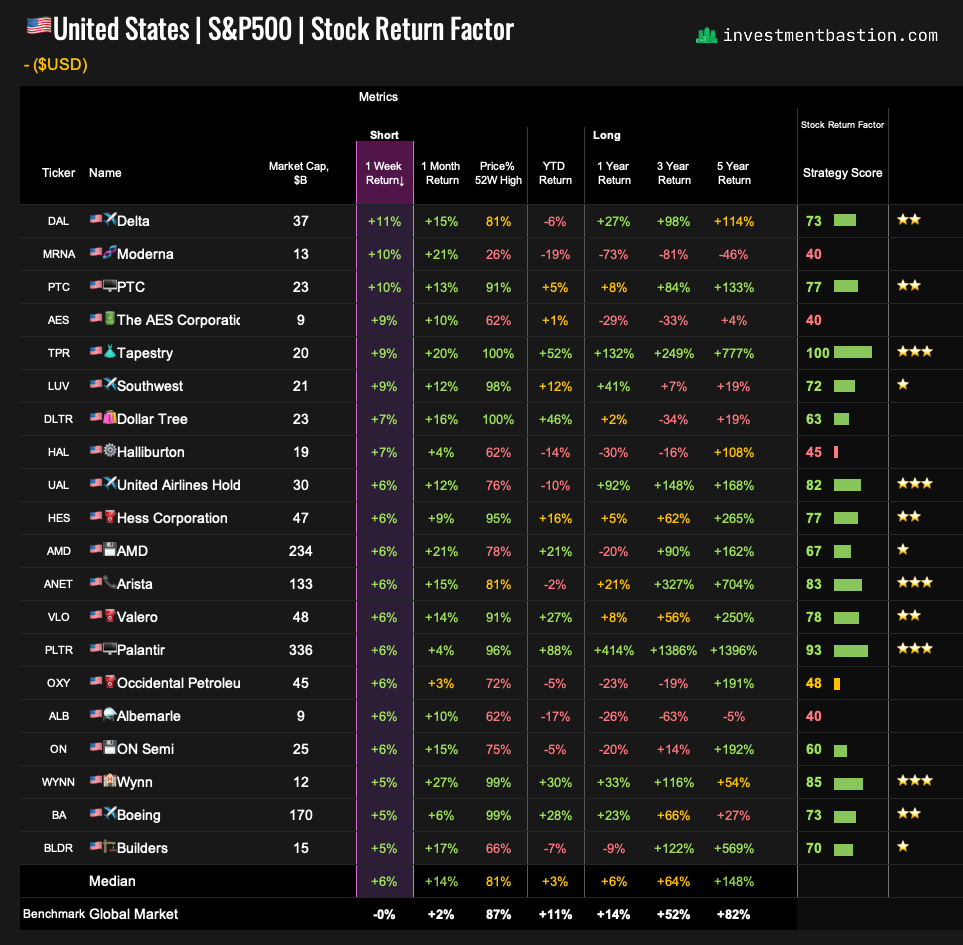

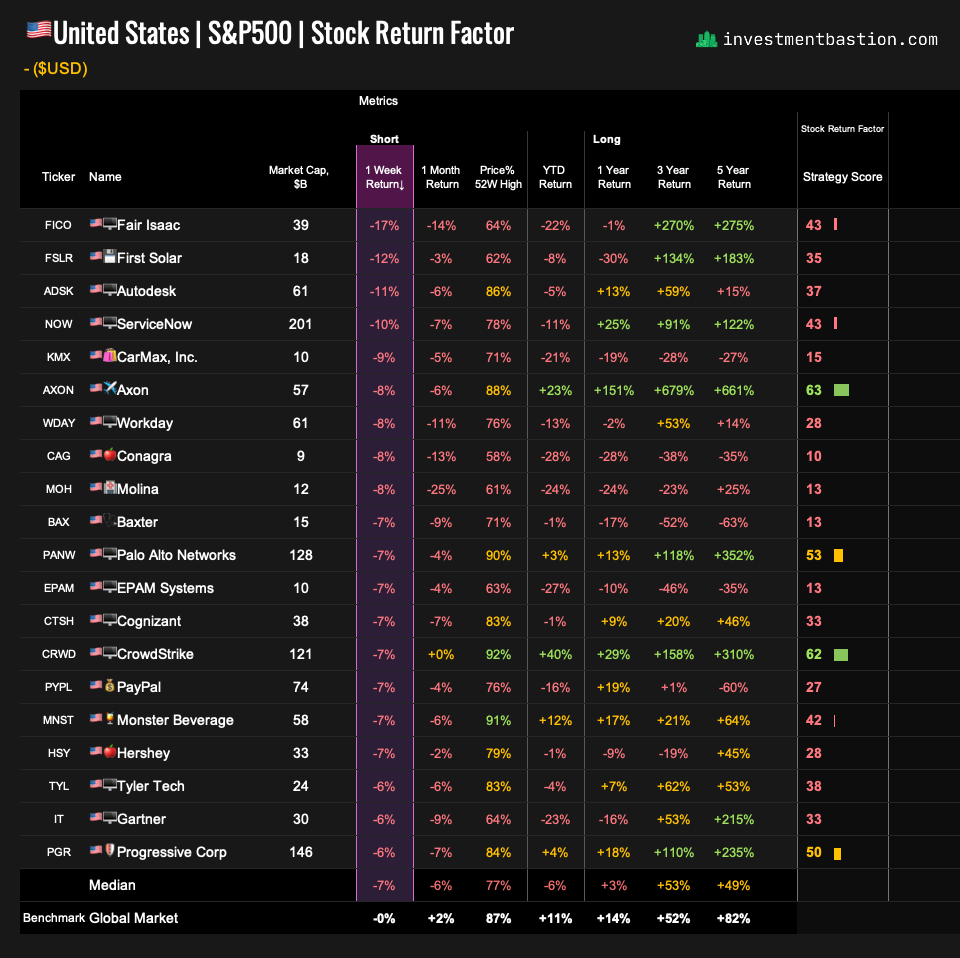

3. 🇺🇸S&P500

Gainers

🛫 Delta Air Lines (DAL, +11%)

Delta shares soared this week, delivering the best performance in the S&P 500.

One of the U.S. “Big Three” airlines, Delta reported resilient revenue for the quarter ending June 30. Operating revenue came in flat year over year, better than feared.

Back in April, just a week after Trump launched his “Liberation Day” tariffs, many expected a sharp drop in airline revenues as economic uncertainty weighed on both corporate and consumer spending.

So far, those fears don’t appear to be materializing.

Losers

📉 Fair Isaac (FICO -17%)

Fair Isaac posted the worst performance in the S&P 500 this week after Federal Housing Finance Agency Director Bill Pulte announced that mortgage giants Fannie Mae and Freddie Mac will immediately allow lenders to use VantageScore 4.0 to assess borrower creditworthiness.

Until now, Fannie and Freddie (50% of U.S. home mortgages) required lenders to use FICO's tri-merge score. This change threatens Fair Isaac’s near-monopoly in mortgage credit scoring and could significantly slow its revenue growth in that market.

Fair Isaac currently scores highly in the GEAR+ strategy, but is excluded from the portfolio due to extremely high valuation multiples. At one point last year, the stock traded at over 100 times earnings. That kind of pricing looks increasingly hard to justify, especially given the shifting political and regulatory backdrop.

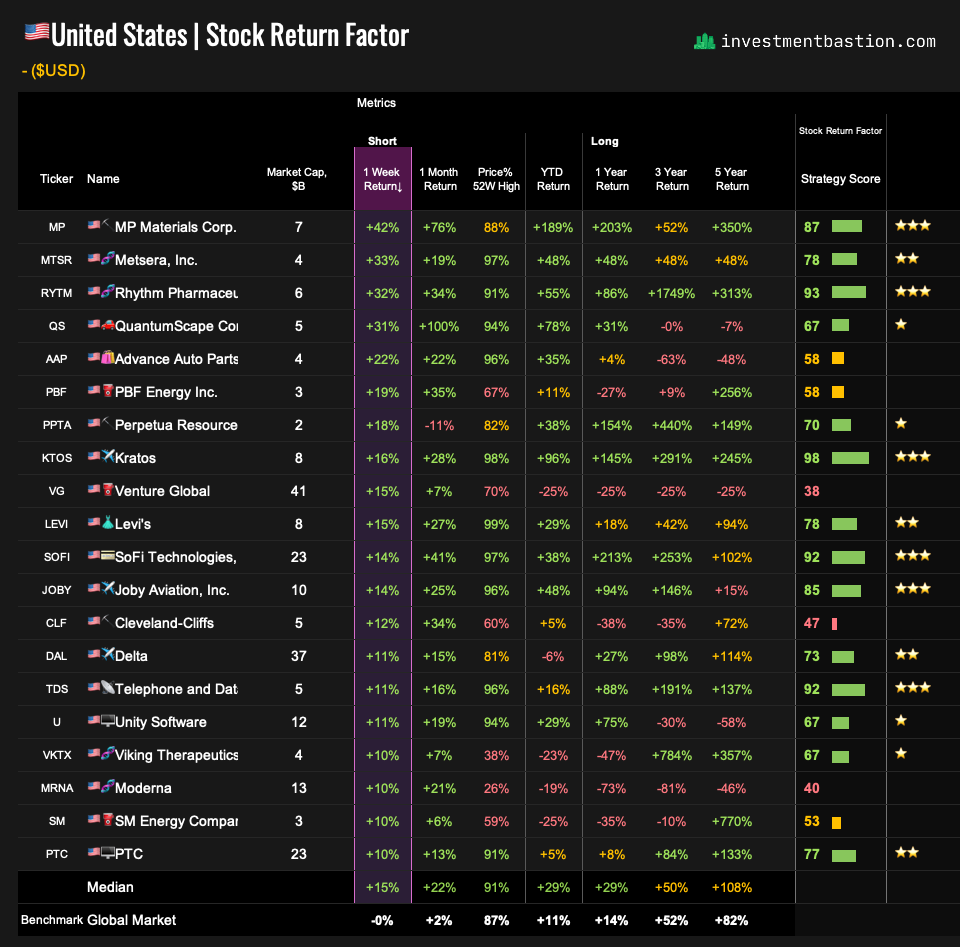

4. 🇺🇸US Broad market

Gainers

🧲 MP Materials (MP, +42%)

Financial Times:

“The Pentagon is making a $400mn direct investment in U.S. rare earths producer MP Materials, in an unusual arrangement highlighting the Trump administration’s determination to break China’s dominance in critical minerals and strengthen domestic supply chains. MP Materials said Thursday that the Pentagon will become its largest shareholder, acquiring a 15% stake in the company, and committing billions more to build a 10,000 metric ton magnet manufacturing facility — expected to begin preparations in 2028.”

I covered MP’s long-term potential back in Market Intel #3.

The U.S. Mining Revival, Top Rare Earth Pick, Powering AI Winners. Market Intel #3

Welcome to Market Intel — an investor briefing built for investors, analysts, and portfolio managers.

The stock qualifies for the Growth + Momentum portfolio — not yet published, but I’m working to release it in August.

Losers

5. 📊100 key ETFs

🌍 Rare Earths

The VanEck Rare Earth and Strategic Metals ETF was one of the top-performing ETFs this week and is now approaching a breakout above its 52-week high.

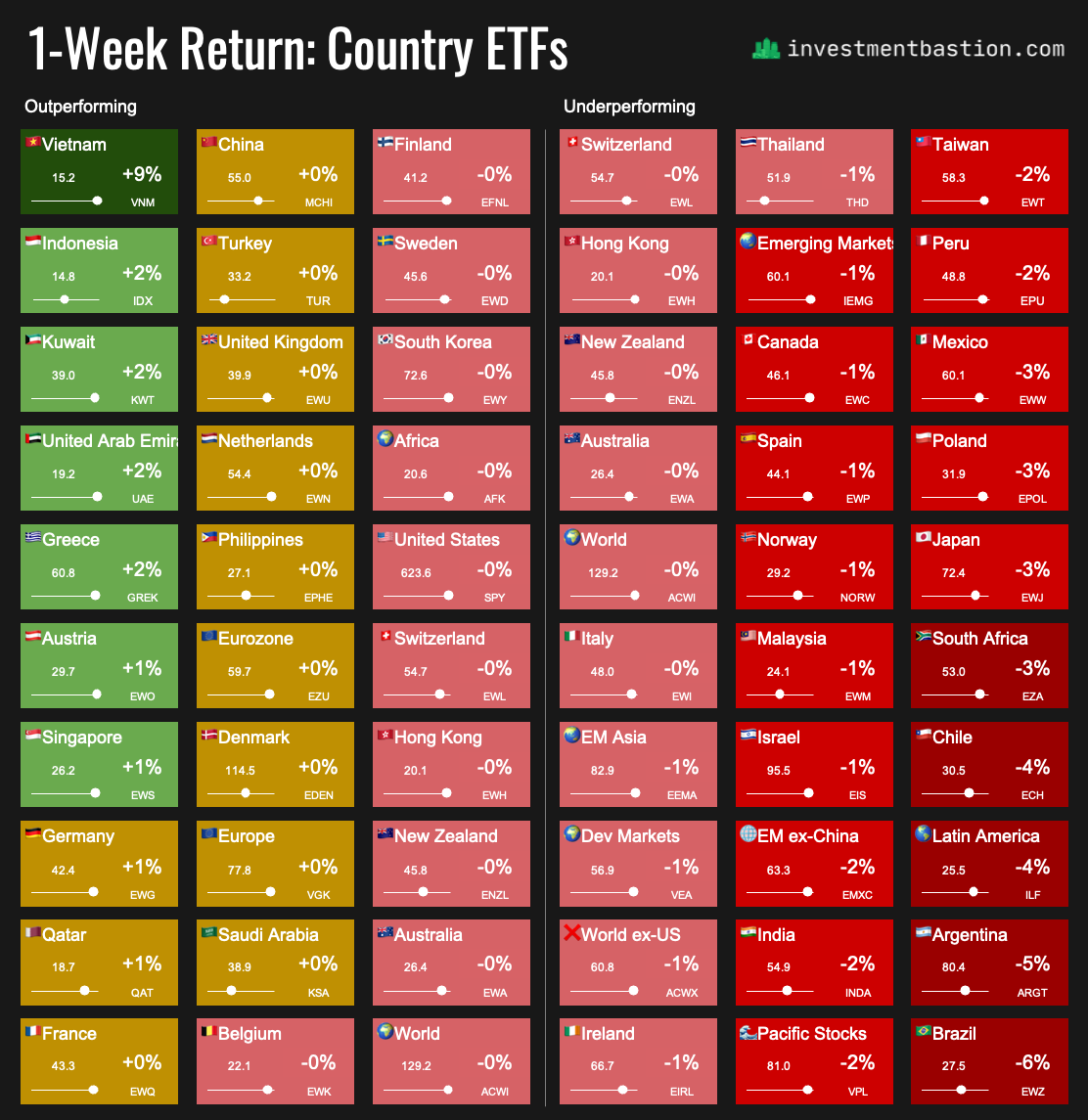

6. 📊Country ETFs

🇻🇳 Vietnam (VNM +9%)

Bloomberg:

“Vietnam’s stocks rallied as trade tensions shifted to other Asian nations facing higher tariffs while waiting to strike a deal with the US. Trump had initially imposed a 46% tariff on Vietnam in early April as part of a broader tariff rollout targeting dozens of countries, but later scaled it back to 10% to allow time for negotiations. Vietnam, a major exporter of apparel and footwear, is one of the most trade-dependent economies in the world.”

The Vietnam ETF (VNM) just broke out to a three-year high. Vietnam is the second country, after the UK, with which Trump has formally announced a trade agreement.

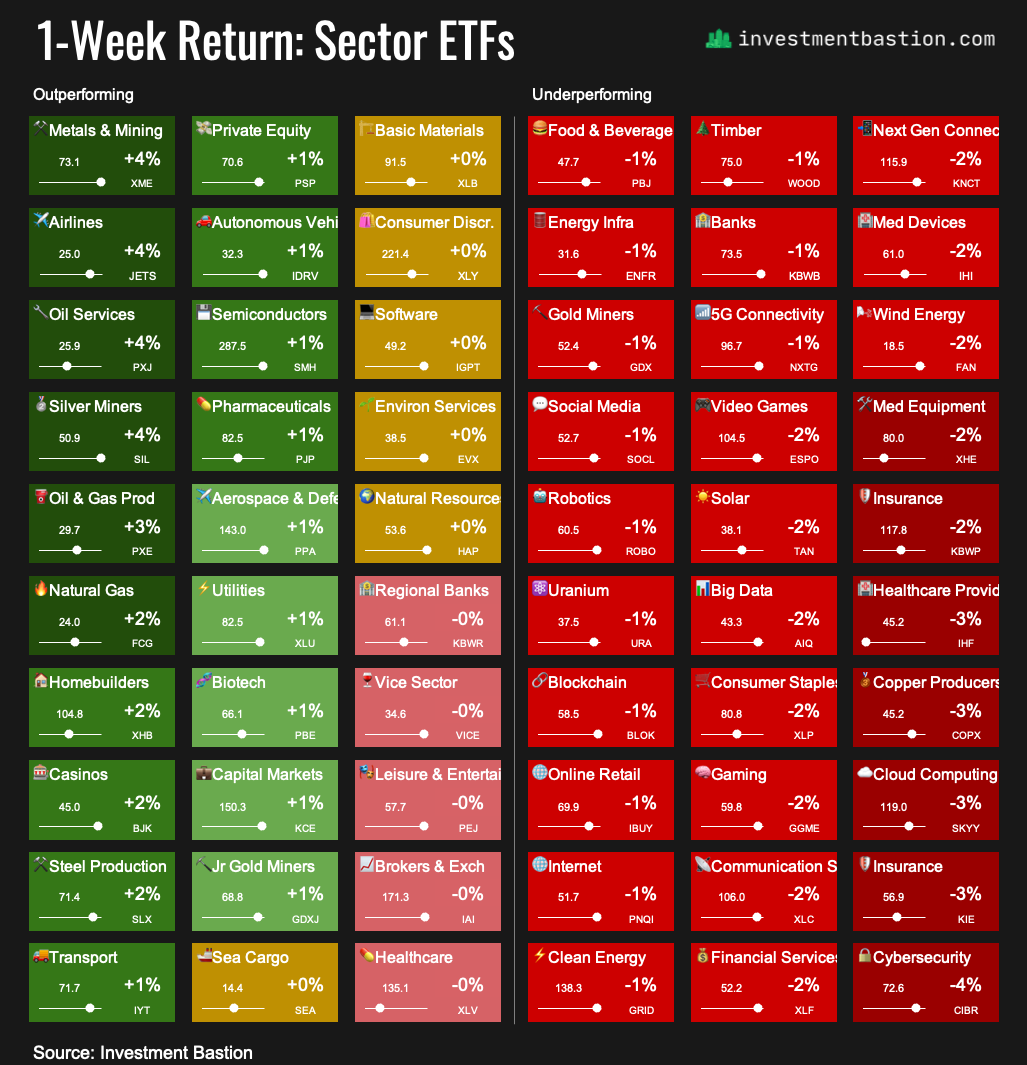

7. 📊Sector ETFs

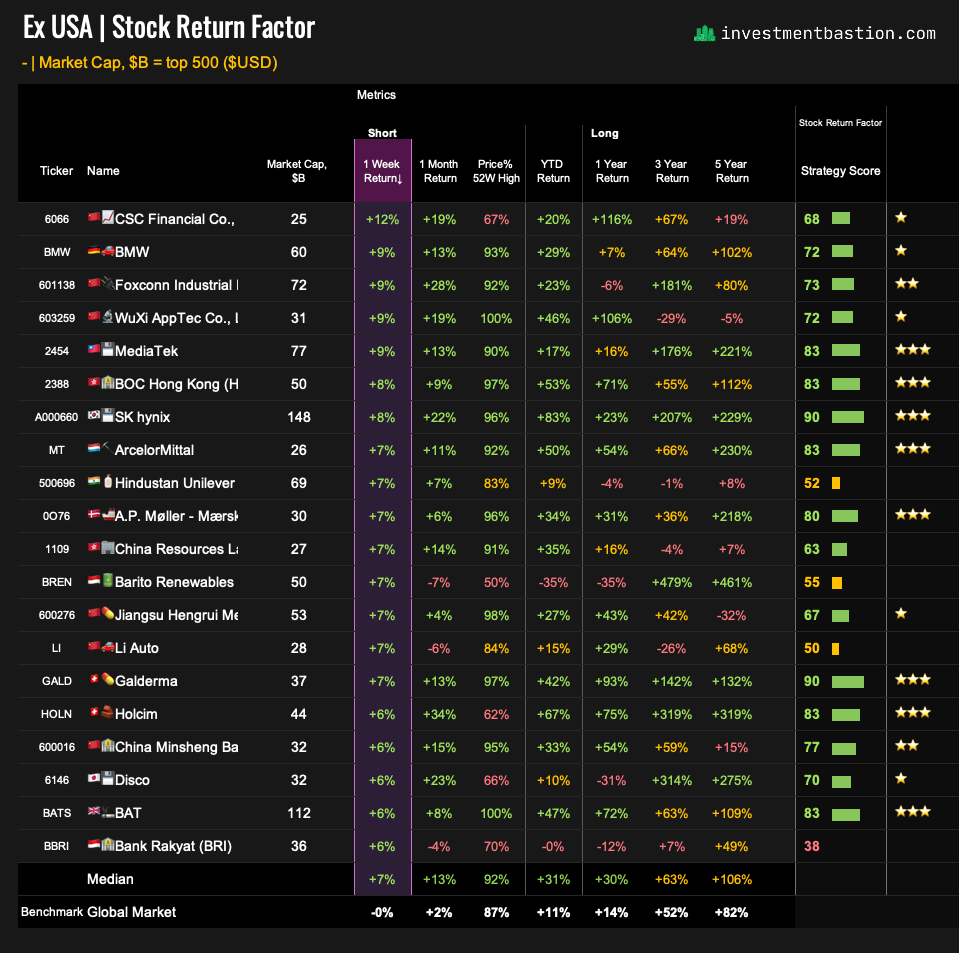

8. 🗺️Global 500 ExUS Stocks

Gainers

🚗 BMW (BMW +9%)

BMW delivered the second-best return among large-cap stocks outside the U.S. this week.

Reuters:

Shares jumped after the German automaker hosted a well-received pre-close earnings call. Analysts noted that BMW reaffirmed its 5–7% auto margin guidance for both Q2 and the full year — a strong signal, especially given ongoing tariff pressures and weakness in China.Bernstein said the guidance helped ease market concerns, despite a mid-three-digit million-euro hit from tariffs.

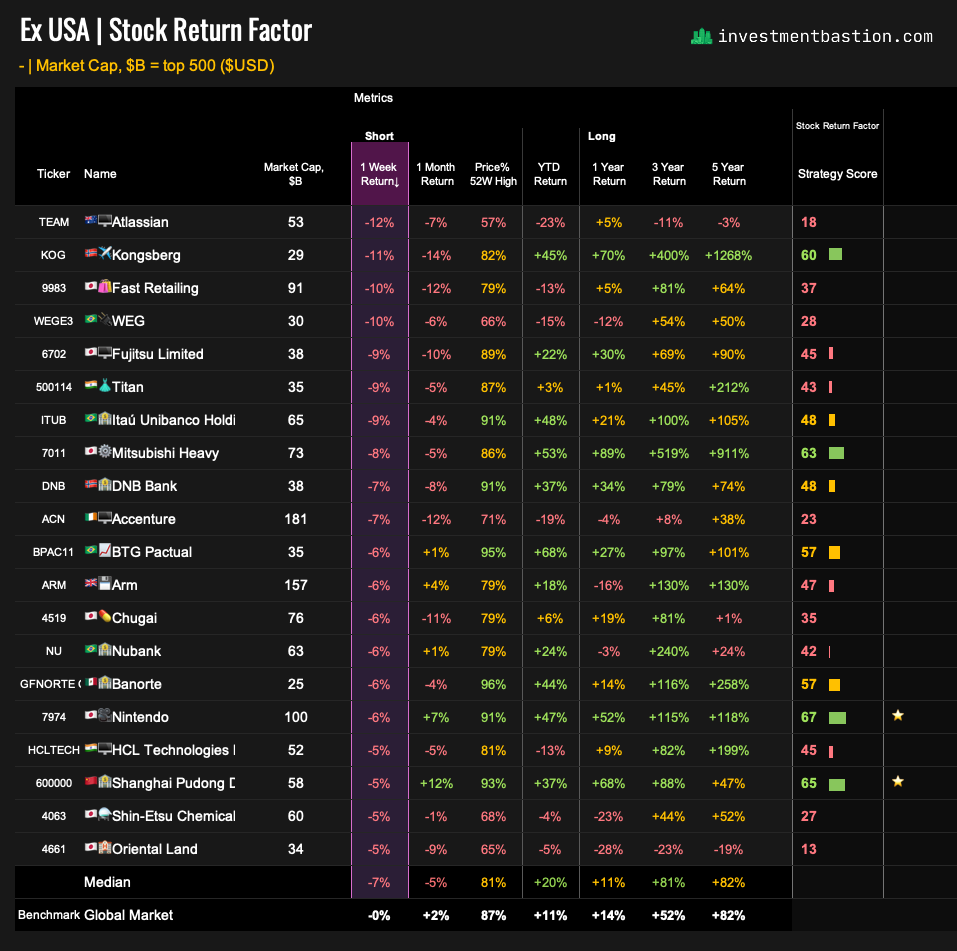

Losers

🛠️ Atlassian (TEAM -12%)

Atlassian delivered the worst performance among the top 500 non-U.S. stocks this week.

The Australian-American software company, best known as the owner of Jira (a leading project management and issue-tracking platform), extended its selloff after co-founder and co-CEO Scott Farquhar sold over $1.6 million worth of shares.

The insider sale added to investor concerns amid broader pressure on richly valued software stocks.

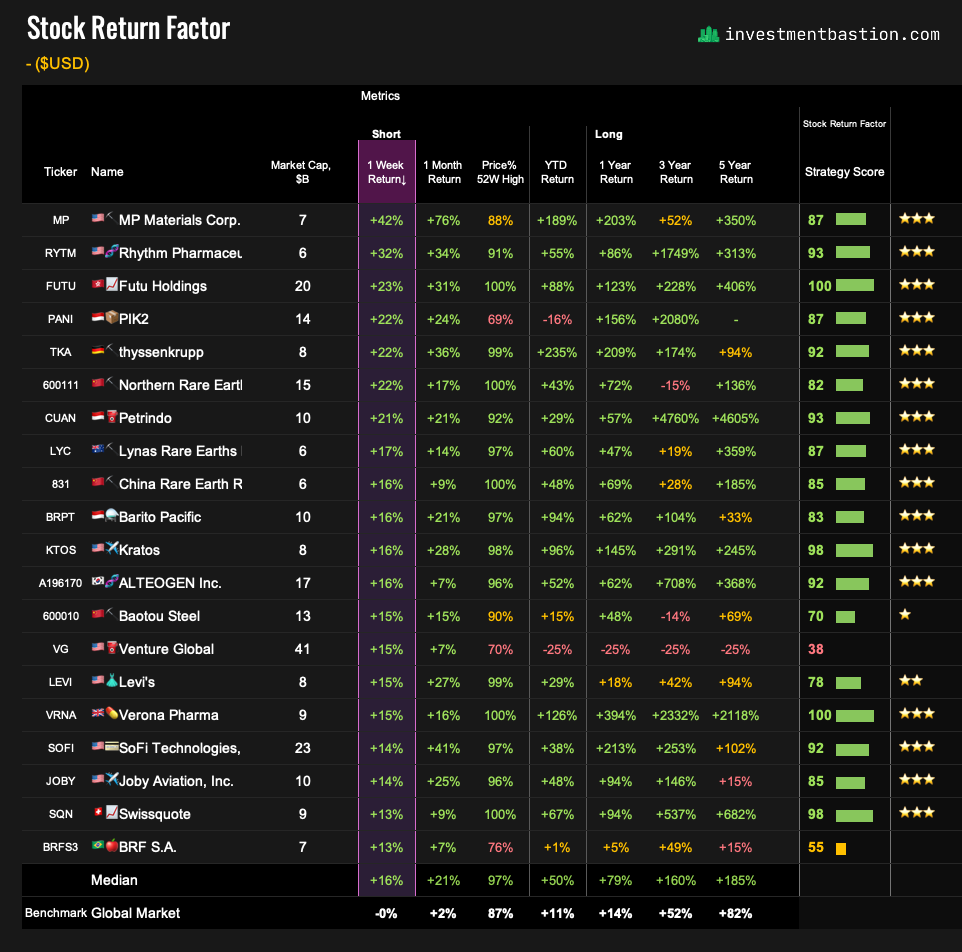

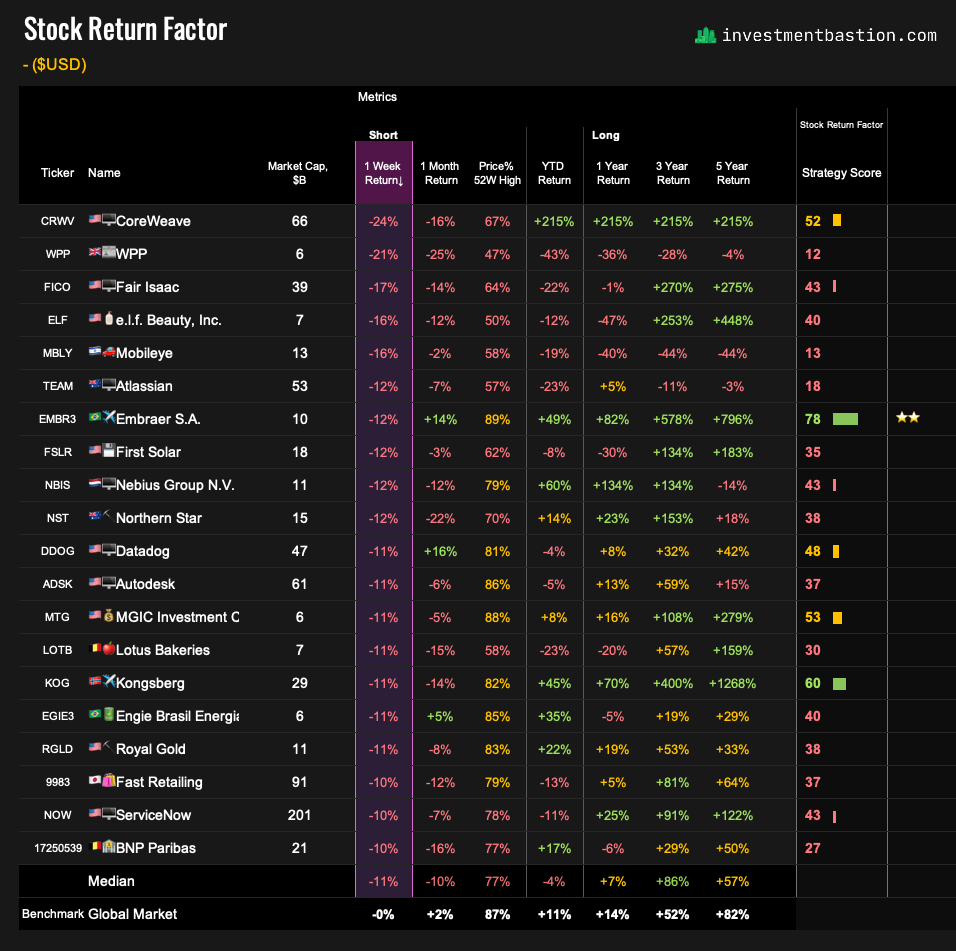

9. 🗺️ Bastion Global 4000 Stocks

Gainers

Losers

📬 See you next week with more signals.